FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

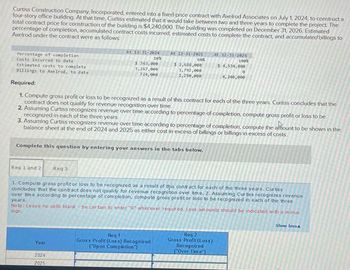

Transcribed Image Text:Curtiss Construction Company, Incorporated, entered into a fixed price contract with Axelrod Associates on July 1, 2024, to construct a

four story office building. At that time, Curtiss estimated that it would take between two and three years to complete the project. The

total contract price for construction of the building is $4,240,000 The building was completed on December 31, 2026 Estimated

percentage of completion, accumulated contract costs incurred, estimated costs to complete the contract, and accumulated billings to

Axelrod under the contract were as follows

Percentage of completion

Cests incurred to date

Estimated costs to complete

Billings to Axelrod, to date

Required:

At 12-11-2024

10%

At 12-31-2025

$2,688,000

1,792,000

AT 12-11-2026

60%

100%

$ 4,534,000

4,240,000

$363,000

3,267,000

724,000

2,250,000

1. Compute gross profit or loss to be recognized as a result of this contract for each of the three years. Curtiss concludes that the

contract does not qualify for revenue recognition over time

2. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute gross profit or loss to be

recognized in each of the three years

3. Assuming Curtiss recognizes revenue over time according to percentage of completion, compute the amount to be shown in the

balance sheet at the end of 2024 and 2025 as either cost in excess of billings or billings in excess of costs

Complete this question by entering your answers in the tabs below.

Req 1 and 21

Reg 3

1. Compute gross profit or loss to be recognized as a result of this contact for each of the three years. Curbss

concludes that the contract does not qualify for revenue recognibon over time. 2. Assuming Cur bus recognizes revenue

over time according to percentage of completion, compute gross profit or loss to be recognized in each of the three

Note: Leave no cells blank be certain to enter "0% wherever required. Loss amounts should be indicated with a minus

sign.

years.

Year

2024

2025

Req 1

Gross Profit (Loss) Recognized

("Upon Completion

Req 2

Gross Profit (Loss)

Recognized

Over Time

Show lessa

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help with calculationarrow_forwardThe following two independent situations involve loss contingencies. Part 1: Benson Company sells two products, Grey and Yellow. Each carries a 1-year warranty. 1. Product Grey—Product warranty costs, based on past experience, will normally be 1% of sales. 2. Product Yellow—Product warranty costs cannot be reasonably estimated because this is a new product line. However, the chief engineer believes that product warranty costs are likely to be incurred. Instructions How should Benson report the estimated product warranty costs for each of the two types of merchandise above? Discuss the rationale for your answer. Do not discuss disclosures that should be made in Benson’s financial statements or notes. Part 2: Constantine Company is being sued for $4,000,000 for an injury caused to a child as a result of alleged negligence while the child was visiting the Constantine Company plant in March 2020. The suit was filed in July 2020. Constantine’s lawyer states that it is probable that…arrow_forward7arrow_forward

- Please help mearrow_forwardA company incurred costs to fulfill a contract that has a four year life. The costs are a direct result of the contract and would not have been incurred had the contract not existed. how should the costs to fulfill the contract be accounted for?arrow_forwardProblem 6-11 (Algo) Long-term contract; revenue recognition upon completion [LO6-9] In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Cost incurred during the year Estimated costs to complete as of year-end 2021 $1,584,000 5,616,000 1,200,000 1,000,000 Cost incurred during the year Estimated costs to complete as of year-end Assume that Westgate Construction's contract with Santa Clara County does not qualify for revenue recognition over time. Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. 2-a. In the journal below, complete the necessary journal entries for the year 2021 (credit "Various accounts" for construction costs incurred).…arrow_forward

- From the following list indicate which of the liabilities that would be classified as current. O a. Deferred revenue on a project that will be completed in 6 months O b. Bank loan payable in 2 years O c. Deferred income taxes O d. Pension liability Oe. The portion of a 10-year bank loan that is due this year O f. Payroll deductions owing to the government Og. A provision for warranty repairs related to a product with a 1-year warranty ype here to search eTextbook and Media 8:arrow_forwardABC Co. estimates total contract costs at completion d In 20x2. ABC incurs actual costs of P2.45M and revizes its ABC completes the construction in 20x3 The actual total 6. In 20x1, ABC Co. enters into a contact with a customer for the uses the cost-to-cost method in measuring its progress on the estimate of total contract costs at completion to P4.6M. construction of a building. The contract price is P6M. ABC Co. me contract. cost of the contract is P4.5M. How much is the profit recognized in 20x3? a. 420,000 b. 450,000 c 500,000 d. 550,000arrow_forwardC3arrow_forward

- Problem 6-10 (Algo) Long-term contract; revenue recognition over time [LO6-8, 6-9] [The following information applies to the questions displayed below.] In 2021, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2023. Information related to the contract is as follows: Cost incurred during the year Estimated costs to complete as of year-end Billings during the year Cash collections during the year Westgate recognizes revenue over time according to percentage of completion. Costs incurred during the year Estimated costs to complete as of year-end Revenue Gross profit (loss) 2021 2022 $2,044,000 $2,628,000 5,256,000 2,628,000 2,170,000 2,502,000 1,885,000 2,600,000 Problem 6-10 (Algo) Part 5 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. (Do not round intermediate…arrow_forwardA contract between two parties (company X & Y) was created such that in return for services rendered, company X would provide payments of $15,000 in 8 months, $35,000 in 16 months, and $40,000 in 24 months. However, a clause was inserted in the contract that allowed company X to pay two equal lump sum payments in months 30 and 36. If interest on the contract is 6.5% compounded annually, determine the value of the lump sum payments that should be written in the contract. When entering your answer, round your values to two decimal places, and use a $ symbol as well as the correct comma separator. For example $12,345.67 Answer: Answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education