Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

not use

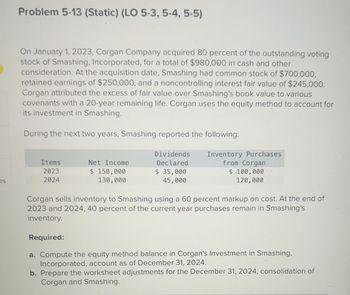

Transcribed Image Text:Problem 5-13 (Static) (LO 5-3,5-4, 5-5)

On January 1, 2023, Corgan Company acquired 80 percent of the outstanding voting

stock of Smashing, Incorporated, for a total of $980,000 in cash and other

consideration. At the acquisition date, Smashing had common stock of $700,000,

retained earnings of $250,000, and a noncontrolling interest fair value of $245,000.

Corgan attributed the excess of fair value over Smashing's book value to various

covenants with a 20-year remaining life. Corgan uses the equity method to account for

its investment in Smashing.

During the next two years, Smashing reported the following:

Items

2023

Net Income

Dividends

Declared

Inventory Purchases

from Corgan

$ 150,000

es

2024

130,000

$ 35,000

45,000

$ 100,000

120,000

Corgan sells inventory to Smashing using a 60 percent markup on cost. At the end of

2023 and 2024, 40 percent of the current year purchases remain in Smashing's

inventory.

Required:

a. Compute the equity method balance in Corgan's Investment in Smashing,

Incorporated, account as of December 31, 2024.

b. Prepare the worksheet adjustments for the December 31, 2024, consolidation of

Corgan and Smashing.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- parrow_forwardam. 14.arrow_forwardProblem 4-18 (Static) (LO 4-2, 4-4, 4-5) On January 1, 2024, Johnsonville Enterprises, Incorporated, acquired 80 percent of Stayer Company's outstanding common shares in exchange for $3,000,000 cash. The price paid for the 80 percent ownership interest was proportionately representative of the fair value of all of Stayer's shares. At acquisition date, Stayer's books showed assets of $4,200,000 and liabilities of $1,600,000. The recorded assets and liabilities had fair values equal to their individual book values except that a building (10-year remaining life) with book value of $195,000 had an appraised fair value of $345,000. Stayer's books showed a $175,500 carrying amount for this building at the end of 2024. Also, at acquisition date Stayer possessed unrecorded technology processes (zero book value) with an estimated fair value of $1,000,000 and a 20-year remaining life. For 2024, Johnsonville reported net income of $650,000 (before recognition of Stayer's income), and Stayer…arrow_forward

- PLEASE PROVIDE SOLUTIONOn January 1, 2022, Lucas Company acquired 85% of outstanding shares of Luna Corp. The consideration transferred includes cash payment of P2,000,000 and issuance of 50,000 shares with a market price of P45 per share. The book value of Luna Corp.’s identifiable net assets approximate its fair value, except for the following: Merchandise inventory’s fair value is lower than the book balance by 150,000. Equipment-A, with 2 years remaining useful life, costing P300,000 is understated by P50,000. Land with a fair value of P500,000 is recognized in the books amounting to P350,000. The following events happened to Luna Corp. Equipment-A was sold in June 30, 2023 for P320,000. 60% of merchandise inventory were sold in 2022. There is no movement as to the ordinary shares of Luna Corp during the year. The unadjusted trial balance as of December 31, 2022 were as follows: Lucas Company Luna Corp Cash 2,240,000 1,800,000 Trade…arrow_forwardOn January 3, 2020, Novak Limited purchased 3,500 (35%) of the common shares of Sonja Corp. for $468,900. The following information is provided about the identifiable assets and liabilities of Sonja at the date of acquisition: Carrying Amount Fair Value Assets not subject to depreciation $516,000 $516,000 Assets subject to depreciation (10 years remaining) 806,000 866,000 Total identifiable assets 1,322,000 1,382,000 Liabilities 108,000 108,000 During 2020, Sonja reported the following information on its statement of comprehensive income: Income before discontinued operations $208,000 Discontinued operations (net of tax) (71,900) Net income and comprehensive income 136,100 Dividends declared and paid by Sonja November 15, 2020 124,000 Assume that the 35% interest is enough to make Sonja an associate of Novak, and that Novak is required to apply IFRS for its financial reporting. The fair…arrow_forwardOn January 1, 2023, Holland Corporation paid $7 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $5.00 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current assets Property and equipment (net) Patents $14,700 Liabilities 288,708 Common stock 199,100 Retained earnings $422,500 $222,500 100,000 100,000 $ 422,500 On January 1, 2023, Holland assessed the carrying amount of Zeeland's equipment (5-year remaining life) to be undervalued by $62,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $226,900. Zeeland's acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Any remaining excess of Zeeland's…arrow_forward

- On January 1, 2023, Holland Corporation paid $7 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $5.00 per share both before and after the acquisition by Holland. Zeeland's acquisition date balance sheet follows: Current assets Property and equipment (net) Patents On January 1, 2023, Holland assessed the carrying amount of Zeeland's equipment (5-year remaining life) to be undervalued by $43,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $246,400. Zeeland's acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Any remaining excess of Zeeland's acquisition-date fair value over its book value was attributed to goodwill. The companies' financial statements for the…arrow_forwardPROBLEM III. On January 1, 2020, P Corporation purchase 80% of S Company's ordinary share for P810,000. P37,500 of the excess is attributable to goodwill and the balance to depreciable asset with economic life of ten years. NCI is measured at fair value on the date of acquisition. On this date, shareholders' equity of the two companies were as follows: P Corporation S Company Ordinary share P1,312,500 P300,000 Retained earnings 1,950,000 525,000 On December 31, 2020, S Company reported net income of P131,250 and paid dividends of P45,000 to Party. Party reported earnings from its own operations of 356,250 and paid dividends of P172,500. Goodwill has been impaired and should be reported at P7,500 on December 31, 2020. 1. Net income attributable to parent 2. NCINISarrow_forwardPROBLEM III. On January 1, 2020, P Corporation purchase 80% of S Company's ordinary share for P810,000. P37,500 of the excess is attributable to goodwill and the balance to depreciable asset with economic life of ten years. NCI is measured at fair value on the date of acquisition. On this date, shareholders' equity of the two companies were as follows: P Corporation S Company Ordinary share P1,312,500 P300,000 Retained earnings 1,950,000 525,000 On December 31, 2020, S Company reported net income of P131,250 and paid dividends of P45,000 to Party. Party reported earnings from its own operations of 356,250 and paid dividends of P172,500. Goodwill has been impaired and should be reported at P7,500 on December 31, 2020. latlecomeoltolbutable-te-perent. NCINIS 3. NCINAS 4. Consolidated retained earnings 5. Consolidated Shareholders' Equityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning