Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 16E

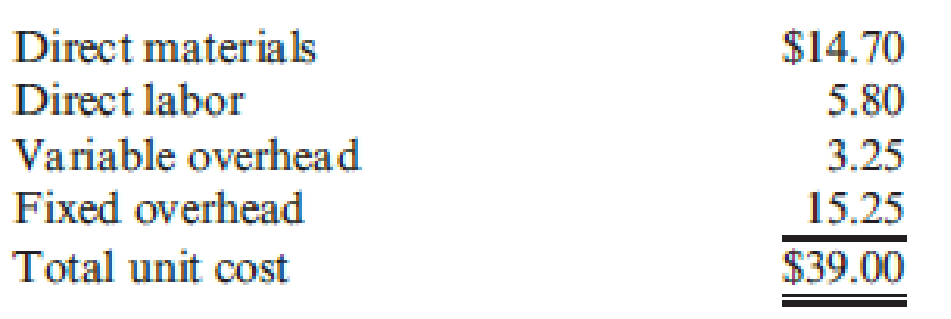

Kildeer Company makes easels for artists. During the last calendar year, a total of 30,000 easels were made, and 31,000 were sold for $52 each. The actual unit cost is as follows:

The selling expenses consisted of a commission of $1.30 per unit sold and advertising copayments totaling $95,000. Administrative expenses, all fixed, equaled $183,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was $132,600 for 3,400 easels.

Required:

- 1. Calculate the number and the dollar value of easels in ending finished goods inventory.

- 2. Prepare a cost of goods sold statement.

- 3. Prepare an absorption-costing income statement. Add a column for percentage of sales.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General Accounting

I won't to this question answer general Accounting not use ai

Financial accounting

Chapter 2 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 2 - What is an accounting information system?Ch. 2 - What is the difference between a financial...Ch. 2 - What are the objectives of a cost management...Ch. 2 - Define and explain the two major subsystems of the...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - Prob. 6DQCh. 2 - What is a direct cost? An indirect cost?Ch. 2 - Prob. 8DQCh. 2 - What is allocation?Ch. 2 - Explain how driver tracing works.

Ch. 2 - What is a tangible product?Ch. 2 - Prob. 12DQCh. 2 - Give three examples of product cost definitions....Ch. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Pietro Frozen Foods, Inc., produces frozen pizzas....Ch. 2 - For next year, Pietro predicts that 50,000 units...Ch. 2 - Pietro expects to produce 50,000 units and sell...Ch. 2 - Refer to Cornerstone Exercises 2.2 and 2.3. Next...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Prob. 9ECh. 2 - The following items are associated with a cost...Ch. 2 - Nizam Company produces speaker cabinets. Recently,...Ch. 2 - Three possible product cost definitions were...Ch. 2 - Wyandotte Company provided the following...Ch. 2 - For each of the following independent situations,...Ch. 2 - LeMans Company produces specialty papers at its...Ch. 2 - Kildeer Company makes easels for artists. During...Ch. 2 - Anglin Company, a manufacturing firm, has supplied...Ch. 2 - Lakeesha Barnett owns and operates a package...Ch. 2 - Millennium Pharmaceuticals, Inc. (MPI), designs...Ch. 2 - Jazon Manufacturing produces two different models...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Orinder Company provided the following information...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - Last year, Orsen Company produced 25,000 juicers...Ch. 2 - The ability to assign a cost directly to a cost...Ch. 2 - Selected information concerning the operations of...Ch. 2 - Brody Company makes industrial cleaning solvents....Ch. 2 - Wright Plastic Products is a small company that...Ch. 2 - The following items are associated with a...Ch. 2 - The actions listed next are associated with either...Ch. 2 - Spencer Company produced 200,000 cases of sports...Ch. 2 - Prob. 33PCh. 2 - Mason, Durant, and Westbrook (MDW) is a tax...Ch. 2 - Orman Company produces neon-colored covers for...Ch. 2 - High drug costs are often in the news. Consumer...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Not use ai solution..arrow_forwardWhat role does assurance boundary definition play in attestation? a) Standard limits work always b) Boundaries never matter c) All areas need equal coverage d) Engagement scope limits determine verification responsibilities. Want answer to this accounting mcqarrow_forwardGeneral Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY