College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Accounting Problem 2.3

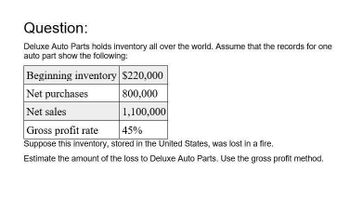

Transcribed Image Text:Question:

Deluxe Auto Parts holds inventory all over the world. Assume that the records for one

auto part show the following:

Beginning inventory $220,000

Net purchases

Net sales

Gross profit rate

800,000

1,100,000

45%

Suppose this inventory, stored in the United States, was lost in a fire.

Estimate the amount of the loss to Deluxe Auto Parts. Use the gross profit method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Answer the following questions. Show your solutions in good form. 1. Fenn Company provided the following information for the current year. Merchandise purchased for resale Freight in Freight out Purchase returns Interest on inventory loan 4,000,000 100,000 50,000 20,000 200,000 What is the inventoriable cost of the purchase? a. 4,280,000 b. 4,030,000 C. 4,080,000 d. 4,130,000arrow_forwardUsing the LIFO method, calculate the cost of ending inventory and cost of goods sold for Cambell Corporation.arrow_forwardNeed help with this questionarrow_forward

- Using the LIFO method, calculate the cost of ending inventory and cost of goods sold for Cale Corporation.arrow_forwardPlease show working and calculations in answers Calculate the value of “Ending Inventory” based on the following information: “Beginning Inventory” = $700 Purchases = $300 Cost of sales = $800 Based on your answer to the previous question, what is the gross profit and gross profit margin if the sales are $1000?arrow_forwardUsing the FIFO method, calculate the cost of ending inventory and cost of goods sold for Clark Corporation. (Click the icon to view the data.) The cost of ending inventory is The cost of goods sold is Data table Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold 880 Quantity Unit Cost 140 $ 210 350 80 270 $ 11.00 $ 14.00 $ Total - X 1,540 2,940arrow_forward

- Information pertaining to the inventory of Palette Company follows. LIFO Selling Replacement Cost Price Cost Category: Supreme Item A $5,600 $6,400 $4,800 Item B 7,200 7,200 7,680 Item C 17,600 17,600 16,800 Category: Classic Item X 28,800 28,800 30,400 Item Y 35,200 42,400 41,600 Item Z 56,000 48,000 52,800 The company has a normal profit margin of 20% of selling price and has no additional costs to complete or sell the items. What is the lower-of-cost-or-market value of the company's inventory applying the rule to (a) each individual item and (b) to each inventory category? Select one: a. Inventory item: $147,200; Inventory Category: $147,200 b. Inventory item: $150,400; Inventory Category: $150,400 c. Inventory item: $143,520; Inventory Category: $150,400 d. Inventory item: $141,120; Inventory Category: $147,520arrow_forwardUsing the average-cost method, calculate the cost of ending inventory and cost of goods sold for Chesney Corporation. (Round the average cost per unit to the nearest cent.) (Click the icon to view the data.) The cost of ending inventory is The cost of goods sold is Data table Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Quantity Unit Cost 170 $ 130 300 60 240 11.00 $ 14.00 $ Total - X 1,870 1,820arrow_forwardWhat is the inventory turnover on these financial accounting question?arrow_forward

- Required information [The following information applies to the questions displayed below.] Pacific Company sells electronic test equipment that it acquires from a foreign source. During the year, the inventory records reflected the following: Beginning inventory Purchases Units 22 Unit Cost $11,540 10,040 Total Cost $ 253,880 421,680 42 Sales (47 units at $24,670 each) Inventory is valued at cost using the LIFO inventory method. Required: 1. Complete the following income statement summary using the LIFO method and the periodic inventory system. PACIFIC COMPANY Income Statement For the Current Year Ended Sales revenue Cost of goods sold Gross profit Expenses 292,000 Pretax income Ending inventoryarrow_forwardMic Drop Company uses the first-in, first-out retail method of inventory valuation. The following information is available: • Beginning inventory: P115,000 at cost; P300,000 at retail • Purchases: P600,000 at cost; P1,100,000 at retail • Net additional markups – P100,000; net markdowns – P200,000 • Sales revenue – P900,000 What is the estimated cost of the ending inventory using the average retail method? A. P240,000 B. P220,000 C. P400,000 D. P200,000arrow_forwardVargas Company uses the perpetual inventory system and the FIFO cost flow method. During the current year, Vargas purchased 400 units of inventory that cost $15.00 each. At a later date during the year, the company purchased an additional 800 units of inventory that cost $18.00 each. Vargas sold 500 units of inventory for $27.00. What is the amount of cost of goods sold that will appear on the current year's income statement? Multiple Choice ο ο ο ο $4,500 $6,000 $7,800 $5,700arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,