FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

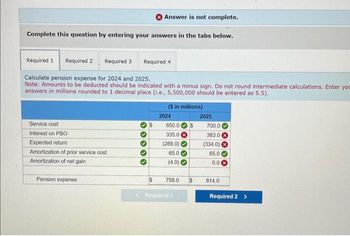

Transcribed Image Text:Answer is not complete.

Complete this question by entering your answers in the tabs below.

Required 1

Required 2 Required 3

Required 4

Calculate pension expense for 2024 and 2025.

Note: Amounts to be deducted should be indicated with a minus sign. Do not round intermediate calculations. Enter you

answers in millions rounded to 1 decimal place (i.e., 5,500,000 should be entered as 5.5).

($ in millions)

2024

2025

Service cost

650.0$

700.0

Interest on PBO

335.0

383.0

Expected return

(288.0)

(334.0) (

Amortization of prior service cost

65.0

65.0

Amortization of net gain

(4.0)

0.0 ×

Pension expense

$

758.0

$

814.0

<Required 1

Required 2 >

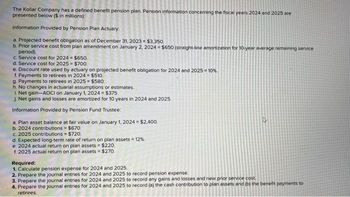

Transcribed Image Text:The Kollar Company has a defined benefit pension plan. Pension information concerning the fiscal years 2024 and 2025 are

presented below ($ in millions):

Information Provided by Pension Plan Actuary:

a. Projected benefit obligation as of December 31, 2023 = $3,350.

b. Prior service cost from plan amendment on January 2, 2024 = $650 (straight-line amortization for 10-year average remaining service

period).

c. Service cost for 2024 = $650.

d. Service cost for 2025 = $700.

e. Discount rate used by actuary on projected benefit obligation for 2024 and 2025 = 10%.

f. Payments to retirees in 2024 $510.

g. Payments to retirees in 2025 $580.

h. No changes in actuarial assumptions or estimates.

1. Net gain-AOCI on January 1, 2024 = $375.

J. Net gains and losses are amortized for 10 years in 2024 and 2025.

Information Provided by Pension Fund Trustee:

a. Plan asset balance at fair value on January 1, 2024 = $2,400.

b. 2024 contributions $670.

c. 2025 contributions $720.

d. Expected long-term rate of return on plan assets = 12%

e 2024 actual return on plan assets $220.

f 2025 actual return on plan assets = $270.

Required:

1. Calculate pension expense for 2024 and 2025.

2. Prepare the journal entries for 2024 and 2025 to record pension expense.

3. Prepare the journal entries for 2024 and 2025 to record any gains and losses and new prior service cost.

4. Prepare the journal entries for 2024 and 2025 to record (a) the cash contribution to plan assets and (b) the benefit payments to

retirees.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Step 1: Define pension expense:

VIEW Step 2: 1. Calculate pension expenses:

VIEW Step 3: 2. Prepare the journal entries to record pension expense as follows:

VIEW Step 4: 3. Prepare the journal entry to record gain or loss as follows:

VIEW Step 5: 4. Prepare the journal entries to record the cash contributions as follows:

VIEW Solution

VIEW Trending nowThis is a popular solution!

Step by stepSolved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Preparing a Pension Worksheet Levine Co. sponsored a defined benefit plan, which included January 1, 2020, balances of $3,000 and $2,880 in Plan Assets and Projected Benefit Obligation, respectively. During 2020, the company incurred $600 in service cost, made plan contributions of $126, and paid benefits to retirees for $90. The discount rate is 9% and the expected and actual rate of return on plan assets is 10%. Prepare a pension worksheet for 2020.Note: Use a negative sign for credits to accounts. Pension Worksheet Reported Net in Financial Statements Balance Sheet Income Statement PlanAssets PBO Net PensionAsset/Liability CashOutflow PensionExpense Balance, January 1, 2020 Service cost Interest cost Expected return Contributions to fund Benefit payments Balance, December 31, 2020arrow_forwardPharoah Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $199,200; projected benefit obligation $248,000. Other data relating to 3 years' operation of the plan are as follows. Annual service cost Settlement rate and expected rate of return Actual return on plan assets Annual funding (contributions) Benefits paid Prior service cost (plan amended, 1/1/20) Amortization of prior service cost Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 2019 $16,200 10 % 18,200 16,200 13,700 2020 $19,000 10 % 21,990 40,200 16,100 161,100 54,000 2021 $26,200 10 % 23,900 48,300 20,700 42,300 511,800arrow_forwardPresented below is pension information related to Fauci, Inc. for the year 2021:Service cost $480,000Interest on projected benefit obligation 200,000Interest on vested benefits 120,000Amortization of prior service cost due to increase in benefits 60,000Expected return on plan assets 90,000The amount of pension expense to be reported for 2021 isa. $590,000.b. $770,000.c. $860,000.d. $650,000.arrow_forward

- The following defined pension data of Waterway Corp. apply to the year 2020. Projected benefit obligation, 1/1/20 (before amendment) $509,000 Plan assets, 1/1/20 496,000 Pension liability 13,000 On January 1, 2020, Waterway Corp., through plan amendment, grants prior service benefits having a present value of 123,000 Settlement rate 9 % Service cost 58,300 Contributions (funding) 59,600 Actual (expected) return on plan assets 48,300 Benefits paid to retirees 43,500 Prior service cost amortization for 2020 16,400 For 2020, prepare a pension worksheet for Waterway Corp. that shows the journal entry for pension expense and the year-end balances in the related pension accounts. (Enter all amounts as positive.) WATERWAY CORP.Pension Worksheet—2020 General Journal Entries Memo Record Items Annual PensionExpense Cash OCI–Priorarrow_forwardun.3arrow_forwardCurrent Attempt in Progress Cullumber Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2025, the following balances relate to this plan. Plan assets Projected benefit obligation Pension asset/liability Accumulated OCI (PSC) $465,800 604,200 138,400 95,000 Dr. As a result of the operation of the plan during 2025, the following additional data are provided by the actuary. (a) Service cost Settlement rate, 10% Actual return on plan assets Amortization of prior service cost Expected return on plan assets Unexpected loss from change in projected benefit obligation, due to change in actuarial predictions Contributions Benefits paid retirees $86,600 55,000 19,300 52,000 79,600 102,800 88,300 Using the data above, compute pension expense for Cullumber. for the year 2025 by preparing a pension worksheet. (Enter all amounts as positive)arrow_forward

- Not a graded assignmentarrow_forwardPresented below is pension information related to Tyre Recycling Inc., for the calendar year 2019. The corporation uses ASPE. Current service costs $ 50,000 Contributions to the plan 55,000 Actual return on plan assets 40,000 Defined benefit obligation (beginning of year) 600,000 Fair value of plan assets (beginning of year) 400,000 Interest cost on the obligation 10% The pension expense to be reportedfor 2019 is Select one: a. $110,000. b. $70,000. c. $65,000. d. $50,000. e. None of the above.arrow_forwardSophia Consultants Inc. has had a defined benefit pension plan since January 1, 2018.The following represents beginning balances as at January 1, 2022:Plan Asset $1,155,300; Defined Benefit Obligation $1,275,000; Net Pension Liability $119,700Additional Information is as follows for 2022:Current Service cost is $186,000 for 2022Company Funding/Contribution is $200,000 for 2022. Funding is made on December 31 of each year.Actual return on assets is $55,900 for 2022.There is an increase in obligation for $29,000 due to changes in Actuarial assumptions at Dec 31, 2022.There are payments made equal to $80,000 per year to retired employees in 2022 (payments to retireesare made at the end of the year on December 31).Past service cost of $85,900 from plan amendment dated December 31, 2022: liability is increasedbecause benefits were increased on a retroactive basis.For 2022, the assumed interest rate is 6%. Assume IFRS.Required:1. Determine Defined Benefit Obligation, Pension Asset, Pension…arrow_forward

- Carla Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $ 197,800; projected benefit obligation $ 252,000. Other data relating to 3 years’ operation of the plan are as follows. 2019 2020 2021 Annual service cost $ 15,800 $ 19,300 $ 26,000 Settlement rate and expected rate of return 10 % 10 % 10 % Actual return on plan assets 17,700 21,740 24,100 Annual funding (contributions) 15,800 39,700 47,300 Benefits paid 13,900 16,100 21,200 Prior service cost (plan amended, 1/1/20) 161,100 Amortization of prior service cost 54,200 41,000 Change in actuarial assumptions establishes a December 31, 2021, projected benefit obligation of: 522,400 Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each…arrow_forwardPlease do not give image formatarrow_forwardSunland Company provides the following information about its defined benefit pension plan for the year 2025. Service cost $91,400 Contribution to the plan 102,900 Prior service cost amortization 9,600 Actual and expected return on plan assets 64,900 Benefits paid 40,600 Plan assets at January 1, 2025 632,300 Projected benefit obligation at January 1, 2025 686,100 Accumulated OCI (PSC) at January 1, 2025 147,300 Interest/discount (settlement) rate 11% Compute the pension expense for the year 2025. Pension expense for 2025 :$__?__arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education