FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

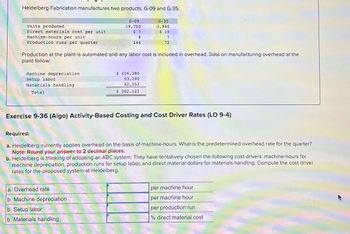

Transcribed Image Text:Heidelberg Fabrication manufactures two products, G-09 and G-35:

Units produced

Direct materials cost per unit

Machine-hours per unit

Production runs per quarter

Machine depreciation

Setup labor

Production at the plant is automated and any labor cost is included in overhead. Data on manufacturing overhead at the

plant follow:

Materials handling

Total

G-09

19,700

$ 7

4

G-35

3,940

$ 19

7

72

$ 106,380

53,190

42,552

$ 202,122

a. Overhead rate

b. Machine depreciation

b. Setup labor

b. Materials handling

Exercise 9-36 (Algo) Activity-Based Costing and Cost Driver Rates (LO 9-4)

Required:

a. Heidelberg currently applies overhead on the basis of machine-hours. What is the predetermined overhead rate for the quarter?

Note: Round your answer to 2 decimal places.

b. Heidelberg is thinking of adopting an ABC system. They have tentatively chosen the following cost drivers: machine-hours for

machine depreciation, production runs for setup labor, and direct material dollars for materials handling. Compute the cost driver

rates for the proposed system at Heidelberg.

per machine hour

per machine hour

per production run

% direct material cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Adirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. Overhead TotalDirectLabor Hours DLH per Product A B Painting Dept. $251,500 11,000 7 7 Finishing Dept. 73,000 10,600 2 3 Totals $324,500 21,600 9 10 The single plantwide factory overhead rate for Adirondack Marketing Inc. isarrow_forwardCraft Company reports the following partial activity-based costing information for its Deluxe model. Complete the table by entering amounts for the missing items. Note: Round "Overhead per unit" to 2 decimal places. Activity Assembly Factory services Setup Total allocated cost Units produced Overhead cost per unit Activity Usage 3,000 direct labor hours 2,800 square feet setups $ $ Activity Rate 10 per direct labor hour per square foot 180 per setup Allocated Cost 28,000 4,500 2,500arrow_forwardEquivalent Units of Production and Related Costs The charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 8,000 units, 65% completed 31,880 To Finished Goods, 184,000 units ? Direct materials, 188,000 units @ $2.10 394,800 Direct labor 404,400 Factory overhead 157,320 Bal., ? units, 20% completed ? Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount is zero or a blank, enter in "0". Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs WholeUnits Equivalent UnitsDirect Materials Equivalent UnitsConversion Inventory in process, beginning…arrow_forward

- The charges to Work in Process-Baking Department for a period as well as information concerning production are as follows. The Baking Department uses the avera cost method, and all direct materials are placed in process during production. Work in Process-Baking Department Bal., 2,500 units, 40% completed Direct materials, 18,300 units Direct labor 5,275 To Finished Goods, 18,000 units 56,364 29,458 15,175 Factory overhead Bal., 2,800 units, 60% completed If required, round cost per equivalent unit answer to two decimal places. a. Determine the number of whole units to be accounted for and to be assigned costs. units b. Determine the number of equivalent units of production. units c. Determine the cost per equivalent unit. X per equivalent unit d. Determine the cost of the units transferred to Finished Goods. Determine the cost of units in ending Work in Process.arrow_forwardThe charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department 21,200 To Finished Goods, 115,000 units 153,400 370,300 144,050 Bal., 5,000 units, 70% completed Direct materials, 118,000 units @ $1.3 Direct labor Factory overhead Bal., ? units, 35% completed Cost per equivalent units of $1.30 for Direct Materials and $4.50 for Conversion Costs. a. Based on the above data, determine the different costs listed below. 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period 3. Cost of ending work in process inventory 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) b. Did the production costs change from the preceding period? 0000 c. Assuming that the direct materials cost per unit did…arrow_forwardAdirondack Marketing Inc. manufactures two products, A and B. Presently, the company uses a single plantwide factory overhead rate for allocating overhead to products. However, management is considering moving to a multiple department rate system for allocating overhead. Painting Dept. Finishing Dept. Totals Overhead $254,100 80,200 $334,300 Ob. $2.07 per dlh Oc. $7.71 per dlh Od. $24.20 per dlh Total Direct Labor Hours 10,500 10,400 20,900 DLH per Product A 9 6 15 B 10 The single plantwide factory overhead rate for Adirondack Marketing Inc. is Oa. $16.00 per dlh 6 16arrow_forward

- BNC Company produces a product in two departments: (1) mixing and (2) finishing. the company uses a process cost accounting system. Accounting Transactions No. Transactions (e) manufacturing overhead is applied to the product based on machine hours used in each department: mixing department - 400 machine hours at $30 per machine hour. Finishing department - 500 machine hours at $20 per machine hour. (f) units costing $56,000 were completed in the mixing department and were transferred to the finishing department. (g) units costing $70,000 were completed in the finishing department and were transferred to finished goods. (h) finished goods costing $40,000 were sold on account for $55,000. Prepare the journal entries to record the preceding transactions for BNC Company. List debit transactions first and then list credit transactions. General Journals No. Account Titles and Explanation Debit ($) Credit ($) (e) work in process inventory - mixing…arrow_forwardThe charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 9,000 units, 70% completed Direct materials, 212,000 units @ $1.8 Direct labor Factory overhead Bal. ? units, 50% completed 28,800 381,600 314,000 122,170 a. Based on the above data, determine the different costs listed below. If required, round your interim calculations to two decimal places. To Finished Goods, 207,000 units 1. Cost of beginning work in process inventory completed this period. 2. Cost of units transferred to finished goods during the period. 3. Cost of ending work in process inventory. 4. Cost per unit of the completed beginning work in process inventory, rounded to the nearest cent. $ 0.0.0.0 $ ?arrow_forwardRedfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two wireless models, Standard and Enhanced, which differ both in the materials and components used and in the labor skill required. Data for the Campus Plant for the third quarter follow. Units produced Machine-hours Direct labor-hours Direct materials costs Direct labor costs Manufacturing overhead Total costs Standard 29,700 17,820 22,275 $ 594,000 356,400 Predetermined overhead rate Enhanced 9,900 11,880 22,275 $ 891,000 757,350 Total Required: Compute the predetermined overhead rate assuming that Redfern Audio uses direct labor costs to allocate overhead costs. Note: Round your answer to 2 decimal places. % of direct labor cost 39,600 29,700 44,550 $ 1,485,000 1,113,750 730, 620 $ 3,329,370arrow_forward

- Dinesh Bhaiarrow_forwardRamapo Company produces two products, Blinks and Dinks. They are manufactured in two departments, Fabrication and Assembly. Data for the products and departments are listed below. Product Blinks Dinks Number of Direct Labor Hours Machine Hours Units Per Unit Per Unit is 920 Oa. $52.18 Ob. $89.11 Oc. $14.85 Od. $77.51 1,843 1 6 7 All of the machine hours take place in the Fabrication department, which has an estimated overhead of $100,400. All of the labor hours take place in the Assembly department, which has an estimated total overhead of $77,500. Ramapo Company uses a single plantwide overhead rate to apply all factory overhead costs based on direct labor hours. The factory overhead allocated per unit of Blinks 9arrow_forwardThe charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of productio Work in Process-Assembly Department 19,500 To Finished Goods, 115,000 units 247,800 214,300 83,270 Bal., 5,000 units, 75% completed Direct materials, 118,000 units @ $2.1 Direct labor Factory overhead Bal., ? units, 40% completed Cost per equivalent units of $2.10 for Direct Materials and $2.60 for Conversion Costs. a. Based on the above data, determine the different costs listed below. 1. Cost of beginning work in process inventory completed this period 2. Cost of units transferred to finished goods during the period 3. Cost of ending work in process inventory 4. Cost per unit of the completed beginning work in process inventory (Rounded to the nearest cent.) b. Did the production costs change from the preceding period? 0000 ? c. Assuming that the direct materials cost per unit did not…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education