FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

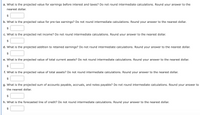

Transcribed Image Text:a. What is the projected value for earnings before interest and taxes? Do not round intermediate calculations. Round your answer to the

nearest dollar.

$

b. What is the projected value for pre-tax earnings? Do not round intermediate calculations. Round your answer to the nearest dollar.

$

c. What is the projected net income? Do not round intermediate calculations. Round your answer to the nearest dollar.

$

d. What is the projected addition to retained earnings? Do not round intermediate calculations. Round your answer to the nearest dollar.

$

e. What is the projected value of total current assets? Do not round intermediate calculations. Round your answer to the nearest dollar.

f. What is the projected value of total assets? Do not round intermediate calculations. Round your answer to the nearest dollar.

$

g. What is the projected sum of accounts payable, accruals, and notes payable? Do not round intermediate calculations. Round your answer to

the nearest dollar.

$

h. What is the forecasted line of credit? Do not round intermediate calculations. Round your answer to the nearest dollar.

$

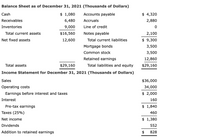

Transcribed Image Text:Balance Sheet as of December 31, 2021 (Thousands of Dollars)

Cash

$ 1,080

Accounts payable

$ 4,320

Receivables

6,480

Accruals

2,880

Inventories

9,000

Line of credit

Total current assets

$16,560

Notes payable

2,100

Net fixed assets

12,600

Total current liabilities

$ 9,300

Mortgage bonds

3,500

Common stock

3,500

Retained earnings

12,860

Total assets

$29,160

Total liabilities and equity

$29,160

Income Statement for December 31, 2021 (Thousands of Dollars)

Sales

$36,000

Operating costs

34,000

Earnings before interest and taxes

$ 2,000

Interest

160

Pre-tax earnings

$ 1,840

Taxes (25%)

460

Net income

$ 1,380

Dividends

552

Addition to retained earnings

2$

828

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the real return? Multiple Choice The after-tax return on assets. The pre-tax return on assets. The inflation-adjusted return on assets. The interest-adjusted return on assets. None of the choices are correct.arrow_forward19. Gross profit margin is a better measure of profitability than return on equity (ROE). Select one: True or Falsearrow_forward9arrow_forward

- Which one of the following is an advantage of LIFO? a. In periods of rising prices, less income taxes are paid b. In periods of rising prices, more holding gains are reported in net income c. Record keeping and financial statement preparation are easier d. Conservative income statement and balance sheet disclousures result from falling pricesarrow_forwardAlthough the income statement is a record of past achievement, the calculations required forcertain expenses involve estimates of the future.’ What does this statement mean? Can you thinkof examples where estimates of the future are used?arrow_forwardwhich one is correct please confirm? QUESTION 9 In using the percentage of sales forecasting method, the assumption is that ______________. a. there is a direct relationship between notes payable and sales b. accounts payable will not increase proportionally with sales c. there is a direct relationship between long-term debt and sales d. inventories will increase proportionately with salesarrow_forward

- Which of the following is not a factor in producing earnings forecasts? a) Estimating the level of dividends b) Separation of recurring and nonrecurring components c) Recognizing potential earnings management d) Recognizing potential income smoothingarrow_forwardWhy does Non-GAAP earnings are controversial?arrow_forwardCould I get the entire answer please? Earnings before taxes, net income and taxes?arrow_forward

- EBIT is equivalent to profits after taxes. true or false?arrow_forwardWhich of the following would not be used as a summary performance measure when using market multiples to determine value? Stock price Net operating assets Net operating profit after tax Book valuearrow_forwardFIFO and weighted average. But what if a company wants to use LIFO to report its inventory because of the significant tax benefit? How could dollar-value LIFO help them use FIFO for managerial purposes but LIFO for financial statement reporting?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education