FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

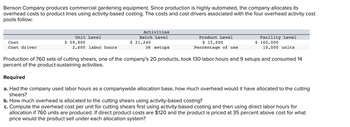

Transcribed Image Text:Benson Company produces commercial gardening equipment. Since production is highly automated, the company allocates its

overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost

pools follow:

Cost

Cost driver

Unit Level

$ 59,800

2,600 labor hours

Activities

Batch Level

$ 21,240

36 setups

Product Level

$ 15,000

Percentage of use

Facility Level

$ 160,000

10,000 units

Production of 760 sets of cutting shears, one of the company's 20 products, took 130 labor hours and 9 setups and consumed 14

percent of the product-sustaining activities.

Required

a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting

shears?

b. How much overhead is allocated to the cutting shears using activity-based costing?

c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using direct labor hours for

allocation if 760 units are produced. If direct product costs are $120 and the product is priced at 35 percent above cost for what

price would the product sell under each allocation system?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Haresharrow_forwardGreenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining Windows DESKTOP- Windows Number of setups Number of products Direct labor-hours Total overhead cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y FEB +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 240 40 1 1 8,800 3,200 11. Using the plantwide overhead rate, what percentage of the total overhead cost is allocated to Product Y an Product Z? (F your intermediate calculations to 2 decimal places. Round your answers to 2…arrow_forwardGibson Company produces commercial gardening equipment. Since production is highly automated, the company allocates its overhead costs to product lines using activity-based costing. The costs and cost drivers associated with the four overhead activity cost pools follow: Cost Cost driver Unit Level $50,600 Req A and B 2,300 labor hours. Production of 890 sets of cutting shears, one of the company's 20 products, took 210 labor hours and 9 setups and consumed 10 percent of the product-sustaining activities. Complete this question by entering your answers in the tabs below. Req C a. Allocated cost b. Allocated cost Activities Batch Level $ 21,160 46 setups Required a. Had the company used labor hours as a companywide allocation base, how much overhead would it have allocated to the cutting shears? b. How much overhead is allocated to the cutting shears using activity-based costing? c. Compute the overhead cost per unit for cutting shears first using activity-based costing and then using…arrow_forward

- Greenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 231,000 11,000 MHs Machine setups Number of setups $ 180,000 300 setups Production design Number of products $ 94,000 2 products General factory Direct labor-hours $ 260,000 10,000 DLHs Activity Measure Product Y Product Z Machining 9,000 2,000 Number of setups 60 240 Number of products 1 1 Direct labor-hours 9,000 1,000 4. What is the activity rate for the Machine Setups activity cost pool?arrow_forwardBody-Solid Inc. manufactures elliptical exercise machines and treadmills. The products are prouced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $25 per machine hour Assembly $12 per direct labor hour Setup $52 per setup Inspecting $25 per inspection Production scheduling $13 per production order Purchasing $10 per purchase order The activity - base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 1,845 1,089 Direct labor hours 472 184 Setups 58 18 Inspections 630 378 Production orders 63 13 Purchase orders 181 110 Units produced 272 182 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the…arrow_forwardGreenwood Company manufactures two products-13,000 units of Product Y and 5,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity- based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Machining Machine setups Production design General factory Activity Measure Machining DESKTOP- Windows Number of setups Number of products Direct labor-hours General factory cost Activity Measure Machine-hours Number of setups Number of products Direct labor-hours Product Y +1 (252) 484-2153 Oh nun Product Y Product Z 8,800 3,200 40 240 1 1 8,800 3,200 % 15. Using the ABC system, what percentage of the General Factory cost is assigned to Product Y and Product Z? (Round your intermediate calculations and final answers to 2 decimal places.) Product Z (@ 2 0…arrow_forward

- Atlas Enterprises Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: Activity Activity Rate Fabrication $27 per machine hour Assembly $11 per direct labor hour Setup $45 per setup Inspecting $23 per inspection Production scheduling $12 per production order Purchasing $9 per purchase order The activity-base usage quantities and units produced for each product were as follows: Activity Base Elliptical Machines Treadmill Machine hours 1,861 1,098 Direct labor hours 413 161 Setups 62 19 Inspections 615 369 Production orders 65 13 Purchase orders 211 129 Units produced 295 198 Use the activity rate and usage information to calculate the total activity cost and…arrow_forwardLakeside Inc. manufactures four lines of remote control boats and uses activity-based costing to calculate product cost. Activity Cost Pools EstimatedTotal Cost Estimated Cost Driver Machining $ 334,000 13,600 machine hours Setup 76,000 420 batches Quality control 103,000 830 inspections Compute the activity rates for each of the following activity cost pools: How do you find the activitiy costs???arrow_forwardGreenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates all of its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products Y and Z: Activity Cost Pool Activity Measure Estimated Overhead Cost Expected Activity Machining Machine-hours $ 227,700 11,000 MHs Machine setups Number of setups $ 153,900 270 setups Production design Number of products $ 91,000 2 products General factory Direct labor-hours $ 257,000 10,000 DLHs Activity Measure Product Y Product Z Machining 8,700 2,300 Number of setups 60 210 Number of products 1 1 Direct labor-hours 8,700 1,300 3. What is the activity rate for the Machining activity cost pool? (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education