FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

On January 1, 2024, the general ledger of Grand Finale Fireworks includes the following account balances:

| Accounts | Debit | Credit |

|---|---|---|

| Cash | $ 44,400 | |

| 47,900 | ||

| Supplies | 9,200 | |

| Equipment | 81,000 | |

| $10,700 | ||

| Accounts Payable | 16,300 | |

| Common Stock, $1 par value | 17,000 | |

| Additional Paid-in Capital | 97,000 | |

| 41,500 | ||

| Totals | $182,500 | $182,500 |

During January 2024, the following transactions occur:

| January 2 | Issue an additional 2,100 shares of $1 par value common stock for $42,000. |

|---|---|

| January 9 | Provide services to customers on account, $19,300. |

| January 10 | Purchase additional supplies on account, $6,600. |

| January 12 | Purchase 1,200 shares of |

| January 15 | Pay cash on accounts payable, $18,200. |

| January 21 | Provide services to customers for cash, $50,800. |

| January 22 | Receive cash on accounts receivable, $18,300. |

| January 29 | Declare a cash dividend of $0.20 per share to all shares outstanding on January 29. The dividend is payable on February 15. (Hint: Grand Finale Fireworks had 17,000 shares outstanding on January 1, 2024, and dividends are not paid on treasury stock.) |

| January 30 | Resell 500 shares of treasury stock for $22 per share. |

| January 31 | Pay cash for salaries during January, $43,700. |

6. Record closing entries. (If no entry is required for a transaction/event, select "No

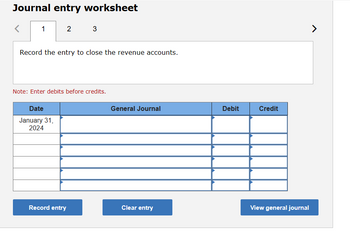

Transcribed Image Text:Journal entry worksheet

1 2

3

Record the entry to close the revenue accounts.

Note: Enter debits before credits.

Date

January 31,

2024

General Journal

Debit

Credit

7

Record entry

Clear entry

View general journal

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Prepare Balance sheet of Mr. Vengo for the year 31* December 2020 in T-form: Particulars Amount Particulars Amount Capital 40,000 4,400 Drawings Creditors Cash at bank Debtors 6,400 4,200 Cash in hand 360 7,200 Furniture 3,700 Plant 10,000 Net profit Closing stock 1,660 General reserve 1,000 14,800arrow_forwardWhat does the company report for the following accounts for the most current fiscal year: Enter your answer in millions. Total Assets: 70,581 Total Liabilities: 67,282 Long-Term debt: 35,822 Other long-term liabilities: 8,294 Operating Income: 18,278 Interest expense: 1,347 2. The company projects the following for the next fiscal year: • Total assets will increase by 5%.• Total liabilities will increase by 6%.• Long-term debt and interest expense will increase by 7%.• Operating income will increase by $750 million. a. Total assets: 74,100 b Total liabilities: 71,319 c. Long-term debt: 38,330 d. operating income: 19,028 e. Interest expense: Provide the next year’s forecasted balances for the above accounts. Round your answer to the nearest million. 1. Compute the forecasted debt to equity ratio for the next fiscal year. Round your answer to two decimal places. 2. Compute the forecasted long-term debt to equity ratio for the next fiscal year. Round your answer to two decimal…arrow_forwardThe 2024 balance sheet for Hallbrook Industries, Incorporated, is shown below. HALLBROOK INDUSTRIES, INCORPORATED Balance Sheet December 31, 2024 ($ in thousands) Assets Cash $ 380 Short-term investments 330 Accounts receivable 380 Inventory 310 Property, plant, and equipment (net) 2,800 Total assets $ 4,200 Liabilities and Shareholders’ Equity Current liabilities $ 580 Long-term liabilities 530 Paid-in capital 1,650 Retained earnings 1,440 Total liabilities and shareholders’ equity $ 4,200 The company’s 2024 income statement reported the following amounts ($ in thousands) Net sales $ 6,400 Interest expense 60 Income tax expense 170 Net income 340 Calculate the current ratio. Note: Round your answer to 2 decimal places. Calculate the acid-test ratio. Note: Round your answer to 3 decimal places. Calculate the debt to equity ratio. Note: Round your answer to 2 decimal places. Calculate the times interest earned…arrow_forward

- Prepare a vertical analysis for the balance sheet data given below. (Round to two decimal places.) Petals, Inc. Balance Sheet December 31, 2019 Assets Current Assets: Cash and Cash Equivalents $10,000 Accounts Receivable, Net 15,600 Merchandise Inventory 38,000 Total Current Assets 63,600 Long-term Investments 15,000 Property, Plant, and Equipment, Net 195,000 Total Assets $273,600 Liabilities Current Liabilities: Accounts Payable $8,500 Notes Payable…arrow_forwardThe following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents Accounts receivable (net) $ 6,300 33,000 73,000 Inventory Property, plant, and equipment (net) 185,000 Accounts payable 52,000 Salaries payable Paid-in capital 24,000 165,000 The only asset not listed is short-term investments. The only liabilities not listed are $43,000 notes payable due in two years and related accrued interest payable of $1,000 due in four months. The current ratio at year-end is 1.5:1. Required: Determine the following at December 31, 2024: 1. Total current assets 2. Short-term investments 3. Retained earningsarrow_forward.arrow_forward

- Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 Assets Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock (4,000 shares) Retained earnings Common equity Total llabilities and equity Sales Operating costs excluding depreciation and amortization EBITDA Depreciation & amortization EBIT Interest EBT Taxes (25%) Net Income Dividends pald Income Statement for Year Ending December 31, 2021 2021 Balances, 12/31/20 2021 Net Income Cash Dividends Addition to retained earnings Balances, 12/31/21 $ 15,000 35,000 34,190 $ 84,190 48,000 $132,190 $ 10,100 7,300 6,200 $ 23,600 15,000 $ 38,600 60,000 33,590 $ 93,590 $132,190 c. Construct Arlington's 2021 statement of stockholders' equity. Shares $ 2020 $ 13,000 30,000 28,000…arrow_forwardBill Inc.'s last year financial statements are shown below: Bill Inc. Balance Sheet as of December 31 Cash $ 90,000 Accounts payable $ 180,000 Receivables 180,000 Notes payable 78,000 Inventory 360,000 Accruals 90,000 Total current assets $630,000 Total current liabilities $ 348,000 Common stock 900,000 Net fixed assets 720,000 Retained earnings 102,000 Total assets $1,350,000 Total liabilities and equity $1,350,000 Bill Inc. Income Statement for December 31 Sales $1,800,000 Operating costs 1,639,860 EBIT $ 160,140 Interest 10,140 EBT $ 150,000 Taxes (40%) 60,000 Net income $90,000 Dividends (60%) $ 54,000 Addition to retained earnings $ 36,000 Suppose that next year's sales will increase by 20 percent over last year's sales. Construct the pro forma financial statements using the percent of sales method. Assume the firm…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

- American Laser, Inc., reported the following account balances on January 1. Accounts Receivable Accumulated Depreciation. Additional Paid-in Capital Allowance for Doubtful Accounts Bonds Payable Buildings. Cash Common Stock, 10,000 shares of $1 part Notes Payable (long-term) Retained Earnings Treasury Stock TOTALS Requirement View transaction list General Journalarrow_forwardCash Accounts Receivable Inventory Property Plant & Equipment Other Assets Total Assets Acme Company Balance Sheet As of January 5, 2020 (amounts in thousands) 14,700 Accounts Payable 4,800 Debt 3,800 Other Liabilities 15,800 Total Liabilities 900 Paid-In Capital 2,400 3,700 5,000 11,100 6,000 Retained Earnings 22,900 Total Equity 28,900 40,000 Total Liabilities & 40,000 Equity Update the balance sheet above to reflect the transactions below, which occur on January 6, 2020 1. Receive payment of $12,000 owed by a customer 2. Buy $15,000 worth of manufacturing supplies on credit 3. Purchase equipment for $44,000 in cash 4. Issue $80,000 in stock 5. Pay $4,000 owed to a supplier 6. Borrow $58,000 from a bank 7. Buy $15,000 worth of manufacturing supplies on credit What is the final amount in Accounts Payable?arrow_forwardAmerican Laser, Inc., reported the following account balances on January 1. Accounts Receivable Accumulated Depreciation. Additional Paid-in Capital Allowance for Doubtful Accounts Bonds Payable Buildings. Cash Common Stock, 10,000 shares of $1 part Notes Payable (long-term) Retained Earnings Treasury Stock TOTALS Requirement View transaction list General Journalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education