FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

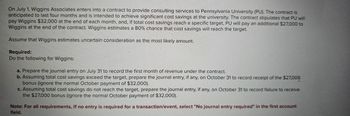

Transcribed Image Text:On July 1, Wiggins Associates enters into a contract to provide consulting services to Pennsylvania University (PU). The contract is

anticipated to last four months and is intended to achieve significant cost savings at the university. The contract stipulates that PU will

pay Wiggins $32,000 at the end of each month, and, if total cost savings reach a specific target, PU will pay an additional $27,000 to

Wiggins at the end of the contract. Wiggins estimates a 80% chance that cost savings will reach the target.

Assume that Wiggins estimates uncertain consideration as the most likely amount.

Required:

Do the following for Wiggins:

a. Prepare the journal entry on July 31 to record the first month of revenue under the contract.

b. Assuming total cost savings exceed the target, prepare the journal entry, if any, on October 31 to record receipt of the $27,000

bonus (ignore the normal October payment of $32,000).

c. Assuming total cost savings do not reach the target, prepare the journal entry, if any, on October 31 to record failure to receive

the $27,000 bonus (ignore the normal October payment of $32,000).

Note: For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first account

field.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Whispering Corp. enters into a contract with a customer to build an apartment building for $1,300,000. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $195,000 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $65,000 each week that completion is delayed. Whispering commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes. August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price LA 70% $ 20 Determine the transaction price for this contract. 5 5arrow_forwardSuper Clubs Hotels, Inc. has signed a service outsourcing contract with Quality Rooms, Inc. for $3 million, which was received in cash at contract inception. Under the agreement, Quality Rooms is obligated to clean and prepare over 5,000 hotels rooms managed by Super Clubs on a daily basis from September 1, 2020 to August 31, 2021. Required: Prepare any journal entry that Quality would record: (1) at inception of the contract and (2) at the end of 2020 to recognize all revenue associated with this contract that should be recognized in 2020.arrow_forwardNvidia enters into a contract which pays $2,100/month for six months of services. In addition, there is a 70% chance the contract will pay an additional $3,500 and a 30% chance the contract will pay an additional $1,500, depending on the outcome of the contract. Assume Nvidia estimates variable consideration as the most likely amount. What is the amount of revenue Nvidia would recognize for the first month of the contract? Note: Do not round intermediate calculations. Round final answer to whole dollars. Multiple Choice $2,100 $2,450 ☐ $2,683arrow_forward

- A company enters into a contract with a customer to build a building, with a performance bonus of $33,500 if the building is completed by September 30, 2021. The bonus is reduced by $5,000 each week that completion is delayed. The company commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by ProbabilitySeptember 30, 2021 70%October 7, 2021 15%October 14, 2021 10%October 21, 2021 5%The amount of revenue the company should recognize related to this bonus is $_______________.arrow_forwardSMDC Construction is constructing an office building under contract for Onyx Company and uses the percentage-of-completion method. The contract calls for progress billings and payments of P1,550,000 each quarter. The total contract price is P18,600,000 and SMDC Construction estimates total costs of P17,750,000. SMDC Construction estimates that the building will take 3 years to complete, and commences construction on January 2, 2018. SMDC Construction completes the remaining 25% of the building construction on December 31, 2020, as scheduled. At that time the total costs of construction are P18,750,000. What is the total amount of Revenue from Long-Term Contracts and Construction Expenses that SMDC Construction will recognize for the year ended December 31, 2020? Revenue Expenses A. P18,600,000 P18,750,000 B. P4,650,000 P 4,687,500 C. P4,650,000 P 5,250,000 D. P4,687,500 P 4,687,500 Group of answer choices D C B Aarrow_forwardJeff Heun, president of Wildhorse Always, agrees to construct a concrete cart path at Dakota Golf Club. Wildhorse Always enters into a contract with Dakota to construct the path for $233,000. In addition, as part of the contract, a performance bonus of $42,800 will be paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date. The performance bonus decreases by $10,700 per week for every week beyond the agreed-upon completion date. Jeff has been involved in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he will receive a good portion of the performance bonus. Jeff estimates, given the constraints of his schedule related to other jobs, that there is 55% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 15% probability that he will be 2 weeks late. a.) Determine the transaction…arrow_forward

- Since 1970, Super Rise, Incorporated, has provided maintenance services for elevators. On January 1, 2024, Super Rise obtains a contract to maintain an elevator in a 90-story building in New York City for 10 months and receives a fixed payment of $98,000. The contract specifies that Super Rise will receive an additional $49,000 at the end of the 10 months if there is no unexpected delay, stoppage, or accident during the year. Super Rise estimates variable consideration to be the most likely amount it will receive. Required: Assume that, because the building sees a constant flux of people throughout the day, Super Rise is allowed to access the elevators and related mechanical equipment only between 3 a.m. and 5 a.m. on any given day, which is insufficient to perform some of the more time-consuming repair work. As a result, Super Rise believes that unexpected delays are likely and that it will not earn the bonus. Prepare the journal entry Super Rise would record on January 1. Assume…arrow_forwardA construction company entered into a fixed-price contract to build an office building for $42 million. Construction costs incurred during the first year were $12 million, and estimated costs to complete at the end of the year were $28 million. The company recognizes revenue over time according to percentage of completion. How much revenue and gross profit or loss will appear in the company's income statement in the first year of the contract? Note: Enter your answers in whole dollars and not in millions (i.e., $4 million should be entered as $4,000,000). Revenuearrow_forwardRakesharrow_forward

- Jeff Heun, president of Larkspur Always, agrees to construct a concrete cart path at Dakota Golf Club. Larkspur Always enters into a contract with Dakota to construct the path for $191000. In addition, as part of the contract, a performance bonus of $48,000 will be paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date The performance bonus decreases by $12,000 per week for every week beyond the agreed-upon completion date. Jeff has been involved in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he will receive a good portion of the performance bonus. Jeff estimates, given the constraints of his schedule related to other jobs, that there is 55% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 15% probability that he will be 2 weeks late. Determine the transaction price that Larkspur…arrow_forwardWilliam Corp. enters into a contract with a customer to build an apartment building for $1,056,300. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $136,200 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $45,400 each week that completion is delayed. William commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability LA 70 % 20 Determine the transaction price for this contract. 5 5 SUPPORTarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education