FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

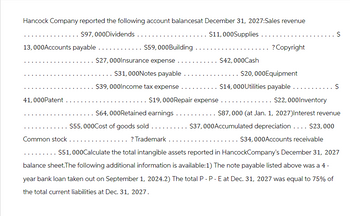

Transcribed Image Text:Hancock Company reported the following account balancesat December 31, 2027:Sales revenue

$97,000Dividends.

$11,000Supplies

13,000Accounts payable

41,000Patent

$59,000Building

Common stock..

$27,000Insurance expense

.... $31,000Notes payable ..

$39,000Income tax expense

$42,000Cash

. . $19,000Repair expense

?Copyright

$20,000Equipment

$14,000Utilities payable.

$22,000Inventory

$64,000Retained earnings.

.. $87,000 (at Jan. 1, 2027)Interest revenue

$55,000Cost of goods sold ..... .. $37,000Accumulated depreciation .... $23,000

$34,000Accounts receivable

? Trademark.

... $51,000Calculate the total intangible assets reported in HancockCompany's December 31, 2027

balance sheet. The following additional information is available:1) The note payable listed above was a 4-

year bank loan taken out on September 1, 2024.2) The total P - P - E at Dec. 31, 2027 was equal to 75% of

the total current liabilities at Dec. 31, 2027.

ՄԴ

S

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Moon Corporation JULY 31, 2011Balance sheet July 31, 2011 AssetsLiabilities & Owners’ Equity Cash . . . . . . . . . . . . . . . . $ 18,000Liabilities: Accounts Receivable . . . 26,000Notes Payable Land . . . . . . . . . . . . . . . . 37,200(due in 60 days). . . . . . . . . . . . . $ 12,400 Building. . . . . . . . . . . . . . 38,000Accounts Payable . . . . . . . . . . . . . 9,600 Office Equipment . . . . . . 1,200Total liabilities . . . . . . . . . . . . . . $ 22,000 Stockholders’ equity: Capital Stock . . . . . . . . . $60,000 Retained Earnings. . . . . 38,400 98,400 Total . . . . . . . . . . . . . . . . $120,400 Total . . . . . . . . . . . . . . . . . . . . . . . . . $120,400 STAR CORPORATIONBALANCE SHEET Star Corporation JULY 31, 20112011Balance sheet July 31, 2011 Assets Liabilities & Owners’ Equity Cash . . . . . . . . . . . . . . . . $ 4,800Liabilities: Accounts Receivable . . . 9,600Notes Payable Land . . . . . . . . . . . . . . . . 96,000(due in 60 days). . . . . . . .…arrow_forward44. Subject :- Accountingarrow_forwardThe following items are reported on a company's balance sheet: $212,700 90,200 252,800 196,700 278,400 Cash Marketable securities Accounts receivable Inventory Accounts payable Determine the (a) current ratio, and (b) quick ratio. Round your answers to one decimal place. a. Current ratio b. Quick ratioarrow_forward

- Based on the financial statements below, what is the current ratio and quick ratio?arrow_forwardThe following items are reported on a company's balance sheet: Cash $579,700 Marketable securities 452,900 Accounts receivable (net) 520,200 Inventory 258,800 Accounts payable 647,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio b. Quick ratioarrow_forwardThe following are financial statements of Carla Vista Co.. Carla Vista Co.Income StatementFor the Year Ended December 31, 2022 Net sales $2,247,500 Cost of goods sold 1,018,500 Selling and administrative expenses 901,000 Interest expense 82,000 Income tax expense 75,000 Net income $ 171,000 Carla Vista Co.Balance SheetDecember 31, 2022 Assets Current assets Cash $ 56,300 Debt investments 81,000 Accounts receivable (net) 169,500 Inventory 118,900 Total current assets 425,700 Plant assets (net) 574,000 Total assets $ 999,700 Liabilities and Stockholders’ Equity Current liabilities Accounts payable $ 161,000 Income taxes payable 37,000 Total current liabilities 198,000 Bonds payable 201,880 Total liabilities 399,880 Stockholders’ equity Common stock 355,000 Retained earnings 244,820…arrow_forward

- ABC Company's accounting records reported the followingaccount balances as of December 31, 2028:Inventory ................... $59,000Trademark ................... $16,000Interest revenue ............ $21,000Accounts receivable ......... $44,000Cost of goods sold .......... $30,000Utilities expense ........... $29,000Salaries payable ............ $14,000Accumulated depreciation .... $37,000Land ........................ ?Dividends ................... $ 9,000Notes payable ............... $48,000Common stock ................ ?Rental revenue .............. $35,000Supplies .................... $23,000Income tax expense .......... $18,000Retained earnings ........... $57,000 (at Jan. 1, 2028)Sales revenue ............... $99,000Equipment ................... $74,000Copyright ................... $38,000Accounts payable ............ $41,000Salaries expense ............ $27,000Cash ........................ $19,000Additional information:The total equity at December 31, 2028 was $196,000.Calculate…arrow_forwardThe following information is available in respect of Vegas plc for the last 2 years ended 31 December. Non-current Assets (at Net Book Value) Current Assets: Inventory Trade receivables Cash at bank Equity and Liabilities: Equity Share capital £1 Share premium Revenue reserve Vegas plc: Statement of Financial Position 31.12.2021 Non-current Liabilities: Loan Current Liabilities: Trade payables Taxation (accrual) Operating profit Taxation £000 390 462 80 88 142 £000 2,100 932 3.032 900 50 852 1,802 1,000 230 3.032 274 (156) 118 (87) 31 31.12.2020 Vegas plc: Income Statement (Extract) for the year ended 31.12.2021 £000 Dividends Retained profit for the year The following information is also available: • There were no non-current asset disposals during the year. • Depreciation for the year was £240,000. £000 210 346 50 73 137 £000 1,975 606 2.581 700 821 1,521 850 210 2.581 Prepare, in a suitable format, the Statement of Cash Flow for Vegas plc for the year ended 31.12.2021, presenting…arrow_forwardThe following items are reported on a company's balance sheet: Line Item Description Amount Cash $277,000 Marketable securities 101,400 Accounts receivable 234,300 Inventory 217,800 Accounts payable 315,500 Determine the (a) current ratio and (b) quick ratio. Round answers to one decimal place.arrow_forward

- .arrow_forwardThe following items are reported on a company's balance sheet: Cash $295,700 Marketable securities 231,000 Accounts receivable (net) 265,300 Inventory 132,000 Accounts payable 330,000 Determine (a) the current ratio and (b) the quick ratio. Round to one decimal place. a. Current ratio b. Quick ratioarrow_forwardK McDaniel and Associates, Inc. reported the following amounts on its 2024 income statement: Year Ended December 31, 2024 Net income Income tax expense Interest expense $ 22,950 6,600 3,000 What was McDaniel's times-interest-earned ratio for 2024? OA. 7.65 OB. 10.85 OC. 9.85 OD. 8.65 point(s) possible ...arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education