EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General Accounting

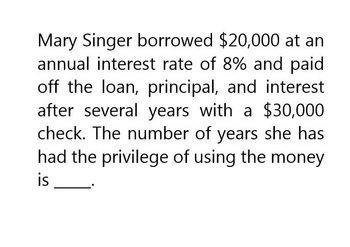

Transcribed Image Text:Mary Singer borrowed $20,000 at an

annual interest rate of 8% and paid

off the loan, principal, and interest

after several years with a $30,000

check. The number of years she has

had the privilege of using the money

is

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Bryan purchased a house for $500,000. She made a down payment of 15.00% of the value of the house and received a mortgage for the rest of the amount at 4.12% compounded semi-annually amortized over 25 years. The interest rate was fixed for a 5 year period. a. Calculate the monthly payment amount. $0.00 Round to the nearest cent b. Calculate the principal balance at the end of the 5 year term. $0.00 Round to the nearest cent c. Calculate the monthly payment amount if the mortgage was renewed for another 5 years at 5.82% compounded semi-annually? $0.00 چی Round to the nearest centarrow_forwardLeona Jefferson purchased a home and obtained a 25 year loan of 436,250$ at an annual interest rate of 7.5%. Find the amount of interest paid on the loan over the 25 years. Round answer to the nearest cent.arrow_forwardkaty took out a loan for $12000 over 3 years, if her total loan repayments amounted to $18750, calculate the interest charged.arrow_forward

- Kia deposited $1,300, at the BEGINNING of each year for 26 years in a credit union account. If the account paid 8% interest, compounded annually, use the appropriate formula to find the future value of her account. $95,037.72$103,940.74 $112,256.00$113,556.00arrow_forwardLeona purchased a home and obtained a 25 year loan of 437,750$ at an annual interest rate of 6.5%. Find the amount of interest paid on the loan over the 25 years. Round answer to nearest cent.arrow_forwardMarsha Terban bought a home for $110,000 with a down payment of $10,000. Her rate of interest is 9 1/2 percent for 15 years. Compute an amortization schedule for the first 3 months of the loan.arrow_forward

- Quinn opened an account with an initial deposit of $2500. At the end of the 2nd and 8th years, he deposited $3000 and $5050, respectively while at the end of the 5th year, withdrew $3000. The account earned 2% nominal annual interest compounded semiannually for the first 3 years, 3% annual effective rate of discount for the next 2 years, and 3.5% annual effective interest rate for the remaining time. How much will Quinn have in his account at the end of the 12th year? and determine Quinns average annual rate of return for the 12-year period.arrow_forwardMs. Tamper bought a house for $180,000. She put 20% down and obtained a mortgage loan for the balance at 4 1/4% for 30 years. a. Find the monthly payment. b. Find the total interest paid.arrow_forwardKia deposited $1,100, at the BEGINNING of each year for 25 years in a credit union account. If the account paid 8% interest, compounded annually, use the appropriate formula to find the future value of her account. A. $73,441.24 B. $80,416.53 C. $86,849.86 D. $87,949.86arrow_forward

- OLA#9.2: Hannah purchased a house for $475,000. She made a downpayment of 25% of the value of the house and received a mortgage for the rest of the amount at 5.50% compounded semi-annually for 25 years. The interest rate was fixed for a 5-year term. a. Calculate the size of the monthly payments. b. Calculate the principal balance at the end of the 5-year term. c. Calculate the size of the monthly payments if after the first 5-year term the mortgage was renewed for another 5-year term at 5.25% compounded semi-annually?arrow_forwardCarie purchased a car for $49,000; she paid $4900 as a down payment and financed the balance amount at 3.5% compounded monthly for 4.5 years. What was the amount of interest charged for the entire loan?arrow_forwardHelen contributed $500 at the end of every month for the past 5 years into an RRSP account, earning 3.8% p.a. compounded quarterly. If she leaves the accumulated contributions for another 4 years in the RRSP at the same rate of interest How much will Helen have in total in her RRSP account? How much did she contribute? How much will be the interest?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you