CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

I need assistance with this question.

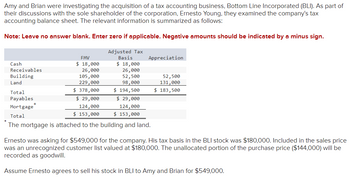

Transcribed Image Text:Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Incorporated (BLI). As part of

their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax

accounting balance sheet. The relevant information is summarized as follows:

Note: Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign.

Cash

Receivables

Building

Land

Total

Payables

FMV

$ 18,000

26,000

105,000

229,000

$ 378,000

Adjusted Tax

Basis

$ 18,000

26,000

52,500

98,000

Appreciation

$ 194,500

52,500

131,000

$ 183,500

$ 29,000

124,000

$ 153,000

Mortgage

Total

$ 29,000

124,000

$ 153,000

The mortgage is attached to the building and land.

Ernesto was asking for $549,000 for the company. His tax basis in the BLI stock was $180,000. Included in the sales price

was an unrecognized customer list valued at $180,000. The unallocated portion of the purchase price ($144,000) will be

recorded as goodwill.

Assume Ernesto agrees to sell his stock in BLI to Amy and Brian for $549,000.

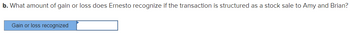

Transcribed Image Text:b. What amount of gain or loss does Ernesto recognize if the transaction is structured as a stock sale to Amy and Brian?

Gain or loss recognized

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Required information [The following information applies to the questions displayed below.] Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Incorporated (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax accounting balance sheet. The relevant information is summarized as follows: (Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign.) Cash Receivables Building Land Total Payables Mortgage* Total FMV $ 8,000 16,000 100,000 215,000 $ 339,000 $ 20,000 111,000 $ 131,000 Gain or loss recognized Adjusted Tax Basis. $ 8,000 16,000 50,000 115,000 $ 189,000 $ 20,000 111,000 $ 131,000 Appreciation 50,000 100,000 $ 150,000 *The mortgage is attached to the building and land. Ernesto was asking for $460,000 for the company. His tax basis in the BLI stock was $140,000. Included in the sales price was an unrecognized customer list…arrow_forward! Required information [The following information applies to the questions displayed below.] Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Incorporated (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax accounting balance sheet. The relevant information is summarized as follows: (Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign.) Cash Receivables Building Land Total Payables Mortgage* FMV 15,000 22,000 95,000 204,000 $ 336,000 $ 24,000 113,000 $ 137,000 Total * The mortgage is attached to the building and land. Gain or loss recognized Corporate-level tax Adjusted Tax Basis $ 15,000 22,000 47,500 44,000 $ 128,500 $ $ $ 24,000 113,000 $ 137,000 Ernesto was asking for $432,000 for the company. His tax basis in the BLI stock was $165,000. Included in the sales price was an unrecognized customer list valued at…arrow_forwardI need assistance with finding the answers.arrow_forward

- Dont uplode any images in the anarrow_forwardDirection: Read the following case study and answer the question: During the period, the business acquires an equipment costing P150,000 in cash. The owner of the business is questioning why you as his accountant, did not include the P150,000 equipment as one of the items of operating expense in the income statement which resulted in a higher income tax of the business?arrow_forwardSolve both questionsarrow_forward

- Can you please answer this accounting question do fast? Ouirky inc.....arrow_forwardc. Assume the same facts as above and in part (b), except that Washi’s net income included a loss on discontinued operations of $33,000 (net of tax). Prepare the journal entries necessary to record Flounder’s equity in the net income of Washi for 2023. Ignore income taxes. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit enter an account title to record investment income and loss enter a debit amount enter a credit amount enter an account title to record investment income and loss enter a debit amount enter a credit amount enter an account title to record investment income and loss enter a debit amount enter a credit amount (To record investment income and loss) enter an account title to record depreciation…arrow_forwardGood afternoon Please help with question. Thanks in advance Full Tax Co. is incorporated and tax resident in Barbados. The audited financial statements for Full Tax Co. for year-end December 31, 2021, show an accounting profit after tax of $5,500,000 after charging the following: Depreciation $1,500,000 Tax $500,000 Property Tax $900,000 Interest expense $15,000 Preference dividends of $40,000 Legal fees $1,110,000 Insurance of $750,000 Bad debts $40,000 Foreign Travel $20,000 Repairs and Maintenance $1,500,000 General expenses $600,000 Other Information Property Tax of $500,000 was paid for the property on which the company’s factory is located; $300,000 for the office premises and $100,000 for the director’s home. The insurance was paid for the factory and office premises. The bad debt expense includes a general provision of $10,000 and a specific provision of $30,000. The company paid interim ordinarily dividends totaling $100,000 Repairs and Maintenance include for $500,000…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College