FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

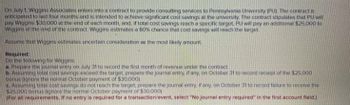

Transcribed Image Text:On July 1 Wiggins Associates enters into a contract to provide consulting services to Pennsylvania University (PU). The contract is

anticipated to last four months and is intended to achieve significant cost savings at the university. The contract stipulates that PU will

pay Wiggins $30.000 at the end of each month, and, if total cost savings reach a specific target. PU will pay an additional $25,000 to

Wiggins at the end of the contract Wiggins estimates a 80% chance that cost savings will reach the target

Assume that Wiggins estimates uncertain consideration as the most likely amount.

Required:

Do the following for Wiggins

a. Prepare the journal entry on July 31 to record the first month of revenue under the contract

b. Assuming total cost savings exceed the target, prepare the journal entry, if any, on October 31 to record receipt of the $25,000

bonus ignore the normal October payment of $30.0001

c. Assuming total cost savings do not reach the target, prepare the journal entry, if any, on October 31 to record failure to receive the

$25.000 bonus ignore the normal October payment of $30,000)

(For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nvidia enters into a contract which pays $2,100/month for six months of services. In addition, there is a 70% chance the contract will pay an additional $3,500 and a 30% chance the contract will pay an additional $1,500, depending on the outcome of the contract. Assume Nvidia estimates variable consideration as the most likely amount. What is the amount of revenue Nvidia would recognize for the first month of the contract? Note: Do not round intermediate calculations. Round final answer to whole dollars. Multiple Choice $2,100 $2,450 ☐ $2,683arrow_forwardA company enters into a contract with a customer to build a building, with a performance bonus of $33,500 if the building is completed by September 30, 2021. The bonus is reduced by $5,000 each week that completion is delayed. The company commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by ProbabilitySeptember 30, 2021 70%October 7, 2021 15%October 14, 2021 10%October 21, 2021 5%The amount of revenue the company should recognize related to this bonus is $_______________.arrow_forwardThe Titanic Shipbuilding Company has a noncancelable contract to build a small cargo vessel. Construction involves a cash outlay of $270,000 at the end of each of the next two years. At the end of the third year, the company will receive payment of $620,000. The company can speed up construction by working an extra shift. In this case, there will be a cash outlay of $584,000 at the end of the first year followed by a cash payment of $620,000 at the end of the second year. Use the IRR rule to show the (approximate) range of opportunity costs of capital at which the company should work the extra shift. Note: Enter your answers as a percent rounded to 2 decimal places. Enter the smallest percent first. The company should work the extra shift if the cost of capital is between % and %.arrow_forward

- Jeff Heun, president of Wildhorse Always, agrees to construct a concrete cart path at Dakota Golf Club. Wildhorse Always enters into a contract with Dakota to construct the path for $233,000. In addition, as part of the contract, a performance bonus of $42,800 will be paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date. The performance bonus decreases by $10,700 per week for every week beyond the agreed-upon completion date. Jeff has been involved in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he will receive a good portion of the performance bonus. Jeff estimates, given the constraints of his schedule related to other jobs, that there is 55% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 15% probability that he will be 2 weeks late. a.) Determine the transaction…arrow_forwardDetermining the Transaction Price for a Revenue Contract A contractor enters into a revenue contract with a customer to build customized equipment for $180,000 with a performance bonus of $99,000 that will be paid based on how quickly the equipment is completed. The amount of the performance bonus decreases by 15% of the original bonus per week for every week beyond the agreed upon completion date. The contractor has had experiences with similar contracts and thus has the data to predict the timing of completion of the contract. Therefore, the contractor concludes that the expected value method is the best predictor of revenue. The contractor estimates that there is a 60% probability that the contract will be completed by the agreed-upon completion date, a 35% probability that it will be completed one week late, and a 5% probability that it will be completed two weeks late. Complete the following table in order to determine the transaction price for revenue recognition for the…arrow_forwardOn April 1st, Tesla entered into a contract of one-month duration to build a barn for Amazon. Tesla is guaranteed to receive a base fee of $5,300 for his services in addition to a bonus depending on when the project is completed. Amazon created incentives for Tesla to finish the barn as soon as he can without jeopardizing the structural integrity of the barn. Amazon offered to pay an additional 30% of the base fee if the project finished 2 weeks early and 10% if the project finished a week early. The probability of finishing 2 weeks early is 30% and the probability of finishing a week early is 60%. What is the expected transaction price with variable consideration estimated as the expected value? Multiple Choice O $5,300 O $7,095 O $5,035 $6,095 Garrow_forward

- Rakesharrow_forwardJeff Heun, president of Larkspur Always, agrees to construct a concrete cart path at Dakota Golf Club. Larkspur Always enters into a contract with Dakota to construct the path for $191000. In addition, as part of the contract, a performance bonus of $48,000 will be paid based on the timing of completion. The performance bonus will be paid fully if completed by the agreed-upon date The performance bonus decreases by $12,000 per week for every week beyond the agreed-upon completion date. Jeff has been involved in a number of contracts that had performance bonuses as part of the agreement in the past. As a result, he is fairly confident that he will receive a good portion of the performance bonus. Jeff estimates, given the constraints of his schedule related to other jobs, that there is 55% probability that he will complete the project on time, a 30% probability that he will be 1 week late, and a 15% probability that he will be 2 weeks late. Determine the transaction price that Larkspur…arrow_forwardWilliam Corp. enters into a contract with a customer to build an apartment building for $1,056,300. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $136,200 to be paid if the building is ready for rental beginning August 1, 2026. The bonus is reduced by $45,400 each week that completion is delayed. William commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by August 1, 2026 August 8, 2026 August 15, 2026 After August 15, 2026 Transaction price $ Probability LA 70 % 20 Determine the transaction price for this contract. 5 5 SUPPORTarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education