FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

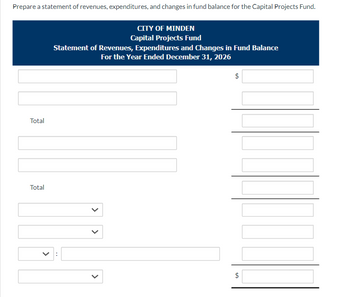

Transcribed Image Text:Prepare a statement of revenues, expenditures, and changes in fund balance for the Capital Projects Fund.

CITY OF MINDEN

Capital Projects Fund

Statement of Revenues, Expenditures and Changes in Fund Balance

For the Year Ended December 31, 2026

Total

Total

+A

$

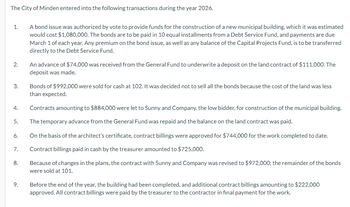

Transcribed Image Text:The City of Minden entered into the following transactions during the year 2026.

1.

2.

3.

4.

5.

6.

7.

8.

9.

A bond issue was authorized by vote to provide funds for the construction of a new municipal building, which it was estimated

would cost $1,080,000. The bonds are to be paid in 10 equal installments from a Debt Service Fund, and payments are due

March 1 of each year. Any premium on the bond issue, as well as any balance of the Capital Projects Fund, is to be transferred

directly to the Debt Service Fund.

An advance of $74,000 was received from the General Fund to underwrite a deposit on the land contract of $111,000. The

deposit was made.

Bonds of $992,000 were sold for cash at 102. It was decided not to sell all the bonds because the cost of the land was less

than expected.

Contracts amounting to $884,000 were let to Sunny and Company, the low bidder, for construction of the municipal building.

The temporary advance from the General Fund was repaid and the balance on the land contract was paid.

On the basis of the architect's certificate, contract billings were approved for $744,000 for the work completed to date.

Contract billings paid in cash by the treasurer amounted to $725,000.

Because of changes in the plans, the contract with Sunny and Company was revised to $972,000; the remainder of the bonds

were sold at 101.

Before the end of the year, the building had been completed, and additional contract billings amounting to $222,000

approved. All contract billings were paid by the treasurer to the contractor in final payment for the work.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Mountain View’s citizens authorized the construction of a new library. As a result of this project, the city had the following transactions during 2018: a. On January 3, 2018, a $600,000 serial bond issue having a stated interest rate of 8% was authorized for the acquisition of land and the construction of a library building. The bonds are to be redeemed in 10 equal annual installments beginning February 1, 2019. b. On January 10, 2018, the city made a $50,000 down payment deposit on the purchase of land, which is to be the site of the library. The contracted price for the land is $150,000, which is $40,000 below what the city estimated it would have to spend to acquire a site. c. On March 1, 2018, the city issued serial bonds having a $450,000 face value at 102. The bond indenture requires any premium to be set aside for servicing bond interest. d. On March 10, 2018, the city paid the remaining amount on the land contract and took title to the land. e. On March 17, 2018, the city…arrow_forwardA bond issue was authorized by vote to provide funds for the construction of a new municipal building, which it was estimated would cost $1,070,000. The bods are to be paid in 10 equal installments from a debt service fund, and payments are due March 1 of each year.arrow_forwardOn October 1, 2019, the City of Mizner issued $6,000,000 in 4%, general obligation bonds at 101 for the purpose of constructing an addition to City Hall. The premium was transferred to a debt service fund. A total of $5,968,750 was used to construct the addition, which was completed prior to June 30, 2020. The remaining funds were transferred to the debt service fund. The bonds were dated October 1, 2019, and paid interest on April 1 and October 1. The first of 20 annual principal payments of $300,000 is due October 1, 2020. The fiscal year for Mizner is July 1- June 30.In addition to a $6,000,000 liability in the government-wide Statement of Net Position, how would the bond sale be reported? Multiple Choice As a $6,000,000 other financing source in the capital projects fund, a $60,000 other financing source in the debt service fund, and as a $6,000,000 liability in the debt service fund. As a $6,060,000 other financing source in the capital projects fund, a $60,000…arrow_forward

- The town of McHenry Has $10,000,000 in general obligation bonds outstanding and maintains a single debt service fund for all debt service transactions. On july 1, 2020, a current refunding took pace in which $10,000,000 in new general obligation bonds were issued. Record the transaction on the books of the debt service fund.arrow_forwardThe following information relates to Redwood City during its fiscal year ended December 31, 2019:a. On October 31, 2019, to finance the construction of a city hall annex, Redwood issued 8%, 10-year general obligation bonds at their face value of $600,000. Construction expenditures during the period equaled $364,000.b. Redwood reported $109,000 from hotel room taxes, restricted for tourist promotion, in a special revenue fund. The fund paid $81,000 for general promotions and $22,000 for a motor vehicle.c. 2019 general fund revenues of $104,500 were transferred to a debt service fund and used to repay $100,000 of 9%, 15-year term bonds and $4,500 of interest. The bonds were used to acquire a citizens’ center.d. At December 31, 2019, as a consequence of past services, city firefighters had accumulated entitlements to compensated absences valued at $140,000. General fund resources available at December 31, 2019, are expected to be used to settle $30,000 of this amount, and $110,000 is…arrow_forward(B) The City of Presho had the following transactions related to the construction of a new courthouse. (1) 1/2/2017: 20 year 4% General Obligation Serial Bonds with a face value of $5,000,000 are issued at 102. Interest and principle payments are made on Jan. 1 and July 1 of each year. The premium was transferred into the Debt Service Fund. The General Fund will fully fund each payment as they become due. (2) 3/1/2017: Land is purchased for a new courthouse at a cost of $300,000. (3) 3/1/2017: A contract is signed for construction of the new courthouse in the amount of $4,300,000. (4) 6/15/2017: Cash ($225,000) sufficient to cover interest and principal payments for the year less the premium is transferred from the General Fund. (5) 7/1/2017: Interest ($100,000) and principal ($125,000) are paid on the courthouse fund serial bonds. (6) 12/1/2017: Receive an invoice for progress completed to date on the courthouse construction project in the amount of $3,700,000. (7) 12/27/2017: $97,500…arrow_forward

- During fiscal year 2019, a municipality issued the following debt instruments: Tax anticipation notes : $2,500,000 Utility bonds : 3,000,000 General obligation bonds : 8,000,000 How much of this debt should be reported in the fund financial statement?arrow_forwardConstruction and debt transactions can affect more than one fund. During 2021 Luling Township engaged in the following transactions related to modernizing the bridge over the Luling River. The township accounts for long-term construction projects in a capital projects fund.• On July 1 it issued 10-year, 4 percent bonds with a face value of $1 million. The bonds were sold for $1,016,510, an amount that provides an annual yield of 3.8 percent (semiannual rate of 1.9 percent). The city incurred $10,000 in issue costs.• On August 1, it was awarded a state reimbursement grant of $800,000. During the year it incurred allowable costs of $600,000. Of these it paid $500,000 in cash to various contractors. It received $450,000 from the state, expecting to receive, early in 2022, the $150,000 difference between allowable costs incurred and cash received. Moreover, it expects to receive the balance of the grant later in 2022. • It invested the bond proceeds in short-term federal securities. During…arrow_forwardI need the journal entry for these questions As of January 1, 2020, the City of Monroe had $12,000,000 in general obligation bonds outstanding. Eliminate the expenditures for bond principal. Adjust for the interest accrued in the prior year government-wide statements, but recorded as an expenditure in the 2020 fund basis statements, ($12,000,000 × 0.03 × 6/12) = $180,000.arrow_forward

- The City of Bernard starts the year of 2020 with the following unrestricted amounts in its general fund: cash of $42,250 and investments of $82,500. In addition, it holds a small building bought on January 1, 2019, for general government purposes for $318,000 and a related long-term debt of $254,400. The building is depreciated on the straight-line method over 10 years. The annual interest rate on the debt is 10 percent. The general fund has four separate functions: general government, public safety, public works, and health and sanitation. Other information includes the following: Receipts: Property taxes $597,000 Sales taxes 107,800 Dividend income 25,000 Charges for general government services 19,400 Charges for public safety services 12,050 Charges for public works 5,700 Charges for health and sanitation services 40,800 Charges for landfill 9,200 Grant to be used for salaries for health workers (no eligibility requirements) 28,500 Issued long-term…arrow_forwardGadubhaiarrow_forwardOn June 1, 2020, the City of Cape May authorized the construction of a police station at an expected cost of $250,000. Financing will be provided through transfers from a Special Revenue Fund. The following transactions occurred during the fiscal year beginning June 1, 2020, relating to the Capital Project Fund. 1. The $250,000 receivable from the Special Revenue Fund was recorded. 2. The Special Revenue Fund transferred $125,000 to the Capital Project Fund to begin construction on the police station. 3. The Capital Project Fund invested the transfer of monies in a six-month certificate, at 5%. 4. A contract in the amount of $250,000 was let to the lowest bidder. 5. Architect and legal fees in the amount of $3,125 were approved for payment. There was no encumbrance for these expenditures. 6. Contract billings in the amount of $250,000 were approved for payment on the completion of the police station and the encumbrance was removed. 7. The six-month certificate was redeemed at maturity…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education