FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

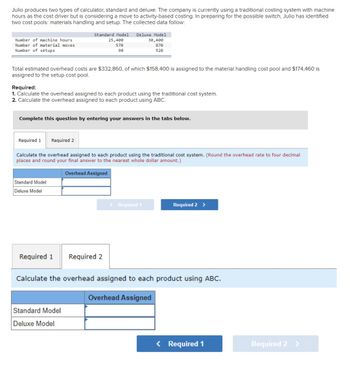

Transcribed Image Text:Julio produces two types of calculator, standard and deluxe. The company is currently using a traditional costing system with machine

hours as the cost driver but is considering a move to activity-based costing. In preparing for the possible switch, Julio has identified

two cost pools: materials handling and setup. The collected data follow:

Number of machine hours

Number of material moves

Number of setups

Total estimated overhead costs are $332,860, of which $158,400 is assigned to the material handling cost pool and $174,460 is

assigned to the setup cost pool.

Required:

1. Calculate the overhead assigned to each product using the traditional cost system.

2. Calculate the overhead assigned to each product using ABC.

Required 1 Required 2

Standard Model Deluxe Model

30,400

870

520

Complete this question by entering your answers in the tabs below.

Standard Model

Deluxe Model

25,400

570

90

Calculate the overhead assigned to each product using the traditional cost system. (Round the overhead rate to four decimal

places and round your final answer to the nearest whole dollar amount.)

Overhead Assigned

Required 1

Standard Model

Deluxe Model

Required 2

< Required 1

Required 2 >

Calculate the overhead assigned to each product using ABC.

Overhead Assigned

< Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Fountain Water Products (FWP) manufacturers water bottles. They have historically used a traditional system that allocated the manufacturing overhead costs based on machine hours. FWP is looking at switching to an ABC system in order to ensure more accurate product costing. They first want to compare the traditional and ABC costing systems to determine if it is worth the effort and costs to implement and maintain. They estimate a total overhead cost of $459,000. Under the traditional system they identified machine hours as the cost driver, and estimated a total of 51,000 machine hours. They actually incurred 48,700 machine hours in production. The total applied MOH calculated under the more precise ABC system was $320,000. The ABC costing system will cost $50,000 to implement. FWP has determined that a benefit of more accurate costing by $80,000 is worth the $50,000 implementation cost. What is the difference between the ABC costing and traditional system? Enter your number as a…arrow_forwardDrippin' in Heat manufactures the finest formal wear west of the Mississippi. The company produces two main products: Suit Jackets and Sport Coats. Currently the company uses a traditional overhead rate in which Manufacturing Overhead is allocated to products based on direct labor hours logged. The projected production levels for the period are 1,200 Suit Jackets and 400 Sport Coats. Due to profitability concerns, management is considering switching to Activity-Based Costing (ABC). Management has divided manufacturing overhead costs into three activities and cost pools: Assembly $30,000; Machine Setup $20,000; and Product Movement $102,400. Management has identified the following cost drivers for each overhead activity: direct labor hours for assembly, number of setups for machine setup, and number of moves for product movement. The following information has been compiled for each product line: Direct Labor Requirements Machine Setup Requirements Product Movement Requirements Suit…arrow_forwardDecorative Doors Ltd produces two types of doors: interior and exterior. The company’s costing system has two direct-cost categories (materials and labour) and one indirect-cost pool. The costing system allocates indirect costs on the basis of machine-hours. Recently, the owners of Decorative Doors have been concerned about a decline in the market share for their interior doors, usually their biggest seller. Information related to Decorative Doors production for the most recent year is as follows: Particulars Interior Exterior Units sold 3200 1800 Selling price $125 $200 Direct material cost per unit $30 $45 Direct production labour cost per hour5 $16 $16 Direct production labour-hours per unit 1.50 2.25 Production runs 40 85 Material moves 72 168 Machine set-ups 45 155 Machine-hours 5500 4500 Number of inspections 250 150 The owners have heard of other companies in the industry that are now…arrow_forward

- Julio produces two types of calculator, standard and deluxe. The company is currently using a traditional costing system with machine hours as the cost driver but is considering a move to activity-based costing. In preparing for the possible switch, Julio has identified two cost pools: materials handling and setup. The collected data follow: Standard Model Deluxe Model Number of machine hours 25,800 30,800 Number of material moves Number of setups 590 890 70 540 Total estimated overhead costs are $347,100, of which $170,200 is assigned to the material handling cost pool and $176,900 is assigned to the setup cost pool. Required: 1. Calculate the overhead assigned to each product using the traditional cost system. 2. Calculate the overhead assigned to each product using ABC.arrow_forwardNutterco, Inc., produces two types of nut butter: peanut butter and cashew butter. Of the two,peanut butter is the more popular. Cashew butter is a specialty line using smaller jars and fewerjars per case. Data concerning the two products follow: Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver. Required:1. Prepare a traditional segmented income statement, using a unit-level overhead rate based ondirect labor hours. Using this approach, determine whether the cashew butter product lineshould be kept or dropped.2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysisusing an ABC approach.arrow_forwardReynoso Corporation manufactures titanium and aluminum tennis racquets. Reynoso’s total overhead costs consist of assembly costs and inspection costs. The following information is available: Cost Titanium Aluminum Total Cost Assembly 500 mach. hours 500 mach. hours $27000 Inspections 350 150 $80000 2100 labor hours 1900 labor hours Reynoso is considering switching from one overhead rate based on labor hours to activity-based costing.Using activity-based costing, how much inspections cost is assigned to titanium racquets? $24000. $40000. $56000. $29000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education