Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Hi expart Provide answer the general accounting question

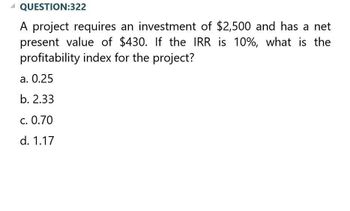

Transcribed Image Text:A QUESTION:322

A project requires an investment of $2,500 and has a net

present value of $430. If the IRR is 10%, what is the

profitability index for the project?

a. 0.25

b. 2.33

c. 0.70

d. 1.17

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which project should you invest in according to the NPV and IRR? Project A NPV@ 10% WACC = $135 and IRR 22% Project B NPV @ 10% WACC = $17 and IRR 21% Project C NPV @ 10% WACC = $146 and IRR 23% O a Project A O b. Cannot determine Oc. Project C O d. Project B O e. Project A or Barrow_forward1) You are considering the following mutually exclusive projects: (15pts) 1 4. Project A -400 50 50 50 230 230 Project B -600 300 300 50 50 50 if the firm required return (WACC) is 10%: a. What is the NPV of project A? b. What is the IRR of project A? C. What is the NPV of project B? d. What is the IRR of project B? e. Which one you must select? a. b. C. d. e.arrow_forwardVipul barrow_forward

- If a $300,000 investment has a project profitability index of 0.25, what is the netpresent value of the project?a. $75,000b. $225,000c. $25,000d. $275,000arrow_forwardComparing Investment Criteria [L01,2,3,5,7] Consider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$300,000 -$40,000 1 20,000 19,000 2 50,000 12,000 3 50,000 18,000 4 390,000 10,500 Whichever project you choose, if any, you require a 15 per cent return on your investment. a. If you apply the payback criterion, which will you choose? Why? b. If you apply the discounted payback criterion, which investment will you choose? Why? c. If you apply the NPV criterion, which investment will you choose? Why? d. If you apply the IRR criterion, which investment will you choose? Why? e. If you apply the profitability index criterion, which investment will you choose? Why? f. Based on your answers in (a) through (e), which project will you finally choose? Why? Please explain your calculations and conclusionsarrow_forwardmay i know the asnwer??arrow_forward

- Consider the following two mutually exclusive investment projects:Project Cash Flowsn A B 0 -$4,000 -$8,5001 $400 $11,5002 $7,000 $400Assume that the MARR = 15%.(a) Using the NPW criterion, which project would you select?(b) On the same chart, sketch the PW(i) function for each alternative fori = 0% and 50%. For what range of i would you prefer Project B?arrow_forwardWhispering Inc. now has the following two projects available: Project Initial CF After-tax CF1 After-tax CF2 1 2 PMT1 PMT2 $ $ -11,634.42 Project 1 -3,290.48 5,300 3,800 Assume that RF = 5.1 percent, risk premium = 10.6 percent, and beta = 1.2. Use the EANPV approach to determine which project Whispering Inc. should choose if they are mutually exclusive. (Round cost of capital and final answers to 2 decimal places, e.g.17.35% or 2,513.25.) 1673.12 1479.74 6,200 should be chosen. 3,200 After-tax CF3 9,600arrow_forwardsolve in a simple wayarrow_forward

- I want to correct answer general accountingarrow_forwardAnswer this question as it is pertaining to two MUTUALLY EXCLUSIVE projects on the following figure. Given r=6%, which project would you choose if you decide to use the internal rate of return (IRR) as the criterion? Group of answer choices Project A Project B Neither Eitherarrow_forwardStart with the partial model in the file Ch10 P23 Build a Model.xlsx on the textbooks Web site. Gardial Fisheries is considering two mutually exclusive investments. The projects expected net cash flows are as follows: a. If each projects cost of capital is 12%, which project should be selected? If the cost of capital is 18%, what project is the proper choice? b. Construct NPV profiles for Projects A and B. c. What is each projects IRR? d. What is the crossover rate, and what is its significance? e. What is each projects MIRR at a cost of capital of 12%? At r = 18%? (Hint: Consider Period 7 as the end of Project Bs life.) f. What is the regular payback period for these two projects? g. At a cost of capital of 12%, what is the discounted payback period for these two projects? h. What is the profitability index for each project if the cost of capital is 12%?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning