FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

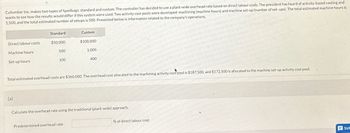

Transcribed Image Text:Cullumber Inc. makes two types of handbags: standard and custom. The controller has decided to use a plant-wide overhead rate based on direct labour costs. The president has heard of activity-based costing and

wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining (machine hours) and machine set-up (number of set-ups). The total estimated machine hours is

1,500, and the total estimated number of setups is 500. Presented below is information related to the company's operations.

Direct labour costs

Machine hours

Set-up hours

Standard

(a)

$50,000

500

100

Custom

$100,000

Predetermined overhead rate

1,000

Total estimated overhead costs are $360,000. The overhead cost allocated to the machining activity cost pool is $187,500, and $172,500 is allocated to the machine set-up activity cost pool.

400

Calculate the overhead rate using the traditional (plant-wide) approach.

% of direct labour cost

41

SUF

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fountain Water Products (FWP) manufacturers water bottles. They have historically used a traditional system that allocated the manufacturing overhead costs based on machine hours. FWP is looking at switching to an ABC system in order to ensure more accurate product costing. They first want to compare the traditional and ABC costing systems to determine if it is worth the effort and costs to implement and maintain. They estimate a total overhead cost of $459,000. Under the traditional system they identified machine hours as the cost driver, and estimated a total of 51,000 machine hours. They actually incurred 48,700 machine hours in production. The total applied MOH calculated under the more precise ABC system was $320,000. The ABC costing system will cost $50,000 to implement. FWP has determined that a benefit of more accurate costing by $80,000 is worth the $50,000 implementation cost. What is the difference between the ABC costing and traditional system? Enter your number as a…arrow_forwardXYZ, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The company's activity-based costing system has four activity cost pools, which are listed below along with their activity measures and activity rates: Activity Cost Pool Supporting direct labor Batch processing Order processing Customer service Activity Measure Number of direct labor-hours. Number of batches. Number of orders Number of customers The company just completed a single order from I Truck for 1,600 custom seat cushions. The order was produced in three batches. Each seat cushion required 0.3 direct labor-hours. The selling price was $141.80 per unit, the direct materials cost was $106 per unit, and the direct labor cost was $13.90 per unit. This was I Truck's only order during the year. Required: Calculate the customer margin on sales to I Truck for the year. Costs: Interstate Trucking Customer Margin-ABC Analysis Customer margin Activity Rate $10 per direct labor-hour $92 per batch $280…arrow_forwardDrippin' in Heat manufactures the finest formal wear west of the Mississippi. The company produces two main products: Suit Jackets and Sport Coats. Currently the company uses a traditional overhead rate in which Manufacturing Overhead is allocated to products based on direct labor hours logged. The projected production levels for the period are 1,200 Suit Jackets and 400 Sport Coats. Due to profitability concerns, management is considering switching to Activity-Based Costing (ABC). Management has divided manufacturing overhead costs into three activities and cost pools: Assembly $30,000; Machine Setup $20,000; and Product Movement $102,400. Management has identified the following cost drivers for each overhead activity: direct labor hours for assembly, number of setups for machine setup, and number of moves for product movement. The following information has been compiled for each product line: Direct Labor Requirements Machine Setup Requirements Product Movement Requirements Suit…arrow_forward

- Barbara, the manager of Metlock, is analyzing the company's MOH costs from last year. Metlock had always followed an actual costing system when determining the costs of its customizable telescopes. Barbara wondered if it would be better to switch to a normal costing system, as she had heard a number of people talking about that at an industry conference she attended the previous month. Since Metlock has a highly machine-intensive operation, machine hours are used as its MOH cost driver. Here are the costs and other MOH information Barbara is analyzing: Budgeted MOH cost Actual MOH cost Budgeted machine hours Actual machine hours $426,240 Actual MOH rate $ 419,040 Determine the actual MOH rate and the budgeted MOH rate Metlock would have used last year under actual costing and normal costing, respectively. (Round answers to 2 decimal places, e.g. 52.75.) Budgeted MOH rate $ 96,000 108,000 /machine hour /machine hourarrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 18 per direct labor-hour $190 per order $ 258 per custom design $ 416 per customer Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs. Direct labor-hours per glider Selling price per glider Direct materials cost per glider The company's direct labor rate is $16 per hour. Standard Model 11 2 0 28.50 $ 1,900 $ 462 Custom Design 2 2 33.00 $2,500 $ 584 Required: Using the company's activity-based costing system,…arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 18 per direct labor-hour $ 200 per order $ 264 per custom design $ 432 per customer Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider Standard Model Custom Design 15 2 2 2 0 2 30.50 34.00 $ 1,850 $ 452 $ 2,480 $ 582 The company's direct labor rate is $20 per hour. Required: Using the company's activity-based costing system,…arrow_forward

- Greenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Windows DESKTOP- Windows Number of setups Number of products Direct labor-hours Total overhead cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y FEB +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y an Product Z? (F your intermediate calculations to 2 decimal places. Round your answers to 2…arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 20 per direct labor-hour $ 200 per order $ 257 per custom design $ 426 per customer Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider Standard Custom Model Design 16 2 2 2 0 2 27.50 33.00 $ 1,900 $ 456 $ 2,440 $ 574 The company's direct labor rate is $20 per hour. Required: Using the company's activity-based costing system,…arrow_forwardJulio produces two types of calculator, standard and deluxe. The company is currently using a traditional costing system with machine hours as the cost driver but is considering a move to activity-based costing. In preparing for the possible switch, Julio has identified two cost pools: materials handling and setup. The collected data follow: Standard Model Deluxe Model Number of machine hours 25,800 30,800 Number of material moves Number of setups 590 890 70 540 Total estimated overhead costs are $347,100, of which $170,200 is assigned to the material handling cost pool and $176,900 is assigned to the setup cost pool. Required: 1. Calculate the overhead assigned to each product using the traditional cost system. 2. Calculate the overhead assigned to each product using ABC.arrow_forward

- If someone can help me soon I will give a thumbs up. Please hurry if possible! Thanks! :)arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $20 per direct labor-hour $ 192 per order $ 265 per custom design $ 432 per customer Management wants to calculate the profitability of a particular customer, Big Sky Outfitters, which ordered the following products over the last 12 months: Standard Model Custom Design Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider The company's direct labor rate is $18 per hour. Required: 15 200 28.50 $ 1,850 $ 470 2220 34.00 $ 2,480 $ 572 Using the company's activity-based costing system,…arrow_forwardThermal Rising, Incorporated, makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has designed an activity-based costing system with the following activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Order processing Custom design processing Customer service Activity Rate $ 16 per direct labor-hour $ 200 per order $ 258 per custom design $ 430 per customer Management would like an analysis of the profitability of a particular customer, Big Sky Outfitters, which has ordered the following products over the last 12 months: Number of gliders Number of orders Number of custom designs Direct labor-hours per glider Selling price per glider Direct materials cost per glider The company's direct labor rate is $20 per hour. Required: Standard Model Custom Design 14 3 2 3 0 29.50 3 33.00 $ 2,410 $ 580 $ 1,800 $ 448 Using the company's activity-based…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education