Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide answer this question

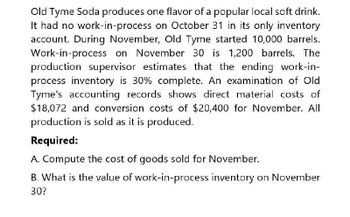

Transcribed Image Text:Old Tyme Soda produces one flavor of a popular local soft drink.

It had no work-in-process on October 31 in its only inventory

account. During November, Old Tyme started 10,000 barrels.

Work-in-process on November 30 is 1,200 barrels. The

production supervisor estimates that the ending work-in-

process inventory is 30% complete. An examination of Old

Tyme's accounting records shows direct material costs of

$18,072 and conversion costs of $20,400 for November. All

production is sold as it is produced.

Required:

A. Compute the cost of goods sold for November.

B. What is the value of work-in-process inventory on November

30?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- All production is sold as it is produced?arrow_forwardHello question is attached, thanks.arrow_forwardJoplin Corporation produces syrups that it sells to candy makers. On November 1, it had no work-in-process inventory. It started production of 45,900 gallons of syrup in November and completed production of 44,000 gallons. The costs of the resources used by Joplin in November consist of the following: Materials $ 67,578 Conversion costs (labor and overhead) 54,300 Required: The production supervisor estimates that the ending work-in-process is 60 percent complete on November 30. Compute the cost of syrup completed and the cost of the syrup in work-in-process ending inventory as of November 30. (Do not round intermediate calculations.) Cost of syrup completed Work-in-process ending inventoryarrow_forward

- Joplin Corporation produces syrups that it sells to candy makers. On November 1, it had no work-in-process inventory. It started production of 43,300 gallons of syrup in November and completed production of 41,000 gallons. The costs of the resources used by Joplin in November consist of the following: Materials $ 47,512 Conversion costs (labor and overhead) 54,200 Required: The production supervisor estimates that the ending work-in-process is 60 percent complete on November 30. Compute the cost of syrup completed and the cost of the syrup in work-in-process ending inventory as of November 30. (Do not round intermediate calculations.)arrow_forwardTwisted Pretzel, Inc. had beginning Work-in-Process Inventory (WIP) of $10,000 and makes only one product. It incurred the following costs during the year: Factory production worker wages $ 40,000 Direct materials 20,000 Allocated factory rent 60,000 Allocated factory utilities 70,000 Sales commissions 100,000 At the end of the year WIP totaled $ 4,000. Calculate the total costs of goods manufactured and transferred to Finished Goods Inventory.arrow_forwardJoplin Corporation produces syrups that it sells to candy makers. On November 1, it had no work-in-process inventory. It started production of 43,500 gallons of syrup in November and completed production of 41,000 gallons. The costs of the resources used by Joplin in November consist of the following: Materials $ 57,200 Conversion costs (labor and overhead) 53,300 Required: The production supervisor estimates that the ending work-in-process is 60 percent complete on November 30. Compute the cost of syrup completed and the cost of the syrup in work-in-process ending inventory as of November 30.arrow_forward

- The Ivam Department transferred 6,000 units to the finished goods storeroom for a month. There was no beginning work in process inventory, but 800 units were still in process at the end of the month and were 70% complete, and production costs incurred totaled $21,320. Inventory costs would be determined using a unit cost of $____.arrow_forwardChillicothe Meat Company produces one of the best sausage products in southern Ohio. The company’s controller used the account-classification method to compile the following information.a. Depreciation schedules revealed that monthly depreciation on buildings and equipment is $19,000.b. Inspection of several invoices from meat packers indicated that meat costs the company $1.10 per pound of sausage produced.c. Wage records showed that compensation for production employees costs $.70 per pound of sausage produced.d. Payroll records showed that supervisory salaries total $10,000 per month.e. Utility bills revealed that the company incurs utility costs of $4,000 per month plus $.20 per pound of sausage produced.Required:1. Classify each cost item as variable, fixed, or semivariable.2. Write a cost formula to express the cost behavior of the firm’s production costs. (Use the formula Y = a + bX, where Y denotes production cost and X denotes quantity of sausage produced.)arrow_forwardBremen Fitness Products produces a sports drink. On October 1, it had no work-in-process inventory. It started production of 9,000 cases of the drink in October and shipped 7,800 cases to retailers. (Bremen holds no finished goods inventory.) The costs of the resources used by Bremen in October consist of the following. Materials $ 87,523 Conversion costs (labor and overhead) 134,975 Required: The production supervisor estimates that the ending work in process is 55 percent complete on October 31. Compute the cost of cases shipped and the amount in work-in-process ending inventory as of October 31. (Do not round intermediate calculations.)arrow_forward

- Luebke Incorporated has provided the following data for the month of November. The balance in the Finished Goods inventory account at the beginning of the month was $52,000 and at the end of the month was $30,000. The cost of goods manufactured for the month was $212,000. The actual manufacturing overhead cost incurred was $55,000 and the manufacturing overhead cost applied to Work in Process was $58,000. The company closes out any underapplied or overapplied manufacturing overhead to cost of goods sold. The adjusted cost of goods sold that would appear on the income statement for November is: Multiple Choice $190,000 $234,000 $231,000 $212,000arrow_forwardGoodrow Industries is calculating its Cost of Goods Manufactured at year-end. The company's accounting records show the following: The Raw Materials Inventory account had a beginning balance of $19,000 and an ending balance of $14,000. During the year, the company purchased $56,000 of direct materials. Direct labor for the year totaled $125,000, while manufacturing overhead amounted to $152,000. The Work in Process Inventory account had a beginning balance of $22,000 and an ending balance of $18,000. Assume that Raw Materials Inventory contains only direct materials. Compute the Cost of Goods Manufactured for the year. (Hint: The first step is to calculate the direct materials used during the year.) Start by calculating the direct materials used during the year. Goodrow Industries Calculation of Direct Materials Used For Current Year Plus: Less: Direct materials usedarrow_forwardDuring March of the current year, Rolly Company purchased P3,500,000 raw materials. During the month, Reyes incurred P2,040,000 direct labor cost and applied 80% of direct labor cost. During the same month, there were changes in inventories as follows: Increase in raw materials P100,000; Decrease in work in process P150,000 and decrease in finished goods 75,000. If the goods available for sale is P7,500,000, what is the amount of finished goods at March 1? a.P203,000 b.P278,000 c.P 0 d.P 75,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning