College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

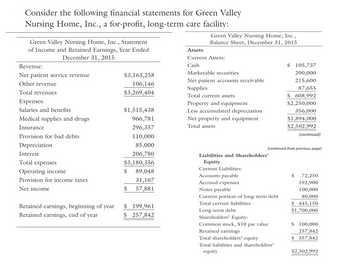

Transcribed Image Text:Consider the following financial statements for Green Valley

Nursing Home, Inc., a for-profit, long-term care facility:

Green Valley Nursing Home, Inc., Statement

of Income and Retained Earnings, Year Ended

December 31, 2015

Assets

Green Valley Nursing Home, Inc.,

Balance Sheet, December 31, 2015

Revenue:

Net patient service revenue

$3,163,258

Other revenue

Total revenues

106,146

$3,269,404

Expenses:

Salaries and benefits

$1,515,438

Medical supplies and drugs

966,781

Insurance

296,357

Current Assets:

Cash

Marketable securities

Net patient accounts receivable

Supplies

Total current assets

Property and equipment

Less accumulated depreciation

Net property and equipment

Total assets

$ 105,737

200,000

215,600

87,655

$ 608,992

$2,250,000

356,000

$1,894,000

$2,502,992

(continued)

Provision for bad debts

110,000

Depreciation

85,000

(continued from previous page)

Interest

206,780

Liabilities and Shareholders'

Total expenses

$3,180,356

Equity

Operating income

Current Liabilities:

$

89,048

Accounts payable

Provision for income taxes

31,167

Accrued expenses

Net income

$

57,881

Notes payable

Current portion of long-term debt

Total current liabilities

$

72,250

192,900

100,000

80,000

Retained earnings, beginning of year

$ 199,961

Retained earnings, end of year

$ 257,842

Long-term debt

Shareholders' Equity:

Common stock, $10 par value

Retained earnings

Total shareholders' equity

Total liabilities and shareholders'

equity

$ 445,150

$1,700,000

$ 100,000

257,842

$ 357,842

$2,502,992

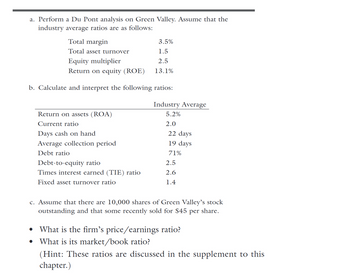

Transcribed Image Text:a. Perform a Du Pont analysis on Green Valley. Assume that the

industry average ratios are as follows:

Total margin

3.5%

Total asset turnover

1.5

Equity multiplier

2.5

Return on equity (ROE)

13.1%

b. Calculate and interpret the following ratios:

Industry Average

Return on assets (ROA)

Current ratio

5.2%

2.0

Days cash on hand

22 days

Average collection period

19 days

Debt ratio

71%

Debt-to-equity ratio

2.5

Times interest earned (TIE) ratio

2.6

Fixed asset turnover ratio

1.4

c. Assume that there are 10,000 shares of Green Valley's stock

outstanding and that some recently sold for $45 per share.

• What is the firm's price/earnings ratio?

What is its market/book ratio?

(Hint: These ratios are discussed in the supplement to this

chapter.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the statements provided Calculate the following liquidity ratios: Current ratio Quick ratio Calculate the following asset management ratios: Average collection period Inventory turnover Fixed asset turnover Total asset turnover Calculate the following financial leverage ratios Debt to equity ratio Long-term debt to equity Calculate the following profitability ratios: Gross profit margin Net profit margin Return on assets Return on stockholders’ equity For example: you should present it like the text, or as:Gross margin = 1,933 divided by 8,689 = 22.2% A competitor of ACME has for the same time period reported the following three ratios: Current ratio 1.52Long-term debt to equity .25 or 25%Net profit margin .08 or 8% Given these three ratios only which company is performing better on each ratio? Also overall who would you say has the best financial performance and position. Support your answer.arrow_forwardNeed Answer with correct answer pleasearrow_forwardConsider that you have $4,332,989 to invest across three assets using the price weighted methodology. Your analysis of these assets has provided the information in the two tables below. (Note: numbers in red are negative) Asset Price at beginning of the year (in $) Expected price at the end of the year (in $) Standard deviation (%) Correlation A B C A 1.00 0.84 0.78 c. In dollars and cents, what is the expected value of this portfolio after 12 months? d. What is the standard deviation of this portfolio, in percentage terms? A B 155.55 137.22 182.22 164.77 42.11 Required a. What is the expected compound annual growth rate of return for this portfolio, in percentage terms? b. What is the expected continuously compounded return on this portfolio in percentage terms? B 0.84 1.00 0.44 41.50 с 0.78 0.44 1.00 C 88.14 104.12 42.33arrow_forward

- Need help pleasearrow_forwardFor each of the investments below, calculate the rate of return earned over the period. Investment Cash Flow During Period - $300 18,000 с 5,000 D 60 E 1,500 (Click on the icon here in order to copy the contents of the data table above into a spreadsheet.) A B The rate of return on Investment A is %. (Round to two decimal places.) Beginning-of-Period End-of-Period Value Value $2,100 160,000 40,000 300 12,000 $700 113,000 45,000 100 13,200arrow_forwardRequired: (a) You are required to calculate the following ratios:(i) Gross profit margin(ii) Operating profit margin(iii) Expenses to sales(iv) Return on Capital Employed(v) Asset turnover(vi) Non-current asset turnover(vii) Current Ratio(viii) Quick Ratio(ix) Inventory days(x) Receivables days(xi) Payable days(xii) Interest cover (b) In light of your calculations comment on the performance of the company over thelast two years.arrow_forward

- Return calculations For the investment shown in the following table, calculate the rate of return earned over the unspecified time period. (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) End-of- Cash flow during period $910 period value $16,400 The rate of return on the investment is %. (Round to two decimal places. If there is a loss, enter as a negative percentage.) Beginning-of- period value $21,900 -Carrow_forwardThe following information relates to four assets: Probability Return on E Return on F Return on G Return on H 0.1 10% 6% 14% 2% 0.2 10% 8% 12% 6% 0.4 10% 10% 10% 9% 0.2 10% 12% 8% 15% 0.1 10% 14% 6% 20% (a) What is the expected return for each of the assets? (4) (b) Calculate the variance of each asset. (8) (c) Determine the covariance of asset F and G. (4) (d) What is the correlation coefficient between assets F and G? (4)arrow_forwardCalculate IRR using excel.arrow_forward

- d. Calculate the Efficiency ratio which includes the sales to total assets ratio, operating return on assets, return on assets, ROA Model, return on equity, and ROE Modelarrow_forwardFor each of the investments below, calculate the rate of return earned over the period. Investment ABCDE Cash Flow During Beginning-of-Period End-of-Period Value Period Value - $400 13,000 4,000 60 1,700 $1,700 140,000 60,000 800 14,500 $800 117,000 46,000 400 12,600arrow_forwardCalculate the HPR of the following investment, entered as a percentage (Example: if your answer is 14.5%, enter 14.5 and not 0.145) Period Cashflow 0 -14100 1 3300 2 3300 3 3100 4 2800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT