Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

For the past year, LP Gas, Inc.

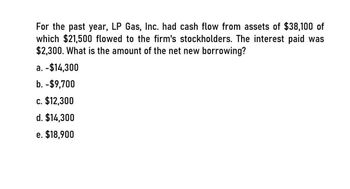

Transcribed Image Text:For the past year, LP Gas, Inc. had cash flow from assets of $38,100 of

which $21,500 flowed to the firm's stockholders. The interest paid was

$2,300. What is the amount of the net new borrowing?

a. -$14,300

b. -$9,700

c. $12,300

d. $14,300

e. $18,900

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please do fast answer with correct calculation for this accounting questionarrow_forwardRainey enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6% interest. Rainey Enterprises loaned $50,000 to Small Co. on June 1, Year 1, for one year at 6 percent interest. Required Show the effects of the following transactions in a horizontal statements. In the Cash Flow column, indicate whether the item is an operating activity (OA), an investing activity (IA), or a financing activity (FA). For any element not affected by the event, leave the cell blank. (Not every cell will require entry. Do not round intermediate calculations. Enter any decreases to account balances and cash outflows with a minus sign. Round your answers to the nearest whole dollar.) (1) The loan to Small Co. (2) The adjusting entry at December 31, Year 1. (3) The adjusting entry and collection of the note on June 1, Year 2. RAINEY ENTERPRISES Horizontal Statements Model Assets Equity Income Statenment Statement of Cash Flow Date Liabilinies Notes Receivable Interest Receivable Retained…arrow_forwardDuring the most current year, XYZ Corp paid $55,240 in interest and $80,400 in dividends. In order to fund a large expansion, the company also raised $297,000 in new equity and borrowed &197000 via the bond market, though a portion of the new borrowing was used to pay back $174,000 in bonds that were maturing this year. Calculate the cash flow to Shareholders.arrow_forward

- Vaden Corp. reported long-term borrowings of $9,400,000, repayments of long-term borrowings of $3,500,000, interest payments of $230,000, repurchase of treasury shares of $150,000, sale of investment securities for $170,000 and cash dividends declared and paid of $95,000. Calculate Vaden’s net cash flow from financing activities.arrow_forwardA company issues $1.1 million of new stock and pays $201,000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $1.51 million in a new bond issue and paid off existing bonds with a face value of $2.05 million. The company bought 501 of another company's $1,010 bonds at a $101,000 premium. The net cash flow provided by financing activities is: A) An outflow of $201,000. B) An inflow of $359,000. C) An inflow of $540,000. D) An outflow of $101,000arrow_forwardA company issues $1.1 million of new stock and pays $201,000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $1.51 million in a new bond issue and paid off existing bonds with a face value of $2.05 million. The company bought 501 of another company's $1,010 bonds at a $101,000 premium. The net cash flow provided by financing activities is: A) An outflow of $201,000. B) An inflow of $359,000. C) An inflow of $540,000. D) An outflow of $101,000 Garrow_forward

- Davis Corporation expects the following transactions in 20X3. Their first year of operations: 21. Sales (90% collectible in 20X3) Bad debt write-offs... Disbursements of costs and expenses Disbursements for income taxes. Purchases of fixed assets... Proceeds from issuance of ordinary shares.... Proceeds from short-term borrowings Payments on short-term borrowings. Depreciation on fixed assets P1,500,000 60,000 1,200,000 90,000 400,000 580,000 100,000 50,000 80,000 What is the cash balance at December 31, 20X3? P150,000 b. P170,000 a. c. P210,000 d. P280,000arrow_forwardCain Corp. reported accrued investment interest receivable of 38,000 and 46,500 at January 1 and December 31, year 1, respectively. During year 1, cash collections from the investments included the following: Capital gains distributions= 145,000; Interest= 152,000. What amount should Cain Corp report as interest revenue from investments for year 1? *arrow_forwardA bank has DA = 2.4 years and DL= 0.9 years. The bank has total equity of $82 million and total assets of $850 million. Interest rates are at 6 percent. If interest rates increase 1%, the predicted dollar change in equity value will equal $10,171,698 -$10,171,698 O $12,724,528 -$12,724,528 $4,928,756arrow_forward

- Blair Madison Company issues $2.5 million of new stock and pays $341,000 in cash dividends during the year. In addition, the company took advantage of falling interest rates to borrow $1.65 million in a new bond issue and paid off existing bonds with a face value of $2.75 million. The company bought 515 of another company's $1,150 bonds at a $115,000 premium. The net cash flow provided by financing activities is:arrow_forwardSLMA Corp. for the last ten years, has earned and had cash flows of about P600,000 every year. As per the predictions of the company'searnings, the same cash flow would continue for the foreseeable future. The expenses for the business every year is about P500,000only. Based on the available public information a P4 million Treasury bond has a prevailing return of P40,000 quarterly. Using Capitalization of Earnings approach, assuming SLMA would sell 20% of its shareholdings, what will be the minimum selling price? ANSWER: 2,500,000 provide the solution pleasearrow_forwardSLMA Corp. for the last ten years, has earned and had cash flows of about P600,000 every year. As per the predictions of the company'searnings, the same cash flow would continue for the foreseeable future. The expenses for the business every year is about P500,000only. Based on the available public information a P4 million Treasury bond has a prevailing return of P40,000 quarterly. Using Capitalization of Earnings approach, assuming SLMA would sell 20% of its shareholdings, what will be the minimum selling price? a. 2,500,000 b. 500,000 c. 1,500,000 d. 1,000,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT