FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

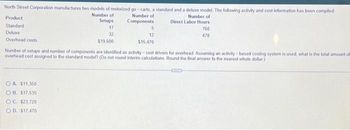

Transcribed Image Text:North Street Corporation manufactures two models of motorized go-carts, a standard and a deluxe model. The following activity and cost information has been compiled

Number of

Number of

Setups

Number of

Components

Direct Labor Hours

17

760

32

470

$19,600

Product

Standard

Deluxe

Overhead costs

5

OA. $11,350

OB. $17,535

OC. $23,720

OD. $17,470

12

$15,470

Number of setups and number of components are identified as activity-cost drivers for overhead Assuming an activity-based costing system is used, what is the total amount off

overhead cost assigned to the standard model? (Do not round interim calculations Round the final answer to the nearest whole dollar)

COD

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Craft Company reports the following partial activity-based costing information for its Deluxe model. Complete the table by entering amounts for the missing items. Note: Round "Overhead per unit" to 2 decimal places. Activity Assembly Factory services Setup Total allocated cost Units produced Overhead cost per unit Activity Usage 3,000 direct labor hours 2,800 square feet setups $ $ Activity Rate 10 per direct labor hour per square foot 180 per setup Allocated Cost 28,000 4,500 2,500arrow_forwardAltex Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, Robert Hermann, has developed the following information. Estimated wheels produced Direct labor hours per wheel (al) Your answer is correct. Overhead rate $ eTextbook and Media (a2) Total estimated overhead costs for the two product lines are $752,600. Car Car wheels 41,000 Calculate overhead rate. (Round answer to 2 decimal places, eg 12.25) $ 1 Truck wheels $ Truck 10,000 3 Compute the overhead cost assigned to the car wheels and truck wheels, assuming that direct labor hours is used to allocate overhead costs. 10.60 per direct labor hour Attempts: 1 of 5 usedarrow_forwardBruce Corporation makes four products in a single facility. These products have the following unit product costs: Products A B C D Direct materials $ 19.90 $ 15.20 $ 20.80 $ 23.20 Direct labor 12.20 8.70 10.50 7.40 Variable manufacturing overhead $ 1.60 $ 2.10 $ 2.00 $ 2.10 Fixed manufacturing overhead 10.80 11.90 8.80 10.70 Unit product cost 44.50 37.90 42.10 43.40 Additional data concerning these products are listed below. Products A B C D Grinding minutes per unit 1.20 0.70 0.60 0.60 Selling price per unit $ 59.30 $ 51.70 $ 59.50 $ 55.60 Variable selling cost per unit $ 3.60 $ 1.50 $ 2.20 $ 3.60 Monthly demand in units 4,000 2,000 4,000 2,000 The grinding machines are potentially the constraint in the production facility. A total of 9,000 minutes are available per month on these machines. Direct labor is a variable cost in this company. Which product makes the MOST profitable use of the grinding machines? (Round your intermediate calculations to…arrow_forward

- Ramapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Product Blinks Dinks Number of Direct Labor Hours Machine Hours Units Per Unit Per Unit is 920 Oa. $52.18 Ob. $89.11 Oc. $14.85 Od. $77.51 1,843 1 6 7 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $100,400. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $77,500. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks 9arrow_forwardQriole Inc. manufactures two products: car wheels and truck wheels. To determine the amount of overhead to assign to each product line, the controller, William Brown, has developed the following information: Estimated wheels produced Direct labour hours per wheel Car Car wheels $ Truck 45,000 11,000 4 Total estimated overhead costs for the two product lines are $1,340,000. Calculate the overhead cost assigned to the car wheels and truck wheels, assuming that direct labour hours are used to allocate overhead costs. 8 180,000arrow_forwardActivity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Activity data have been supplied for the following two products: Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost Activity Rates $9 per direct labor-hour $3 per machine-hour $45 per setup $150 per order $ 130 per shipment $ 875 per product K425 0 $ Total Expected Activity K425 M67 2,000 M67 200 1,000 2,800 Required: How much total overhead cost would be assigned to K425 and M67 using the activity-based costing system? 0 7 7 14 2 50 40 2 NNNN 2arrow_forward

- Gable Company uses three activity pools. Each pool has a cost driver. Information for Gable Company follows: Total Cost of Pool $ 454,960 100,000 72,720 Estimated Cost Driver 96,800 10,000 505 Activity Pools Machining Designing costs Setup costs Suppose that Gable Company manufactures three products, A, B, and C. Information about these products follows: Product A Product B 38,000 4,000 40 Number of machine hours Number of design hours Number of batches Cost Driver Number of machine hours Number of design hours Number of batches Product A Product B Product C Total Overhead Assigned 48,000 2,200 170 Required: Using activity rates, determine the amount of overhead assigned to each product. Note: Do not round intermediate calculations. Round the final answer to nearest whole number. Product C 10,800 3,800 295arrow_forwardCarla Vista Industries has three activity cost pools and two products. It expects to produce 2,700 units of Product SZ09 and 1,400 of Product NZ16. Having identified its activity cost pools and the cost drivers for each pool, Carla Vista accumulated the following data relative to those activity cost pools and cost drivers. question: Assign the overhead cost to the two products: SZ09$? and NZ16$?arrow_forwardCrmration manufactures bwo models of office chairs, a standard and a deluxe model. The following activity and cost information has been compiled: Number of Number of Number of Setups Components Direct Labor Hours 10 290 Preduct Standard 13 18 235 32 Delue $72,000 $95,200 Overhead costs Amnealraditional costing system applies the overhead costs based on direct labor hours. What is the total amount of overhead costs assigned to the standard model? (Do not round interim calculations. Round the final anewes ln the a whole dollar) OA S92.358 OB $74,842 OC $83,600 OD. $52.587 O Time Remaining: 01:46:06 Next % 5 6. 7. 8. ఉం W R Y 314arrow_forward

- A company has the following overhead costs and activities: Estimated Expected Activity Product V Product W Product X Overhead Activities and Activity Measures Machine setups (setups) Processing customer orders (orders) Assembling products (assembly-hours) $9,178.00 Cost S7,234.50 $3,565.50 69 12 10 20 21 492 697 111 4. A company sells two products, one with sales of $10,000 and variable expenses of $2,500, another with sales of $46,000 and variable expenses of $15,420. Fixed expenses are $33,100. Breakeven point for the whole company is close to: А. 833,100 В. $22,900 C. $51,020 D. $48,676 A company that reduces the proportion of variable costs in its cost structure will: A. enjoys higher stability in profits. B. increase its profits more when the economy is good. C. have a loss more easily when the economy is bad. D. be indifferent. 5. 6. is normally recorded on any financial statement but irrelevant in decision making which is not. A. Sunk cost B. Incremental cost C. Differential…arrow_forwardHeidelberg Fabrication manufactures two products, G-09 and G-35: Units produced Direct materials cost per unit Machine-hours per unit Production runs per quarter Machine depreciation Setup labor Production at the plant is automated and any labor cost is included in overhead. Data on manufacturing overhead at the plant follow: Materials handling Total G-09 19,700 $ 7 4 G-35 3,940 $ 19 7 72 $ 106,380 53,190 42,552 $ 202,122 a. Overhead rate b. Machine depreciation b. Setup labor b. Materials handling Exercise 9-36 (Algo) Activity-Based Costing and Cost Driver Rates (LO 9-4) Required: a. Heidelberg currently applies overhead on the basis of machine-hours. What is the predetermined overhead rate for the quarter? Note: Round your answer to 2 decimal places. b. Heidelberg is thinking of adopting an ABC system. They have tentatively chosen the following cost drivers: machine-hours for machine depreciation, production runs for setup labor, and direct material dollars for materials handling.…arrow_forwardDogarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education