FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances:

| Accounts | Debit | Credit |

|---|---|---|

| Cash | $24,300 | |

| 42,500 | ||

| Allowance for Uncollectible Accounts | $2,700 | |

| Inventory | 42,000 | |

| Land | 79,600 | |

| Accounts Payable | 29,200 | |

| Notes Payable (8%, due in 3 years) | 42,000 | |

| Common Stock | 68,000 | |

| 46,500 | ||

| Totals | $188,400 | $188,400 |

The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions:

| January 3 | Purchase 1,050 units for $115,500 on account ($110 each). |

|---|---|

| January 8 | Purchase 1,150 units for $132,250 on account ($115 each). |

| January 12 | Purchase 1,250 units for $150,000 on account ($120 each). |

| January 15 | Return 160 of the units purchased on January 12 because of defects. |

| January 19 | Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO perpetual inventory system. |

| January 22 | Receive $529,000 from customers on accounts receivable. |

| January 24 | Pay $359,000 to inventory suppliers on accounts payable. |

| January 27 | Write off accounts receivable as uncollectible, $2,100. |

| January 31 | Pay cash for salaries during January, $110,000. |

The following information is available on January 31, 2024.

- At the end of January, the company estimates that the remaining units of inventory purchased on January 12 are expected to sell in February for only $100 each. [Hint: Determine the number of units remaining from January 12 after subtracting the units returned on January 15 and the units assumed sold (FIFO) on January 19.]

- The company records an

adjusting entry for $5,070 for estimated future uncollectible accounts. - The company accrues interest on notes payable for January. Interest is expected to be paid each December 31.

- The company accrues income taxes at the end of January of $13,500.

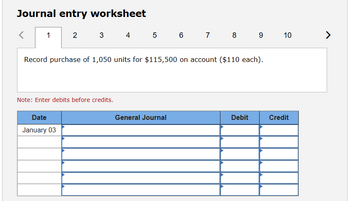

Transcribed Image Text:Journal entry worksheet

<

1

2

3

4 5 6 7 8 9

Record purchase of 1,050 units for $115,500 on account ($110 each).

Note: Enter debits before credits.

Date

January 03

10

110

General Journal

Debit

Credit

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vinubhaiarrow_forwardPrepare a closing journal entry for the income statement accounts, assuming the events on December 29-31 were the only transactions to affect income statement accounts. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit December 31 Clear entry View general journal Record entryarrow_forward.arrow_forward

- On January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forwardOn January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forwardHancock Company reported the following account balancesat December 31, 2027:Sales revenue $97,000Dividends. $11,000Supplies 13,000Accounts payable 41,000Patent $59,000Building Common stock.. $27,000Insurance expense .... $31,000Notes payable .. $39,000Income tax expense $42,000Cash . . $19,000Repair expense ?Copyright $20,000Equipment $14,000Utilities payable. $22,000Inventory $64,000Retained earnings. .. $87,000 (at Jan. 1, 2027)Interest revenue $55,000Cost of goods sold ..... .. $37,000Accumulated depreciation .... $23,000 $34,000Accounts receivable ? Trademark. ... $51,000Calculate the total intangible assets reported in HancockCompany's December 31, 2027 balance sheet. The following additional information is available:1) The note payable listed above was a 4- year bank loan taken out on September 1, 2024.2) The total P - P - E at Dec. 31, 2027 was equal to 75% of the total current liabilities at Dec. 31, 2027. ՄԴ Sarrow_forward

- On January 1, 2024, the general ledger of 3D Family Fireworks includes the following account balances: Accounts Cash Accounts Receivable Allowance for Uncollectible Accounts Supplies Notes Receivable (6%, due in 2 years) Land Accounts Payable Common Stock Retained Earnings Totals Debit $27,300 15,300 4, 200 21,000 80,600 a-1. The receivables turnover ratio is a-2. The company collecting cash from customers b-1. Allowance for Uncollectible Accounts ratio b-2. The company expects an $148,400 Credit $1,600 During January 2024, the following transactions occur: January 2 January 6 Provide services to customers for cash, $52,100. Provide services to customers on account, $89,400. January 15 Write off accounts receivable as uncollectible, $3,900. (Assume the company uses the allowance method) Pay cash for salaries, $33,100. January 20 January 22 Receive cash on accounts receivable, $87,000. January 25 Pay cash on accounts payable, $7,200. January 30 Pay cash for utilities during January,…arrow_forwardOn January 1, 2024, the general ledger of Big Blast Fireworks includes the following account balances: Accounts Debit Credit Cash $24,300 Accounts Receivable 42,500 Allowance for Uncollectible Accounts $2,700 Inventory 42,000 Land 79,600 Accounts Payable 29,200 Notes Payable (8%, due in 3 years) 42,000 Common Stock 68,000 Retained Earnings 46,500 Totals $188,400 $188,400 The $42,000 beginning balance of inventory consists of 420 units, each costing $100. During January 2024, Big Blast Fireworks had the following inventory transactions: January 3 Purchase 1,050 units for $115,500 on account ($110 each). January 8 Purchase 1,150 units for $132,250 on account ($115 each). January 12 Purchase 1,250 units for $150,000 on account ($120 each). January 15 Return 160 of the units purchased on January 12 because of defects. January 19 Sell 3,600 units on account for $576,000. The cost of the units sold is determined using a FIFO…arrow_forwardOn January 1, 2024, the general ledger of ACME Fireworks includes the following account balances: Accounts Debit Credit Cash $25,700 Accounts Receivable 47,400 Allowance for Uncollectible Accounts $4,800 Inventory 20,600 Land 52,000 Equipment 18,000 Accumulated Depreciation 2,100 Accounts Payable 29,100 Notes Payable (6%, due April 1, 2025) 56,000 Common Stock 41,000 Retained Earnings 30,700 Totals $163,700 $163,700 During January 2024, the following transactions occur: January 2 Sold gift cards totaling $9,200. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $153,000. ACME uses the perpetual inventory system. January 15 Firework sales for the first half of the month total $141,000. All of these sales are on account. The cost of the units sold is $76,800. January 23 Receive $126,000 from customers on accounts receivable. January 25…arrow_forward

- On January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances:Accounts Debit CreditCash $ 21,900Accounts Receivable 36,500Allowance for Uncollectible Accounts $ 3,100Inventory 30,000Land 61,600Accounts Payable 32,400Notes Payable (8%, due in 3 years) 30,000Common Stock 56,000Retained Earnings 28,500Totals $150,000 $150,000The $30,000 beginning balance of inventory consists of 300 units, each costing…arrow_forwardConsider the following financial data for Larry’s Computer Stores: Statement of Financial Position as of December 31, 2012 Cash & equivalents $ 94,500 Accounts payable $ 122,500 Receivables 202,500 Short-term bank note 162,500 Inventories 364,000 Accrued wages and taxes 110,500 Total current assets $ 661,000 Total short-term liab. $ 395,500 Long-term debt 418,000 Net fixed assets 468,500 Common equity 316,000 Total assets $ 1,129,500 Total liabilities & equity $ 1,129,500 Statement of Earnings for the Year Ended December 31, 2012 Sales revenue $ 450,000 Cost of merchandise sold 250,000 Gross profit $ 200,000 Operating expenses 97,500 Earnings before interest and taxes (EBIT) $ 102,500 Interest expense 46,500 Earnings before taxes (EBT) $ 56,000 Federal and state income taxes (45 percent) 25,200 Net earnings $ 30,800…arrow_forwardBalance Sheet as of December 31, 2021 (Thousands of Dollars) Cash $ 1,080 Accounts payable $ 4,320 Receivables 6,480 Accruals 2,880 Inventories 9,000 Line of credit Total current assets $16,560 Notes payable 2,100 Net fixed assets 12,600 Total current liabilities $ 9,300 Mortgage bonds 3,500 Common stock 3,500 Retained earnings 12,860 Total assets $29,160 Total liabilities and equity $29,160 Income Statement for December 31, 2021 (Thousands of Dollars) Sales $36,000 Operating costs 34,000 Earnings before interest and taxes $ 2,000 Interest 160 Pre-tax earnings $ 1,840 Taxes (25%) 460 Net income $ 1,380 Dividends 552 Addition to retained earnings 2$ 828arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education