FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

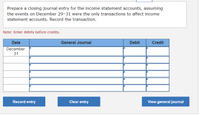

Transcribed Image Text:Prepare a closing journal entry for the income statement accounts, assuming

the events on December 29-31 were the only transactions to affect income

statement accounts. Record the transaction.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

December

31

Clear entry

View general journal

Record entry

Transcribed Image Text:American Laser, Incorporated, reported the following account balances on January 1.

Credit

Debit

$ 5,000

Accounts Receivable

Accumulated Depreciation

Additional Paid-in Capital

$ 30,000

90,000

2,000

0

Allowance for Doubtful Accounts

Bonds Payable

Buildings

247,000

10,000

Cash

Common Stock, 10,000 shares of $1 par

10,000

10,000

Notes Payable (long-term)

120,000

Retained Earnings

Treasury Stock

0

TOTALS

$ 262,000 $ 262,000

The company entered into the following transactions during the year.

January 15 Issued 5,000 shares of $1 par common stock for $50,000 cash.

January 31 Collected $3,000 from customers on account.

February 15 Reacquired 3,000 shares of $1 par common stock into treasury for $33,000 cash.

March 15 Reissued 2,000 shares of treasury stock for $24,000 cash.

August 15 Reissued 600 shares of treasury stock for $4,600 cash.

September 15 Declared (but did not yet pay) a $1 cash dividend on each outstanding share of common stock.

October 1 Issued 100, 10-year, $1,000 bonds, at a quoted bond price of 101.

October 3 Wrote off a $1,500 balance due from a customer who went bankrupt.

December 29 Recorded $230,000 of service revenue, all of which was collected in cash.

December 30 Paid $200,000 cash for this year's wages through December 31. Ignore payroll taxes and payroll deductions.

December 31 Calculated $10,000 of depreciation for the year to be recorded. (Ignore accrual adjustments for interest and income

taxes.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 12/31/2020: During 2020, $10,000 in accounts receivable were written off. At the end of the second year of operations, Yolandi Company had $1,000,000 in sales and accounts receivable of $400,000. XYZ’s management has estimated that 1.5% of sales will be uncollectible. For the end of 2020, after the adjusting entry for bad debts was journalized, what is the balance in the following accounts: Bad debt expense: Allowance for doubtful accounts: For the end of 2020, what is the company's net realizable value?arrow_forwardAt the end of 2020, Bonita Company has accounts receivable of $960,000 and an allowance for doubtful accounts of $48,000. On January 16, 2021, Bonita Company determined that its receivable from Ramirez Company of $7,200 will not be collected, and management authorized its write-off. What is the net amount expected to be collected of Bonita Company’s accounts receivable after the write-off of the Ramirez receivable? Net amount expected to be collected $arrow_forwardThe payroll register of Heritage Co. indicates $1,500 of social security withheld and $375 of Medicare tax withheld on total salaries of $25,000 for the period. Federal withholding for the period totaled $4,250. Retirement savings withheld from employee paychecks were $2,500 for the period. Journalize the entry to record the period’s payroll. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forward

- Blossom Equipment Sales Company, which sells only on account, had a $120,000 balance in its Accounts Receivable and a $4,200 balance in its Allowance for Expected Credit Losses on December 31, 2023. During 2024, the company's sales of equipment were $820,000, and its total cash collections from customers were $780,000. During year, the company identified customers with accounts totalling $6,000 that would be unable to pay and wrote these receivables off. However, one of these customers subsequently made a payment of $800. (Note that this amount is not included in the cash collections noted above.) At the end of 2024, management grouped its receivables based on credit risk and estimated the expected rate of credit losses for each group. Based on this, management determined that the total expected credit losses would be $7,200. what amount of credit losses would appear on the statement of income for the year ended december 31, 2024arrow_forwardDexter Company applies the direct write-off method in accounting for uncollectible accounts. March 11 Dexter determines that it cannot collect $45,000 of its accounts receivable from its customer Leer Company. 29 Leer Company unexpectedly pays its account in full to Dexter Company. Dexter records its recovery of this bad debt. Prepare journal entries to record the above selected transactions of Dexter.arrow_forwardSolstice Company, which uses the direct write-off method, determines on October 1 that it cannot collect $53,000 of its accounts receivable from its customer, P. Moore. On October 30, P. Moore unexpectedly pays his account in full to Solstice Company. Record Solstice’s entries for recovery of this bad debt.arrow_forward

- At year-end December 31, Chan Company estimates its bad debts as 0.30% of its annual credit sales of $812, 000. Chan records its bad debts expense for that estimate. On the following February 1, Chan decides that the $406 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan's journal entries to record the transactions of December 31, February 1, and June 5. Journal entry worksheet Record the estimated bad debts expense. Note: Enter debits before credits. Please explain and elaborate!arrow_forwardThe accounts receivable balance for Renue Spa at December 31, Year 1, was $86,000. Also on that date, the balance in the Allowance for Doubtful Accounts was $2,300. During Year 2, $2,300 of accounts receivable were written off as uncollectible. In addition, Renue unexpectedly collected $190 of receivables that had been written off in a previous accounting period. Services provided on account during Year 2 were $218,000, and cash collections from receivables were $220,000. Uncollectible accounts expense was estimated to be 1 percent of the sales on account for the period. Required Record the transactions in general journal form and post to T-accounts. Based on the preceding information, compute (after year-end adjustment): (1) Balance of allowance for doubtful accounts at December 31, Year 2. (2) Balance of accounts receivable at December 31, Year 2. (3) Net realizable value of accounts receivable at December 31, Year 2. What amount of uncollectible accounts expense will Renue…arrow_forwardDuring the year, credit sales amounted to $800,000. Cash collected on credit sales amounted to $760,000, and $18,000 has been written off. At the end of the year, the company adjusted for bad debts expense using the percent-of-sales method and applied a rate, based on past history, of 2.5%. The ending balance of Accounts Receivable would be:arrow_forward

- The annual report for Fabeck Finishing Corporation contained the following information: (in millions) Accounts Receivable Allowance for Doubtful Accounts Accounts Receivable, Net 2021 $673 32 $641 Assume that accounts receivable write-offs amounted to $13 during 2021 and $3 during 2020, and that Fabeck Finishing did not record any recoveries. Bad Debt Expense 2020 $735 31 $704 Required: Determine the Bad Debt Expense for 2021 based on the above facts. (Enter your answer in millions.) millionarrow_forwardAt the close of its first year of operations, December 31, 2021, Mega Company had accounts receivable of $540,000, after deducting the related allowance for doubtful accounts. During 2021, the company had charges to bad debt expense of $90,000 and wrote off, as uncollectible, accounts receivable of $40,000. What should the company report on its statement of financial position at December 31, 2021, as accounts receivable before the allowance for doubtful accounts?arrow_forwardAt year-end (December 31), Chan Company estimates its bad debts as 1% of its annual credit sales of $487,500. Chan records its bad debts expense for that estimate. On the following February 1, Chan decides that the $580 account of P. Park is uncollectible and writes it off as a bad debt. On June 5, Park unexpectedly pays the amount previously written off. Prepare Chan’s journal entries to record the transactions of December 31, February 1, and June 5.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education