Corporate Fin Focused Approach

5th Edition

ISBN: 9781285660516

Author: EHRHARDT

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

What is the amount of each payment?

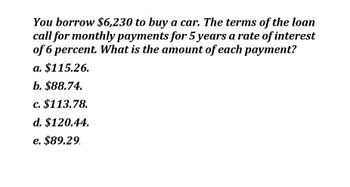

Transcribed Image Text:You borrow $6,230 to buy a car. The terms of the loan

call for monthly payments for 5 years a rate of interest

of 6 percent. What is the amount of each payment?

a. $115.26.

b. $88.74.

c. $113.78.

d. $120.44.

e. $89.29.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculating and comparing add-on and simple interest loans. Eli Nelson is borrowing 10,000 for five years at 7 percent. Payments, which are made on a monthly basis, are determined using the add-on method. a. How much total interest will Eli pay on the loan if it is held for the full five-year term? b. What are Elis monthly payments? c. How much higher are the monthly payments under the add-on method than under the simple interest method?arrow_forwardCalculating interest and APR of installment loan. Assuming that interest is the only finance charge, how much interest would be paid on a 5,000 installment loan to be repaid in 36 monthly installments of 166.10? What is the APR on this loan?arrow_forwardCost of Bank Loan Mary Jones recently obtained an equipment loan from a local bank. The loan is for 15,000 with a nominal interest rate of 11%. However, this is an installment loan, so the bank also charges add-on interest. Mary must make monthly payments on the loan, and the loan is to be repaid in 1 year. What is the effective annual rate on the loan (assuming a 365-day year)?arrow_forward

- The following loan is a simple interest amortized loan with monthly payments. $7000, 7%, 4 years (a) Find the monthly payment. (Give your answer to the nearest cent.) Payment $189.58 (b) Find the total interest for the given simple interest amortized loan. (Give your answer to the nearest cent.) Total interest $ 2100 Xarrow_forwardThe following loan is a simple interest amortized loan with monthly payments. $5000, 7 1/2%, 4 years (a) Find the monthly payment. (Give your answer to the nearest cent.)Payment $ (b) Find the total interest for the given simple interest amortized loan. (Give your answer to the nearest cent.)Total interest $arrow_forwardYou want to take out a $250,000 mortgage (home loan). The interest rate on the loan is 5% and the loan is for 25 years. How much will your semi- monthly payments be? a. $655 $622 c. $730 O d. $680 e. $752 O b.arrow_forward

- 1. Consider a home mortgage of $150,000 at a fixed APR of 4.5% for 25 years. a. Calculate the monthly payment. b. Determine the total amount paid over the term of the loan. c. Of the total amount paid, what percentage is paid toward the principal and what percentage is paid for interest. 2. Someone needs to borrow $11,000 to buy a car and the person has determined that monthly payments of $225 are affordable. The bank offers a 3-year loan at 7% APR, a 4-year loan at 7.5%, or a 5-year loan at 8% APR. Which loan best meets the person's needs? Explain. Question content area bottom Part 1 Which loan best meets the person's needs? (Round to the nearest cent as needed.) A. The first loan best meets the person's needs because the monthly payment of $enter your response here is less than the maximum budgeted amount of $225 per month. B. The second loan best meets the person's needs because the monthly payment of $enter your response here…arrow_forwardYou obtain a $265,000, 15-year fixed-rate mortgage. The annual interest rate is 6.25 percent. In addition to the principal and interest paid, you must pay $275 a month into an escrow account for insurance and taxes. What is the total monthly payment (to the nearest dollar)? a. $2,272 b. $1,632 c. $2,547 d. $1,907 e. $2,311arrow_forwardYou have just taken a 30-year mortgage loan for $200,000. The annual percentage rate on the loan is 6%, and payments will be made monthly. Estimate your monthly payments. A). $1,245.55 B). $1,188.07 C). $1,205.01 D). $1,199.10 E). $1,263.89 in excelarrow_forward

- You want to buy a house and will need to borrow $220,000. The interest rate on your loan is 5.47 percentcompounded monthly and the loan is for 20 years. What are your monthly mortgage payments?Multiple ChoiceA. $1,585.11B. $1459.31 C. $1,530.30D. $1.502.78E. $1,509.63arrow_forwardThe following loan is a simple interest amortized loan with monthly payments. $155,000, 9- 9-%, 30 years 2 (a) Find the monthly payment. (Give your answer to the nearest cent.) Payment $ (b) Find the total.interest for the given simple interest amortized loan. (Give your answer to the nearest cent.) Total interest | Enter a number.arrow_forward1. Consider a loan at 4.125% APR on 6 years for a $23,000 car a. Estimate the monthly payment (using the average balance method). b. How much would you pay in total for interest?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning