Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

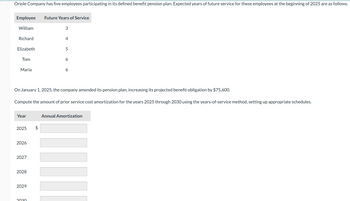

Transcribed Image Text:Oriole Company has five employees participating in its defined benefit pension plan. Expected years of future service for these employees at the beginning of 2025 are as follows.

Employee

Future Years of Service

William

3

Richard

4

Elizabeth

5

Tom

6

Maria

6

On January 1, 2025, the company amended its pension plan, increasing its projected benefit obligation by $75,600.

Compute the amount of prior service cost amortization for the years 2025 through 2030 using the years-of-service method, setting up appropriate schedules.

Year

Annual Amortization

2025

2026

2027

2028

2029

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Given the following information for Tyler Companys pension plan at the beginning of the year, calculate the corridor, excess net loss (gain), and amortized net loss (gain). Assume an average remaining service life of 15 years.arrow_forwardBlossom Company has five employees participating in its defined benefit pension plan. Expected years of future service for these employees at the beginning of 2025 are as follows. Employee Future Years of Service Daniel 3 Mark 4 Nancy 5 Kenneth Betty 6 6 On January 1, 2025, the company amended its pension plan, increasing its projected benefit obligation by $80,640. Compute the amount of prior service cost amortization for the years 2025 through 2030 using the years-of-service method, setting up appropriate schedules. Year Annual Amortization 2025 $ 2026 2027 2028 2029 2025arrow_forwardBramble Company has five employees participating in its defined benefit pension plan. Expected years of future service for these employees at the beginning of 2020 are as follows. Employee Future Years of Service Jim Paul Nancy Dave Kathy On January 1, 2020, the company amended its pension plan, increasing its projected benefit obligation by $86,400. Compute the amount of prior service cost amortization for the years 2020 through 2025 using the years-of-service method. setting up appropriate schedules. Annual Amortization Year 2020 2021 2022 2023 2024 2025 S 100 eTextbook and Media: Save for Later Attempts: 0 of 3 used Submit Answerarrow_forward

- Metlock Company has five employees participating in its defined benefit pension plan. Expected years of future service for these employees at the beginning of 2020 are as follows. Employee Future Years of Service Jim 3 Paul 4 Nancy 5 Dave 6 Kathy 6 On January 1, 2020, the company amended its pension plan, increasing its projected benefit obligation by $ 84,960.Compute the amount of prior service cost amortization for the years 2020 through 2025 using the years-of-service method, setting up appropriate schedules.arrow_forwardThe Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 2023 = $3,200. b. Prior service cost from plan amendment on January 2, 2024 = $600 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024 = $640. d. Service cost for 2025 = $690. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%. f. Payments to retirees in 2024 = $500. g. Payments to retirees in 2025 = $570. h. No changes in actuarial assumptions or estimates. i. Net gain-AOCI on January 1, 2024 = $370. j. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2024 = $2,300. b. 2024 contributions = $660. c. 2025 contributions = $710. d. Expected…arrow_forwardThe Kollar Company has a defined benefit pension plan. Pension Information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 2023 = $3,200. b. Prior service cost from plan amendment on January 2, 2024 = $600 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024 = $640. d. Service cost for 2025 = $690. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10% f. Payments to retirees in 2024 = $500. g. Payments to retirees in 2025 = $570. h. No changes in actuarial assumptions or estimates. 1. Net gain-AOCI on January 1, 2024 = $370. J. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2024 = $2,300. b. 2024 contributions = $660. c. 2025 contributions = $710. d. Expected…arrow_forward

- The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 2023 = $2,000. b. Prior service cost from plan amendment on January 2, 2024 = $600 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024 = $560. d. Service cost for 2025 = $610. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%. f. Payments to retirees in 2024 = $420. g. Payments to retirees in 2025 = $490. h. No changes in actuarial assumptions or estimates. i. Net gain-AOCI on January 1, 2024 = $250. j. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2024 = $1,500. b. 2024 contributions = $580. c. 2025 contributions = $630. d. Expected…arrow_forwardarasota Company has five employees participating in its defined benefit pension plan. Expected years of future service for these employees at the beginning of 2020 are as follows. Employee Future Years of Service Jim 3 Paul 4 Nancy 5 Dave 6 Kathy 6 On January 1, 2020, the company amended its pension plan, increasing its projected benefit obligation by $74,880.Compute the amount of prior service cost amortization for the years 2020 through 2025 using the years-of-service method, setting up appropriate schedules. Year Annual Amortization 2020 $enter a dollar amount 2021 enter a dollar amount 2022 enter a dollar amount 2023 enter a dollar amount 2024 enter a dollar amount 2025 enter a dollar amountarrow_forwardThe Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: a. Projected benefit obligation as of December 31, 2023 = $3,350. b. Prior service cost from plan amendment on January 2, 2024 = $650 (straight-line amortization for 10-year average remaining service period). c. Service cost for 2024 = $650. d. Service cost for 2025 = $700. e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%. f. Payments to retirees in 2024 $510. g. Payments to retirees in 2025 $580. h. No changes in actuarial assumptions or estimates. 1. Net gain-AOCI on January 1, 2024 = $375. J. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: a. Plan asset balance at fair value on January 1, 2024 = $2,400. b. 2024 contributions $670. c. 2025 contributions $720. d. Expected long-term rate…arrow_forward

- The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: Projected benefit obligation as of December 31, 2023 = $1,550. Prior service cost from plan amendment on January 2, 2024 = $450 (straight-line amortization for 10-year average remaining service period). Service cost for 2024 = $530. Service cost for 2025 = $580. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%. Payments to retirees in 2024 = $390. Payments to retirees in 2025 = $460. No changes in actuarial assumptions or estimates. Net gain—AOCI on January 1, 2024 = $235. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: Plan asset balance at fair value on January 1, 2024 = $1,200. 2024 contributions = $550. 2025 contributions = $600. Expected long-term rate of return on plan assets =…arrow_forwardThe Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: Projected benefit obligation as of December 31, 2023 = $1,800. Prior service cost from plan amendment on January 2, 2024 = $400 (straight-line amortization for 10-year average remaining service period). Service cost for 2024 = $520. Service cost for 2025 = $570. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%. Payments to retirees in 2024 = $380. Payments to retirees in 2025 = $450. No changes in actuarial assumptions or estimates. Net gain—AOCI on January 1, 2024 = $230. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: Plan asset balance at fair value on January 1, 2024 = $1,600. 2024 contributions = $540. 2025 contributions = $590. Expected long-term rate of return on plan assets =…arrow_forwardThe Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are presented below ($ in millions): Information Provided by Pension Plan Actuary: Projected benefit obligation as of December 31, 2023 = $1,800. Prior service cost from plan amendment on January 2, 2024 = $400 (straight-line amortization for 10-year average remaining service period). Service cost for 2024 = $520. Service cost for 2025 = $570. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%. Payments to retirees in 2024 = $380. Payments to retirees in 2025 = $450. No changes in actuarial assumptions or estimates. Net gain—AOCI on January 1, 2024 = $230. Net gains and losses are amortized for 10 years in 2024 and 2025. Information Provided by Pension Fund Trustee: Plan asset balance at fair value on January 1, 2024 = $1,600. 2024 contributions = $540. 2025 contributions = $590. Expected long-term rate of return on plan assets =…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT