FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

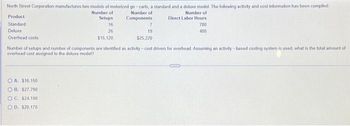

Transcribed Image Text:North Street Corporation manufactures two models of motorized go-carts, a standard and a deluxe model. The following activity and cost information has been compiled

Number of

Number of

Number of

Components

Setups

16

26

$15,120

Product

Standard

Deluxe

Overhead costs

7

OA. $16,150

O.B. $27,790

OC. $24,100.

OD. $20,170

19

$25,220

Direct Labor Hours

780

400

Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of

overhead cost assigned to the deluxe model?

erre

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $85,557 and the cost drivers for Product 1 is 346 and 237 for Product 2. The assembling activity pool has estimated costs of $67,616 and the cost drivers for Product 1 is 200 and 300 for Product 2. Direct labor hours for Product 1 is 311and 107 for Product 2. What is the total manufacturing overhead cost to be assigned to Product 1 using a single overhead rate as under tradional cost accounting? Round your final answer to the nearest whole dollar and do not put a dollar sign in your answer.arrow_forwardELU Company makes two products in a single facility. These products have the following unit product costs: Product A Product B Direct materials $10.90 $15.80 Direct labour 12.50 12.60 Variable manufacturing overhead 2.40 1.20 Fixed manufacturing overhead 11.60 7.20 Unit product cost $37.40 $36.80 Additional data concerning these products are listed below. Product A Product B Mixing minutes per unit 2.00 1.00 Selling price per unit $55.80 $54.60 Variable selling cost per unit $2.10 $1.40 Monthly demand in units 2,000 1,000 The mixing machines are potentially a constraint in the production facility. A total of 4,000 minutes are available per month on these machines. Direct labour is a variable cost in this company. Required: How many minutes of mixing machine time would be required to satisfy demand for both products? How many of each product should be produced, rounded to the nearest…arrow_forwardQ8 Lens Care Incorporated (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.60 per part Manufacturing supervision Hours of machine time $ 14.92 per hour Assembly Number of parts $ 3.90 per part Machine setup Each setup $ 57.10 per setup Inspection and testing Logged hours $ 46.10 per hour Packaging Logged hours $ 20.10 per hour LCI currently sells the B-13 model for $4,475 and the F-32 model for $4,580. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 165.10 $ 76.08 Number of parts 172 132 Machine hours 8.50 4.32 Inspection…arrow_forward

- Subject: Accountingarrow_forwardConcord Company manufactures two products, Mini A and Maxi B. Concord's overhead costs consist of setting up machines- $860000; machining- $2020000; and inspecting- $570000. Information on the two products is: Direct labour hours Machine setups Machine hours Inspections Mini A Maxi B $1324000. $1660400. $1690400. O $2542105. 10000 600 24000 800 28000 400 26000 700 Overhead applied to Maxi B using activity-based costing isarrow_forwardBruce Corporation makes four products in a single facility. These products have the following unit product costs: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product cost Additional data concerning these products are listed below. Products A B C $ 17.50 $ 21.40 $ 14.40 19.50 22.90 17.30 D $ 17.10 11.30 6.30 7.50 10.00 29.40 16.30 16.40 7.00 18.40 $ 72.70 $ 68.10 $ 58.10 $ 53.80 Products Grinding minutes per unit Selling price per unit Variable selling cost per unit Monthly demand in units A B C D 2.40 1.45 1.00 $ 88.20 $3.25 4,900 $ 80.60 $3.95 3,900 $ 77.40 1.30 $ 72.10 $ 4.70 3,900 $5.40 5,900 The grinding machines are potentially the constraint in the production facility. A total of 10,500 minutes are available p on these machines. Direct labor is a variable cost in this company. Which product makes the MOST profitable use of the grinding machines? Note: Round your intermediate calculations to 2 decimal places. Multiple Choice…arrow_forward

- A company computed the following activity rates using activity-based costing. Activity Setup Materials handling Inspection Activity Setup The company's deluxe model used the following activities to produce 2,000 units. Compute the overhead cost per unit for the deluxe model using activity-based costing. Materials handling Inspection /* 3 E Multiple Choice D C $ $6.00 $8.50. 4 101 R F V % 5 $2,000 per setup $100 per materials requisition $4 per unit inspected T 6 setups 50 materials requisitions 2,000 units inspected G Activity Rate ^ Activity Rate 40 6 Y H & Q Search 4- O ► 11 ) O fn P 112 + C = ins A prt sc ] delete backspacearrow_forwardNovak Industries manufactures dining chairs and tables. The following information is available regarding the two products and their estimated use of cost drivers: Machine setups Inspections Labor hours (a) Dining Chairs Dining chairs 255 Tables 305 Tables Estimated Cost $ Novak is considering switching from one overhead rate based on labor hours to ABC. 655 Perform the following analyses for these two components of overhead: 525 2,600 2,400 Compute total machine setups and inspection costs assigned to each product, using a single overhead rate. (Round overhead rate value to 3 decimal places, e.g. 52.711 and final answers to 0 decimal places, e.g. 5,275.) $49,140 $73,040 Total Costsarrow_forwardA company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $81,411 and the cost drivers for Product 1 is 400 and 262 for Product 2. The assembling activity pool has estimated costs of $62,196 and the cost drivers for Product 1 is 200 and 300 for Product 2. Direct labor hours for Product 1 is 452and 114 for Product 2. What is the total manufacturing overhead cost to be assigned to Product 1 using a single overhead rate as under tradional cost accounting?arrow_forward

- Rex Industries has identified three different activities as cost drivers: machine setups, machine hours, and inspections. The overhead and estimated usage are: Compute the overhead rate for each activity. Round your answers to two decimal places. Overhead Overhead Annual Rate per Activity per Activity Usage Activity Machine Setups $157,850 4,100 $ Machine Hours 324,622 14,114 2$ Inspections 119,000 3,400arrow_forwardGlover Company makes three products in a single facility. These products have the following unit product costs: Product A B C Direct materials $ 32.80 $ 49.30 $ 55.70 Direct labor 20.20 22.80 13.60 Variable manufacturing overhead 1.20 0.60 0.90 Fixed manufacturing overhead 13.50 9.10 9.70 Unit product cost $ 67.70 $ 81.80 $ 79.90 Additional data concerning these products are listed below. Product A B C Mixing minutes per unit 1.20 1.20 0.20 Selling price per unit $ 58.00 $ 80.40 $ 73.90 Variable selling cost per unit $ 0.60 $ 1.10 $ 2.30 Monthly demand in units 2,000 3,300 1,300 The mixing machines are potentially the constraint in the production facility. A total of 6,520 minutes are available per month on these machines. Direct labor is a variable cost in this company. Required: a. How many minutes of mixing machine time would be required to satisfy demand for all three products? b. How much of…arrow_forwardCraft Company reports the following partial activity-based costing information for its Deluxe model. Complete the table by entering amounts for the missing items. Note: Round "Overhead per unit" to 2 decimal places. Activity Assembly Factory services Setup Total allocated cost Units produced Overhead cost per unit Activity Usage 3,000 direct labor hours 2,800 square feet setups $ $ Activity Rate 10 per direct labor hour per square foot 180 per setup Allocated Cost 28,000 4,500 2,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education