FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

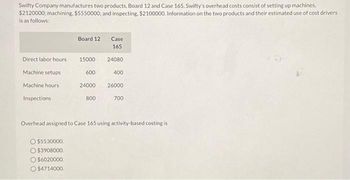

Transcribed Image Text:Swifty Company manufactures two products, Board 12 and Case 165. Swifty's overhead costs consist of setting up machines,

$2120000; machining, $5550000; and inspecting, $2100000. Information on the two products and their estimated use of cost drivers

is as follows:

Direct labor hours

Machine setups

Machine hours

Inspections

Board 12

O$5530000.

O $3908000.

O $6020000.

O $4714000.

15000

600

24000

800

Case

165

24080

400

26000

700

Overhead assigned to Case 165 using activity-based costing is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Product Direct Overhead Labor Hours (dlh) B Painting Dept. $256,100 10,600 तlh 7 dlh 8 dlh Finishing Dept. 83,700 11,000 2. Totals $339,800 21,600 dlh 9 dih 15 dih Using a single plantwide rate, the factory overhead allocated per unit of Product B is Oa. 5169.12 Ob. $15.73 Oc. $235.95 Od. $14157arrow_forwardBlue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead DirectLabor Hours (dlh) Product A B Painting Dept. $408,206 10,600 dlh 12 dlh 2 dlh Finishing Dept. 32,280 4,000 3 18 Totals $440,486 14,600 dlh 15 dlh 20 dlh The overhead from both production departments allocated to each unit of Product A if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method isarrow_forwardHayward Industries manufactures dining chairs and tables. The following information is available: Dining Chairs Tables Total Cost Machine setups 200 Inspections Labor hours 250 600 $48,000 470 $72,000 2,600 2,400 Hayward is considering switching from one overhead rate based on labor hours to activity-based costing. Perform the following analyses for these two components of overhead: Compute total machine setups and inspection costs assigned to each product, using a single overhead rate. Total Costs Dining chairs $_ $_ Tables Compute total machine setups and inspection costs assigned to each product, using activity-based costing. Total Costs Dining chairs $_ Tables $_arrow_forward

- . The company has traditionally used a plantwide manufacturing overhead rate based on machine hours to allocate manufacturing overhead to its products. The company estimates that it will incur attached ss below thanks wgwirgwarrow_forwardBlue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead DirectLabor Hours (dlh) Product A B Painting Dept. $231,800 10,900 dlh 15 dlh 7 dlh Finishing Dept. 76,800 6,300 2 18 Totals $308,600 17,200 dlh 17 dlh 25 dlh The factory overhead allocated per unit of Product B in the Painting Department if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method isarrow_forwardBlue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead DirectLabor Hours (dlh) Product A B Painting Dept. $473,696 11,300 dlh 15 dlh 4 dlh Finishing Dept. 51,744 4,900 5 18 Totals $525,440 16,200 dlh 20 dlh 22 dlh The overhead from both production departments allocated to each unit of Product A if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method is a.$357.76 per unit b.$41.92 per unit c.$681.60 per unit d.$10.56 per unitarrow_forward

- Blue Ridge Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. The following table presents information about estimated overhead and direct labor hours. Overhead DirectLabor Hours (dlh) Product A B Painting Dept. $309,088 10,400 dlh 12 dlh 3 dlh Finishing Dept. 46,852 5,300 6 16 Totals $355,940 15,700 dlh 18 dlh 19 dlh The overhead from both production departments allocated to each unit of Product B if Blue Ridge Marketing Inc. uses the multiple production department factory overhead rate method is a.$230.60 per unit b.$8.84 per unit c.$29.72 per unit d.$409.68 per unitarrow_forward2.A company makes two products 1 and 2. The finishing activity pool has estimated manufacuring costs of $82,749 and the cost drivers for Product 1 is 359 and 282 for Product 2. The assembling activity pool has estimated costs of $63,039 and the cost drivers for Product 1 is 200 and 300 for Product 2. Direct labor hours for Product 1 is 497and 303 for Product 2. What is the total manufacturing overhead cost to be assigned to Product 1 using a single overhead rate as under tradional cost accounting? Round your final answer to the nearest whole dollar and do not put a dollar sign in your answer.arrow_forwardAssume that company makes only two products: Product A and Product B. The company’s activity-based costing system has allocated $144,000 to an activity called machine setups. It is considering allocating the machine setups cost to its products using either the number of setups or setup hours as the activity measure. It gathered the following data with respect to these two potential activity measures: Product A Product B Number of machine setups 30 45 Number of setup hours per setup 6 6 If the company uses number of setup hours as the activity measure, what is the activity rate for machine setups? rev: 10_30_2021_QC_CS-283805 Garrison 17e Rechecks 2021-11-13 Multiple Choice $11,825 $12,000 $320 $350arrow_forward

- North Street Corporation manufactures two models of motorized go-carts, a standard and a deluxe model. The following activity and cost information has been compiled Number of Number of Number of Components Setups 16 26 $15,120 Product Standard Deluxe Overhead costs 7 OA. $16,150 O.B. $27,790 OC. $24,100. OD. $20,170 19 $25,220 Direct Labor Hours 780 400 Number of setups and number of components are identified as activity-cost drivers for overhead. Assuming an activity-based costing system is used, what is the total amount of overhead cost assigned to the deluxe model? errearrow_forward[The following information applies to the questions displayed below.] Performance Products Corporation makes two products, titanium Rims and Posts. Data regarding the two products follow: Rims Posts Direct Labor- Hours per unit 0.60 0.60 Additional information about the company follows: a. Rims require $17 in direct materials per unit, and Posts require $14. b. The direct labor wage rate is $20 per hour. Activity Cost Pool Machine setups Special processing General factory c. Rims are more complex to manufacture than Posts and they require special equipment. d. The ABC system has the following activity cost pools: Annual Production Activity Cost Pool Machine setups Special processing General factory 26,000 units 84,000 units $ 14.00 Activity Measure Number of setups Machine-hours Direct labor-hours X Answer is not complete. Activity Rate Required: 1. Compute the activity rate for each activity cost pool. (Round your answers to 2 decimal places.) Estimated Overhead Cost $ 39,480 $…arrow_forwardA company produces pool pumps. Overhead costs have been identified as follows: Activity Pool Cost Material handling Machine maintenance Setups Cost Driver Number of moves Number of machine hours 14 Number of production runs $ 70,840.00 73,000.00 82,038.00 Total Activity 460 36,500 66 Number of moves Economy 10,080 162 The company makes three models of pumps with the following activity demands: Units produced Standard 21,000 132 Premium 3,545 166 Machine hours 9,550 21,800 5,150 Production runs 17 17 32 Required: a. Calculate the activity rate for each activity. b. Determine the amount of indirect costs assigned to each of the products. Complete this question by entering your answers in the tabs below. Required A Required B Determine the amount of indirect costs assigned to each of the products. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education