FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

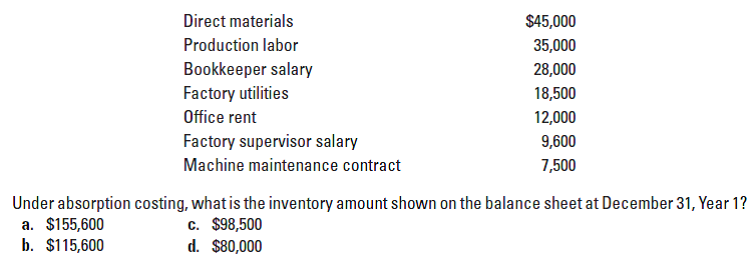

Queen Sales, Inc. has just completed its first year of operations. The company has not had any sales

to date. Queen has incurred the following costs associated with its production as of December 31, Year 1:

Transcribed Image Text:$45,000

Direct materials

Production labor

35,000

Bookkeeper salary

Factory utilities

28,000

18,500

Office rent

12,000

Factory supervisor salary

9,600

Machine maintenance contract

7,500

Under absorption costing, what is the inventory amount shown on the balance sheet at December 31, Year 1?

a. $155,600

b. $115,600

c. $98,500

d. $80,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Gadubhaiarrow_forwardHw.185.arrow_forwardCrane incurred the following costs while manufacturing its product: Materials used in production, $144000; factory depreciation, $84000; property taxes on the administrative offices, $36000; labor costs of assembly-line workers, $119000; factory supplies used, $32000; advertising expense, $37000; property taxes on the factory, $44000; delivery expense, $47000; salaries of the sales staff, $77000; and sales commissions, $41000. The total product costs for Crane are O $583000. O $459000. O $661000. O $423000. Toxtbook and Mediaarrow_forward

- Specter Company, a small manufacturer, has submitted the items below concerning last year'soperations. The president's secretary, trying to be helpful, has alphabetized the list.Administrative salaries $2,400Advertising expense 1,200Depreciation—factory building 800Depreciation—factory equipment 1,600Depreciation—office equipment 180Direct labour cost 21,900Raw materials inventory, beginning 2,100Raw materials inventory, ending 3,200Finished goods inventory, beginning 46,980Finished goods inventory, ending 44,410General liability insurance expense 240Indirect labour cost 11,800Insurance on factory 1,400Purchases of raw materials 14,600Repairs and maintenance of factory 900Sales salaries 2,000Taxes on factory 450Travel and entertainment expense 1,410Work in process inventory, beginning 1,670Work in process inventory, ending 1,110Required:a. Prepare a schedule of Cost of Goods Manufactured in good form for the year. UseDecember and current year for time period. b. Determine the Cost of…arrow_forwardA review of Plunkett Corporation's accounting records for last year disclosed the following selected Variable costs Direct materials used $ 56,000 Direct labor $179,100 Manufacturing overhead $154,000 Selling costs $108,400 Fixed costs Manufacturing overhead $267,000 Selling costs $121,000 Administrative costs $235,900 In addition, the company suffered a $27,700 uninsured factory fire loss during the year. What were Plunkett's product costs and period costs for last yeararrow_forwardRequired information [The following information applies to the questions displayed below.) Sweeten Company had no jobs in progress at the beginning of the year and no beginning inventories. It started. completed, and sold only two jobs during the year-Job P and Job Q. The company uses a plantwide predetermined overhead rate based on machine-hours. At the beginning of the year, it estimated that 4,000 machine-hours would be required for the period's estimated level of production. Sweeten also estimated $29,800 of fixed manufacturing overhead cost for the coming period and variable manufacturing overhead of $2.90 per machine-hour. Because Sweeten has two manufacturing departments-Molding and Fabrication-it is considering replacing its plantwide overhead rate with departmental rates that would also be based on machine-hours. The company gathered the following additional information to enable calculating departmental overhead rates: Estimated total machine-hours used Estimated total fixed…arrow_forward

- Sweet Tooth Confectionary incurred $155,000 of manufacturing overhead costs during the year just ended. However, only $145,000 of overhead was applied to production. At the conclusion of the year, the following amounts of the year’s applied overhead remained in the various manufacturing accounts. Prepare a journal entry to close out the balance in the Manufacturing Overhead account and prorate the balance to the three manufacturing accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forwardTamarisk Corporation incurred the following costs during 2022. Direct materials used in product Depreciation on factory Property taxes on store Labor costs of assembly-line workers Factory supplies used (a) * Your answer is incorrect. Compute cost of goods manufactured. $115,200 Cost of goods manufactured 57,600 7,200 105,600 22,400 Advertising expense Property taxes on factory Delivery expense Sales commissions Salaries paid to sales clerks Work in process inventory was $11,600 at January 1 and $14,800 at December 31. Finished goods inventory was $57,600 at January 1 and $43,700 at December 31. $43,200 314400 13,600 20,000 33,600 48,000arrow_forwardProduct J is one of the many products manufactured and sold by Gooble Company. An income statement by product line for the past year indicated a net loss for Product J of $7,250. This net loss resulted from sales of $265,000, cost of goods sold of $186,500, and operating expenses of $85,750. It is estimated that 30% of the cost of goods sold represents fixed factory overhead costs and that 40% of the operating expense is fixed. If Product J is retained, the revenue, costs, and expenses are not expected to change significantly from those of the current year. However, because of the net loss, management is considering the elimination of the unprofitable endeavor. Because of the large number of products manufactured, the total fixed costs and expenses are not expected to decline significantly if Product J is discontinued. Prepare a differential analysis report, dated February 8 of the current year, on the proposal to discontinue Product J. Gooble Company Proposal to Discontinue Product J…arrow_forward

- During March of the current year, Rolly Company purchased P3,500,000 raw materials. During the month, Reyes incurred P2,040,000 direct labor cost and applied 80% of direct labor cost. During the same month, there were changes in inventories as follows: Increase in raw materials P100,000; Decrease in work in process P150,000 and decrease in finished goods 75,000. If the goods available for sale is P7,500,000, what is the amount of finished goods at March 1? a.P203,000 b.P278,000 c.P 0 d.P 75,000arrow_forwardLoneStar Co. is a manufacturing company that produces only one product, cowboy boots, has provided the following data concerning its operations in 2019 and 2020: 2019 was the company’s first year of operations. In 2019 the company produced 1,000 pairs of cowboy boots and sold 900 pairs. The company sold boots at $250 a pair. The company incurred the following costs in 2019: direct materials of $70 a pair, direct labor costs of $20 a pair, variable selling and administrative of $5 a pair, variable manufacturing overhead of $10 a pair, and fixed manufacturing overhead of $20,000. Lastly, they paid $50,000 for fixed selling and administrative expenses. In 2020, selling price and all costs remained the same except that direct material costs went up by $5 a pair. The company produced 2,000 pairs in 2020 and sold 1,500 pairs. LoneStar Co. uses FIFO inventory method (the oldest units are sold first). A. What is the unit product cost for 2019 and 2020 under variable costing? B. What is the…arrow_forwardHarshman Company constructed a building for its own use. The company incurred costs of $45,000 for materials and supplies, $64,000 for direct labor, and $5,000 for a supervisor's overtime that was caused by the construction. Harshman uses a factory overhead rate of 50% of direct labor cost. Before construction, the company had received a bid of $159,000 from an outside contractor. 1. Assuming common practice is followed, at what value should Harshman capitalize the building? 2. The cost of the constructed asset will more closely approximate the cost of an equivalent purchased asset when the approach is used.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education