FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

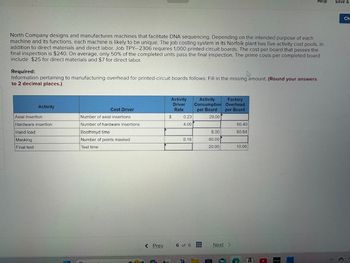

Transcribed Image Text:North Company designs and manufactures machines that facilitate DNA sequencing. Depending on the intended purpose of each

machine and its functions, each machine is likely to be unique. The job costing system in its Norfolk plant has five activity cost pools, in

addition to direct materials and direct labor. Job TPY-2306 requires 1,000 printed-circuit boards. The cost per board that passes the

final inspection is $240. On average, only 50% of the completed units pass the final inspection. The prime costs per completed board

include $25 for direct materials and $7 for direct labor.

Required:

Information pertaining to manufacturing overhead for printed-circuit boards follows: Fill in the missing amount. (Round your answers

to 2 decimal places.)

Activity

Axial insertion

Hardware insertion

Hand load

Masking

Final test

Cost Driver

Number of axial insertions

Number of hardware insertions

Boothroyd time

Number of points masked

Test time

< Prev

Activity

Driver

Rate

$

0.23

4.00

0.18

6 of 6

Activity

Consumption

per Board

29.00

8.00

80.00

20.00

Factory

Overhead

per Board

Next >

60.40

60.64

10.00

(

G

3

Help

A

112

Save &

Ch

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Julio produces two types of calculator, standard and deluxe. The company is currently using a traditional costing system with machine hours as the cost driver but is considering a move to activity-based costing. In preparing for the possible switch, Julio has identified two cost pools: materials handling and setup. The collected data follow: Number of machine hours Number of material moves Number of setups Total estimated overhead costs are $332,860, of which $158,400 is assigned to the material handling cost pool and $174,460 is assigned to the setup cost pool. Required: 1. Calculate the overhead assigned to each product using the traditional cost system. 2. Calculate the overhead assigned to each product using ABC. Required 1 Required 2 Standard Model Deluxe Model 30,400 870 520 Complete this question by entering your answers in the tabs below. Standard Model Deluxe Model 25,400 570 90 Calculate the overhead assigned to each product using the traditional cost system. (Round the…arrow_forwardGreenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Windows DESKTOP- Windows Number of setups Number of products Direct labor-hours Total overhead cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y FEB +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y an Product Z? (F your intermediate calculations to 2 decimal places. Round your answers to 2…arrow_forwardGibson Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Cost Cost driver Unit Level $50,600 Req A and B 2,300 labor hours. Production of 890 sets of cutting shears, one of the company's 20 products, took 210 labor hours and 9 setups and consumed 10 percent of the product-sustaining activities. Complete this question by entering your answers in the tabs below. Req C a. Allocated cost b. Allocated cost Activities Batch Level $ 21,160 46 setups Required a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using…arrow_forward

- Medical Tape makes two products: Generic and Label. It estimates it will produce 404,444 units of Generic and 656,000 of Label, and the overhead for each of its cost pools is as follows: Estimated Cost Pool Overhead Material Receipts $126,000 Machine Setups 325,000 Assembly 585,000 Inspection 330,000 Total $1,366,000 It has also estimated the activities for each cost driver as follows: Driver Generic Label Inspections 450 650 Requisitions 400 1,000 Parts 250 400 Setups 300 350 How much is the overhead allocated to each unit of Generic and Label? Do not round intermediate computations and round your answers to two decimal places. Generic Label Cost per unit $arrow_forwardBody-Solid Inc. manufactures elliptical exercise machines and treadmills. The products are prouced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $25 per machine hour Assembly $12 per direct labor hour Setup $52 per setup Inspecting $25 per inspection Production scheduling $13 per production order Purchasing $10 per purchase order The activity - base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 1,845 1,089 Direct labor hours 472 184 Setups 58 18 Inspections 630 378 Production orders 63 13 Purchase orders 181 110 Units produced 272 182 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the…arrow_forwardAtlas Enterprises Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $27 per machine hour Assembly $11 per direct labor hour Setup $45 per setup Inspecting $23 per inspection Production scheduling $12 per production order Purchasing $9 per purchase order The activity-base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 1,861 1,098 Direct labor hours 413 161 Setups 62 19 Inspections 615 369 Production orders 65 13 Purchase orders 211 129 Units produced 295 198 Use the activity rate and usage information to calculate the total activity cost and…arrow_forward

- Lynwood, Inc. produces two different products (Product A and Product X) using two different activities: Machining, which uses machine hours as an activity driver, and Inspection, which uses number of batches as an activity driver. The activity rate for Machining is $180 per machine hour, and the activity rate for Inspection is $580 per batch. The activity drivers are used as follows: Product A: (machine hours= 1,200) (number of batches 55) Product X: (mahine hours= 3,200) (number of batches 18) Totals: (Machine hours= 4,400) (number of batches 73) What is the amount of Machining cost assigned to Product X?arrow_forwardNichols Inc. manufactures remote controls. Currently the company uses a plant- wide rate for allocating manufacturing overhead. The plant manager believes it is time to refine the method of cost allocation and has the accounting department identify the primary production activities and their cost drivers: Activities Material handling Assembly Inspection Cost driver Number of parts Labour hours Time at inspection station The current traditional cost method allocates overhead based on direct manufacturing abour hours using a rate of £200 per labour hour. a. b. Allocation Rate £2 per part £20 per hour £3 per minute What are the indirect manufacturing costs per remote control assuming an activity- based-costing method is used and a batch of 50 remote controls are produced? The batch requires 100 parts, 6 direct manufacturing labour hours, and 2.5 minutes of inspection time. £4.00 per remote control £6.55 per remote control £24.00 per remote control £327.50 per remote control C. d.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education