Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Accurate Answer

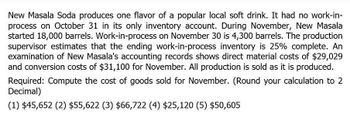

Transcribed Image Text:New Masala Soda produces one flavor of a popular local soft drink. It had no work-in-

process on October 31 in its only inventory account. During November, New Masala

started 18,000 barrels. Work-in-process on November 30 is 4,300 barrels. The production

supervisor estimates that the ending work-in-process inventory is 25% complete. An

examination of New Masala's accounting records shows direct material costs of $29,029

and conversion costs of $31,100 for November. All production is sold as it is produced.

Required: Compute the cost of goods sold for November. (Round your calculation to 2

Decimal)

(1) $45,652 (2) $55,622 (3) $66,722 (4) $25,120 (5) $50,605

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An examination of Buckhorn Fabricators records reveals the following transactions: a. On December 31, the physical inventory of raw material was 9,950 gallons. The book quantity, using the weighted average method, was 10,000 gal @ .52 per gal. b. Production returned to the storeroom materials that cost 775. c. Materials valued at 770 were charged to Factory Overhead (Repairs and Maintenance), but should have been charged to Work in Process. d. Defective material, purchased on account, was returned to the vendor. The material returned cost 234. e. Goods sold to a customer, on account, for 5,000 (cost 2,500) were returned because of a misunderstanding of the quantity ordered. The customer stated that the goods returned were in excess of the quantity needed. f. Materials requisitioned totaled 22,300, of which 2,100 represented supplies used. g. Materials purchased on account totaled 25,500. Freight on the materials purchased was 185. h. Direct materials returned to the storeroom amounted to 950. i. Scrap materials sent to the storeroom were valued at an estimated selling price of 685 and treated as a reduction in the cost of all jobs worked on during the period. j. Spoiled work sent to the storeroom valued at a sales price of 60 had production costs of 200 already charged to it. The cost of the spoilage is to be charged to the specific job worked on during the period. k. The scrap materials in (i) were sold for 685 cash. Required: Record the entries for each transaction.arrow_forwardKildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for 52 each. The actual unit cost is as follows: The selling expenses consisted of a commission of 1.30 per unit sold and advertising copayments totaling 95,000. Administrative expenses, all fixed, equaled 183,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 132,600 for 3,400 easels. Required: 1. Calculate the number and the dollar value of easels in ending finished goods inventory. 2. Prepare a cost of goods sold statement. 3. Prepare an absorption-costing income statement. Add a column for percentage of sales.arrow_forwardHello question is attached, thanks.arrow_forward

- Provide answer this questionarrow_forwardQueen Sales, Inc. has just completed its first year of operations. The company has not had any sales to date. Queen has incurred the following costs associated with its production as of December 31, Year 1:arrow_forwardJoplin Corporation produces syrups that it sells to candy makers. On November 1, it had no work-in-process inventory. It started production of 45,900 gallons of syrup in November and completed production of 44,000 gallons. The costs of the resources used by Joplin in November consist of the following: Materials $ 67,578 Conversion costs (labor and overhead) 54,300 Required: The production supervisor estimates that the ending work-in-process is 60 percent complete on November 30. Compute the cost of syrup completed and the cost of the syrup in work-in-process ending inventory as of November 30. (Do not round intermediate calculations.) Cost of syrup completed Work-in-process ending inventoryarrow_forward

- Twisted Pretzel, Inc. had beginning Work-in-Process Inventory (WIP) of $10,000 and makes only one product. It incurred the following costs during the year: Factory production worker wages $ 40,000 Direct materials 20,000 Allocated factory rent 60,000 Allocated factory utilities 70,000 Sales commissions 100,000 At the end of the year WIP totaled $ 4,000. Calculate the total costs of goods manufactured and transferred to Finished Goods Inventory.arrow_forwardJoplin Corporation produces syrups that it sells to candy makers. On November 1, it had no work-in-process inventory. It started production of 43,300 gallons of syrup in November and completed production of 41,000 gallons. The costs of the resources used by Joplin in November consist of the following: Materials $ 47,512 Conversion costs (labor and overhead) 54,200 Required: The production supervisor estimates that the ending work-in-process is 60 percent complete on November 30. Compute the cost of syrup completed and the cost of the syrup in work-in-process ending inventory as of November 30. (Do not round intermediate calculations.)arrow_forwardJoplin Corporation produces syrups that it sells to candy makers. On November 1, it had no work-in-process inventory. It started production of 43,500 gallons of syrup in November and completed production of 41,000 gallons. The costs of the resources used by Joplin in November consist of the following: Materials $ 57,200 Conversion costs (labor and overhead) 53,300 Required: The production supervisor estimates that the ending work-in-process is 60 percent complete on November 30. Compute the cost of syrup completed and the cost of the syrup in work-in-process ending inventory as of November 30.arrow_forward

- Cedargrove Cider processes and bottles apple cider for sale through retail and big box grocery outlets. It had no work in process on May 31 in its only inventory account. The company started 20,200 cases during June. On June 30, work in process is 5,100 cases. The production supervisor estimates that the ending work-in-process inventory is 60 percent complete. Cost records at Cedargrove recorded June production costs of $94,850 in materials cost and $118,500 in conversion costs. All production is sold as it is produced. Required: Compute cost of goods sold for June. What is the value of work-in-process inventory on June 30? The president tells the controller that the company has already met its income target for the quarter, which ends on June 30, but whether the target can be met next quarter is in doubt. The president asks the controller to change the production manager’s estimate about the ending work-in-process inventory to increase the probability the company can meet the…arrow_forwardThe Ivam Department transferred 6,000 units to the finished goods storeroom for a month. There was no beginning work in process inventory, but 800 units were still in process at the end of the month and were 70% complete, and production costs incurred totaled $21,320. Inventory costs would be determined using a unit cost of $____.arrow_forwardGive correct solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning