Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial Accounting give me answer

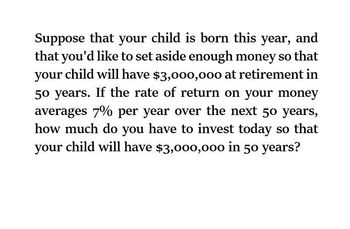

Transcribed Image Text:Suppose that your child is born this year, and

that you'd like to set aside enough money so that

your child will have $3,000,000 at retirement in

50 years. If the rate of return on your money

averages 7% per year over the next 50 years,

how much do you have to invest today so that

your child will have $3,000,000 in 50 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please solve this problemarrow_forwardGeneral Accountingarrow_forwardYou believe you will need to have saved $480,000 by the time you retire in 30 years in order to live comfortably. You also believe that you will inherit $115,000 in 5 years. a) If the interest rate is 6% per year, what is the future value of your inheritance at retirement? b) How much additional money must you save to meet your retirement goal, assuming you save your entire inheritance?arrow_forward

- You believe you will need to have saved $593,000 by the time you retire in 30 years in order to live comfortably. You also believe that you will inherit $113,000 in 5 years. 1) If the interest rate is 7% per year, what is the future value of your inheritance at retirement? 2) How much additional money must you save to meet your retirement goal, assuming you save your entire inheritance?arrow_forwardYou are trying to decide how much to save for retirement. Assume you plan to save $5,000 per year with the first investment made one year from now. You think you can earn 10.0% per year on your investments and you plan to retire in 43 years, immediately after making your last $5,000 investment. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $5,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 20 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 20th withdrawal (assume your savings will continue to earn 10.0% in retirement)? d. If, instead, you decide to withdraw $300,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it…arrow_forwardYou are trying to decide how much to save for retirement. Assume you plan to save $4,500 per year with the first investment made one year from now. You think you can earn 6.0% per year on your investments and you plan to retire in 45 years, immediately after making your last $4,500 investment. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $4,500 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 16 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 16th withdrawal (assume your savings will continue to earn 6.0% in retirement)? d. If, instead, you decide to withdraw $191,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it…arrow_forward

- Assume that you just inherited an annuity that will pay you $10,000 per year for10 years, with the first payment being made today. A friend of your mother offersto give you $60,000 for the annuity. If you sell it, what rate of return would yourmother’s friend earn on his investment? If you think a “fair” return would be 6%, howmuch should you ask for the annuity? (13.70%, $78,016.92)arrow_forwardYou believe you will need to have saved $500,000 by the time you retire in 40 years in order to live comfortably. If the interest rate is 6 percent per year, how much must you save each year to meet your retirement goal?arrow_forwardYou are trying to decide how much to save for retirement. Assume you plan to save $6,000 per year with the first investment made one year from now. You think you can earn 6% per year on your investments and you plan to retire in 43 years, immediately after making your last $6,000 investment. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $6,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 18 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 18th withdrawal (assume your savings will continue to earn 6% in retirement)? d. If, instead, you decide to withdraw $100,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take…arrow_forward

- You would like to provide $145,000 a year forever for your heirs. How much money must you deposit today to fund this goal if you can earn a guaranteed 5.8 percent rate of return?arrow_forwardIn planning for your retirement, you have decided that you would like to be able to withdraw $60,000 per year for a 10 year period. The first withdrawal will occur 20 years from today. a. What amount must you invest today if your return is 10% per year? b. What amount must you invest today if your return is 15% per year?arrow_forwardYou are trying to decide how much to save for retirement. Assume you plan to save $4,000 per year with the first investment made one year from now. You think you can earn 10.5% per year on your investments and you plan to retire in 36 years, immediately after making your last $4,000 investment. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $4,000 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 28 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 28th withdrawal (assume your savings will continue to earn 10.5% in retirement)? d. If, instead, you decide to withdraw $270,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning