FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

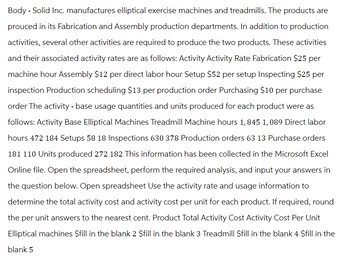

Transcribed Image Text:Body-Solid Inc. manufactures elliptical exercise machines and treadmills. The products are

prouced in its Fabrication and Assembly production departments. In addition to production

activities, several other activities are required to produce the two products. These activities

and their associated activity rates are as follows: Activity Activity Rate Fabrication $25 per

machine hour Assembly $12 per direct labor hour Setup $52 per setup Inspecting $25 per

inspection Production scheduling $13 per production order Purchasing $10 per purchase

order The activity - base usage quantities and units produced for each product were as

follows: Activity Base Elliptical Machines Treadmill Machine hours 1,845 1,089 Direct labor

hours 472 184 Setups 58 18 Inspections 630 378 Production orders 63 13 Purchase orders

181 110 Units produced 272 182 This information has been collected in the Microsoft Excel

Online file. Open the spreadsheet, perform the required analysis, and input your answers in

the question below. Open spreadsheet Use the activity rate and usage information to

determine the total activity cost and activity cost per unit for each product. If required, round

the per unit answers to the nearest cent. Product Total Activity Cost Activity Cost Per Unit

Elliptical machines $fill in the blank 2 $fill in the blank 3 Treadmill $fill in the blank 4 $fill in the

blank 5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Harbour Company makes two models of electronic tablets, the Home and the Work. Basic production information follows: Setup costs Quality control Maintenance Total Direct materials cost per unit Direct labor cost per unit Sales price per unit Expected production per month Harbour has monthly overhead of $200,170, which is divided into the following activity pools: $ 80,560 68,310 51,300 $ 200,170 Number of setups Number of inspections Number of machine hours Home 44 320 1,600 Home The company also has compiled the following information about the chosen cost drivers: Work 62 Required 1 Required 2 Required 3 370 1,100 $ 40 Required 4 15 357 740 units Work Total 106 690 2,700 $ 65 36 567 440 units Required: 1. Suppose Harbour uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the production cost per unit for each of Harbour's products under a traditional costing system. Complete this question…arrow_forwardActivity-Based Costing Cardio Care Inc. manufactures stationary bicycles and treadmills. The products are produced in the Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $22 per machine hour (mh) Assembly $14 per direct labor hour (dlh) Setup $40 per setup Inspecting $20 per inspection Production scheduling $16 per production order Purchasing $4 per purchase order The activity-base usage quantities and units produced for each product were as follows: Stationary Bicycle Treadmill Machine hours 2,210 1,090 Direct labor hours 470 200 Setups 40 10 Inspections 650 370 Production orders 60 40 Purchase orders 150 80 Units produced 1,000 1,000 Use the activity rate and usage information to compute the total…arrow_forwardDhapaarrow_forward

- Harbour Company makes two models of electronic tablets, the Home and the Work. Basic production information follows: Direct materials cost per unit Direct labor cost per unit Sales price per unit Expected production per month Harbour has monthly overhead of $177,870, which is divided into the following activity pools: Setup costs Quality control Maintenance Total $ 72,000 66,270 39,600 $ 177,870 Number of setups Number of inspections Number of machine hours Home $38 20 354 790 units Home Work 49 41 320 1,200 2,100 385 The company also has compiled the following information about the chosen cost drivers: Work Total 90 705 3,300 $65 35 572 340 units Required: 1. Suppose Harbour uses a traditional costing system with machine hours as the cost driver. Determine the amount of overhead assigned to each product line. 2. Calculate the production cost per unit for each of Harbour's products under a traditional costing system. 3. Calculate Harbour's gross margin per unit for each product under…arrow_forwardA company produces pool pumps. Overhead costs have been identified as follows: Activity Pool Cost Material handling Machine maintenance Setups Cost Driver Number of moves Number of machine hours 14 Number of production runs $ 70,840.00 73,000.00 82,038.00 Total Activity 460 36,500 66 Number of moves Economy 10,080 162 The company makes three models of pumps with the following activity demands: Units produced Standard 21,000 132 Premium 3,545 166 Machine hours 9,550 21,800 5,150 Production runs 17 17 32 Required: a. Calculate the activity rate for each activity. b. Determine the amount of indirect costs assigned to each of the products. Complete this question by entering your answers in the tabs below. Required A Required B Determine the amount of indirect costs assigned to each of the products. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places.arrow_forwardDetermine the maturity date and compute the interest of each of the following notes: (use 360 days for interest calculation. Round to the nearest dollar) The options for the shaded blanks A - E are the months January through December.arrow_forward

- Rahularrow_forwardActivity-Based Costing CardioTrainer Equipment Company manufactures stationary bicycles and treadmills. The products are produced in the Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $22 per machine hour (mh) Assembly $12 per direct labor hour (dlh) Setup $40 per setup Inspecting $18 per inspection Production scheduling $8 per production order Purchasing $5 per purchase order The activity-base usage quantities and units produced for each product were as follows: Stationary Bicycle Treadmill Machine hours 1,680 1,070 Direct labor hours 243 131 Setups 45 131 Inspections 158 94 Production orders 60 32 Purchase orders 240 98 Units produced 500 350 Use the activity rate and usage information to compute the total activity costs and the activity…arrow_forwardThe following table presents the activities and activity drivers that LampPlus uses in manufacturing Product 1 and Product 2. Complete the table: Activity Design Preparation Machining Finishing Inspection Packaging Shipping Cost Activity Driver $ 39,060 Design time $ 67,650 Labor hours 105,200 Machine hours $ Batches Units Orders $ 12,720 Packages Driver Usage Prod. 1 840 3,130 209 76 Prod. 2 1,330 hours hours 300 56 Activity Rate $ $ $ $ /hour /hour 20 /hour 50 /batch 17 /unit 302 /order /package Activity Cost:Prod. 1 $ $ $ $ 34,430 31,200 Activity Cost:Prod. 2 9,690 $ 12,986 $ 19,720 3,600arrow_forward

- The Sit-N-Spin Corporation manufactures and assembles office chairs. Sit-N-Spin uses an activity-based costing system to allocate all manufacturing conversion costs. Each chair consists of 20 separate parts totaling $125 in direct materials, and requires 2.0 hours of machine time to produce. Additional information follows: Activity Allocation Base Cost Allocation Rate Materials handling Number of parts $2.75 per part Machining Machine hours $3.00 per machine hour Assembling Number of parts $1.50 per part Packaging Number of finished units $2.75 per finished unit What is the cost of assembling per chair?arrow_forwardLens Care Inc. (LCI) manufactures specialized equipment for polishing optical lenses. There are two models - one mainly used for fine eyewear (F-32) and another for lenses used in binoculars, cameras, and similar equipment (B-13).The manufacturing cost of each unit is calculated using activity-based costing, using the following manufacturing cost pools: Cost Pools Allocation Base Costing Rate Materials handling Number of parts $ 3.00 per part Manufacturing supervision Hours of machine time $ 14.86 per hour Assembly Number of parts $ 3.60 per part Machine setup Each setup $ 56.80 per setup Inspection and testing Logged hours $ 45.80 per hour Packaging Logged hours $ 19.80 per hour LCI currently sells the B-13 model for $3,125 and the F-32 model for $2,900. Manufacturing costs and activity usage for the two products are as follows: B-13 F-32 Direct materials $ 164.80 $ 75.84 Number of parts 166 126 Machine hours 8.20 4.26…arrow_forwardProduct Costs using Activity Rates Hercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $30 per machine hour Assembly $35 per direct labor hour Setup $90 per setup Inspecting $20 per inspection Production scheduling $19 per production order Purchasing $5 per purchase order The activity-base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 600 400 Direct labor hours 190 223 Setups 30 30 Inspections 15 25 Production orders 40 30 Purchase orders 318 85 Units produced 500 320 Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product. Total…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education