FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

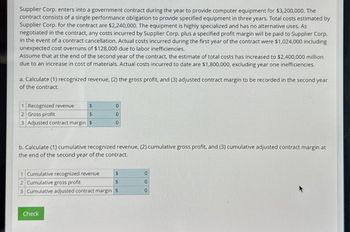

Transcribed Image Text:Supplier Corp. enters into a government contract during the year to provide computer equipment for $3,200,000. The

contract consists of a single performance obligation to provide specified equipment in three years. Total costs estimated by

Supplier Corp. for the contract are $2,240,000. The equipment is highly specialized and has no alternative uses. As

negotiated in the contract, any costs incurred by Supplier Corp. plus a specified profit margin will be paid to Supplier Corp.

in the event of a contract cancellation. Actual costs incurred during the first year of the contract were $1,024,000 including

unexpected cost overruns of $128,000 due to labor inefficiencies.

Assume that at the end of the second year of the contract, the estimate of total costs has increased to $2,400,000 million

due to an increase in cost of materials. Actual costs incurred to date are $1,800,000, excluding year one inefficiencies.

a. Calculate (1) recognized revenue, (2) the gross profit, and (3) adjusted contract margin to be recorded in the second year

of the contract.

1 Recognized revenue

$

2 Gross profit

$

3 Adjusted contract margin $

0

0

0

b. Calculate (1) cumulative recognized revenue, (2) cumulative gross profit, and (3) cumulative adjusted contract margin at

the end of the second year of the contract.

1 Cumulative recognized revenue

$

2 Cumulative gross profit

$

3 Cumulative adjusted contract margin $

Check

00

0

K

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gallerani Corporation has received a request for a special order of 5,500 units of product A90 for $27.70 each. Product A90's unit product cost is $27.20, determined as follows: Direct materials $ 2.95 Direct labor 8.25 Variable manufacturing overhead Fixed manufacturing overhead 7.35 8.65 Unit product cost $27.20 Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $4.00 per unit and that would require an investment of $19,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:arrow_forwardComet, Inc. has been experiencing the following costs when it produces 12,000 units of a subassembly: Direct materials.. .$108,000 Direct labor.... 72,000 100,000 Fixed overhead... A supplier offers to sell Comet an identical product for $18 per unit. Determine whether Comet should continue to make the product or should buy the product under each of the following conditions: (1) The fixed overhead represents the cost of insurance, taxes and depreciation on the manufacturing plant allocated to this product on the basis of the number of square feet occupied by the manufacturing operation. Comet has no alternative plans for use of this space. If Comet makes the product, it would be: (circle one) (a) $114,000 better off (b) $36,000 better off (c) $64,000 worse off (d) $60,000 better off (e) $100,000 worse off (2) The same information as part (1) with the following modification: $40,000 of the fixed costs represent the salary of a production manager who would be let go if Comet discontinues…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Vikrambhaiarrow_forwardSheffield Corp. incurs the following costs to produce 9000 units of a subcomponent: Direct materials Direct labor Variable overhead Fixed overhead $9000 O $28950 O $(3500) $8950 O $(3250) 12500 12200 20000 An outside supplier has offered to sell Sheffield the subcomponent for $2.75 a unit. No fixed overhead costs are avoidable. If Sheffield accepts the offer, by how much will net income increase (decrease)?arrow_forwardMelbourne Corporation has traditionally made a subcomponent of its major product. Annual production of 30,000 subcomponents results in the following costs: Direct materials $ 250,000 Direct labor $ 200,000 Variable manufacturing overhead $ 190,000 Fixed manufacturing overhead $ 120,000 Melbourne has received an offer from an outside supplier who is willing to provide the 30,000 units of the subcomponent each year at a price of $28 per unit. There would be no effect of this decision on the total fixed manufacturing overhead of the company. Melbourne knows that the facilities now being used to manufacture the subcomponent could be rented to another company for revenue of $80,000 per year if the subcomponent were purchased from the outside supplier. The financial advantage (disadvantage) of making the subcomponent would be: Multiple Choice $0 $280,000 $120,000 $200,000arrow_forward

- enjamin Inc. produces shoes. The accountant wants to calculate the fixed and variable costs associated with the leasing of machinery. or the past four months were collected as follows: Month April May June July Lease cost $15,000 10,000 12,000 16,000 Machine hours 800 500 770 900 Using the high-low method, calculate the fixed cost of leasing. O $2,500 $5,000 O$13,500 O $7,500arrow_forwardOtsego Industries manufactured 300,000 units of product last year and identified the following costs associated with the manufacturing activity: Variable costs: Direct materials used Direct labor Indirect materials and supplies Power to run plant equipment Fixed costs: Supervisory salaries Plant utilities (other than for plant equipment) Depreciation on plant and equipment Property taxes on building Answer is not complete. $ 10,965.00 $ 8,160.00 $ 19,125.00 ($000) $ 6,120.0 4,060.0 1,420.0 1,300.0 Required: Unit variable costs and total fixed costs are expected to remain unchanged in the following year. However, management expects a slowdown in sales, because of the economy in the following year. Calculate the unit cost and the total cost if 255,000 units are produced next year. Note: Enter your total cost answers in thousands. Round your answers to 2 decimal places. Total variable costs Total fixed costs Total costs Unit costs $ 2,460.0 1,896.7 2,285.0 1,518.3arrow_forward6 Helix Company has been approached by a new customer to provide 1,500 units of its regular product at a special price of $7 per unit. The regular selling price of the product is $9 per unit. Helix is operating at 80% of its capacity of 11,500 units. Identify whether the following costs are relevant to Helix's decision as to whether to accept the order at the special selling price. No additional fixed manufacturing overhead will be incurred because of this order. The only additional selling expense on this order will be a $0.70 per unit shipping cost. There will be no additional administrative expenses because of this order. Calculate the operating income from the order. a. Selling price b. Direct materials cost c. Direct labor cost d. Variable manufacturing overhead e. Fixed manufacturing overhead f. Regular selling expenses g. Additional selling expenses h. Administrative expenses Revenue (cost) per unit $ 7.00 (1.00) (2.00) (1.80) (0.75) (1.30) (0.70) (0.80) Relevant Not Relevant…arrow_forward

- Gallerani Corporation has received a request for a special order of 5,600 units of product A90 for $27.50 each. Product A90's unit product cost is $27.25, determined as follows: $ 2.85 8.15 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 7.25 9.00 Unit product cost $27.25 Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $3.90 per unit and that would require an investment of $28,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be: Multiple Cholce ($48,440) $1.960 $1.400 ($85.960)arrow_forwardSixthZ incurred the following costs during 2018: Variable costs treehouse Manufacturing: Direct Materials $500 Direct Labor $270 VMO $40 Variable Selling & Admin $75 Fixed costs per year Fixed Manufacturing Overhead $125,000 Fixed Selling & Admin $60,000 During the year, SixthZ produced 1,100 treehouses and sold 950 treehouses. The selling price of each set was $1,000. Assuming SixthZ uses variable costing, what is the unit product cost? O $941.58 O $885 O $923.64 O $810arrow_forwardProduct B has revenue of $39,500, variable cost of goods sold of $25,500, variableselling expenses of $16,500, and fixed costs of $15,000, creating a loss from operationsof $17,500. Prepare and show in solution a differential analysis as of May 9 todetermine if Product B should be continued (Alternative 1) or discontinued (Alternative 2), assuming fixed costs are unaffected by the decision.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education