FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

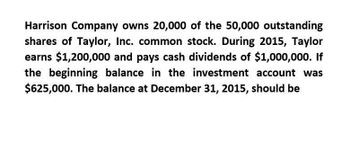

Transcribed Image Text:Harrison Company owns 20,000 of the 50,000 outstanding

shares of Taylor, Inc. common stock. During 2015, Taylor

earns $1,200,000 and pays cash dividends of $1,000,000. If

the beginning balance in the investment account was

$625,000. The balance at December 31, 2015, should be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Harrison Company owns 20,000 of the 50,000 outstanding shares of Taylor, Inc. common stock. During 2015, Taylor earns $1,200,000 and pays cash dividends of $1,000,000. If the beginning balance in the investment account was $625,000. the balance at December 31, 2015, should be A. $1,025,000 B. $825,000 C. $705,000 D. $625,000arrow_forwardAdams Industries holds 40,000 shares of FedEx common stock. On December 31, 2015, and December 31, 2016, the market value of the stock is $95 and $100 per share, respectively. What is the appropriate reporting category for this investment and at what amount will it be reported in the 2016 balance sheet?arrow_forwardCompany E reports net income of $100,000 for 2015. Assume the income is earned evenly throughout the year. Dividends of $10,000 are paid on December 31. What will Company R report as investment income under the following ownership situations, if: a. Company R owns a 10% interest from July 1 to December 31? b. Company R owns a 10% interest from January 1 to June 30 and a 25% interest from July 1 to December 31? c. Company R owns a 30% interest from January 1 to June 30 and a 10% interest from July 1 to December 31?arrow_forward

- On July 1, 2015, Denver Company purchased 30,000 shares of Eagle Company's 100,000 outstanding ordinary shares for P200 per share. On December 15, 2015, Eagle paid P400,000 in dividends to its share ordinary shareholders. Eagle's net income for the year ended December 31, 2015 was P1,200,000, earned evenly throughout the year. In its 2015 income statement, what amount of income from the investment should Denver report?a. 360,000b. 180,000c. 120,000d. 60,000arrow_forwardOn January 1, 2017, Rama Corporation paid $150,000 for 30% of Samer Company's stock. Rama reported a net income of $25,000 in 2017, paid out $10,000 in dividends, and the annual amortization was $1,000 due to the undervaluation of the buildings (F.V> B.V). Rama uses the equity method. What is the balance of investment in Samer Company that will be reported on December 31, 2017? a. $157,500 O b. $153,500 O c. $150,000 d. $153,400arrow_forwardHow much should be reported in La Casa’s P&L section of the statement of comprehensive income and how much is the carrying value of the investment at the end of 2018?arrow_forward

- Smith Corporation is reviewing the following transactions for its year-ended December 31, 2015. For each item listed, indicate the: Name of the account to use. Whether it is current or long-term, asset or liability. The amount. On December 15, 2015 the company declared a $2.00 per share dividend on 40,000 shares of common stock outstanding, to be paid on January 5, 2013 Credit sales for year amounted to $10,000,000. Smith estimates its Allowance for Doubtful Accounts as 3% of credit sales. At December 31, bonds payable of $100,000,000 are outstanding. The bonds pay 12% interest every September 30 and mature in installments of $25,000,000 every September 30. Bonuses to key employees based on net income for 2015 are estimated to be $150,000. Included in long-term investments are 10-year U.S. Treasury bonds that mature March 31, 2016. The bonds were purchased November 20, 2015. The accounts receivable account includes $20,000 due in three years from employees. The property, plant,…arrow_forwardA trucking company is required to determine the cost of capital for its common shares. The company expects to pay a dividend of $ 1.45 by the end of the year (2021). The following table shows the dividends for the last 5 years. Year Dividend2020 $ 1.32019 1.22018 1.1 2017 1 2016 0.98 2015 0.90 After administrative costs, the company expects to earn $ 25 per share from a new issue and has a 15% market rate. a) Determine the growth rate of dividends from 2016 to 2020. (g =?) b) Determine the value or price of the sharesarrow_forwardThe December 31, 2018, balance sheet of Whelan, Inc, showed long-term debt of $1,385,000, $137.000 in the common stock account, and $2,620,000 in the adoitional paid-in surplus account. The Deocember 31. 2019, balance sheet showed long-term debt of $1.550.000, $147,000 in the common stock account and $2,920,000 in the additional paid-in surplus account. The 2019 income stalement showed an interest expense of $92,500 and the company paid oul $142.000 in cash dividends during 2019. The fim's net capital spending for 2019 was $930,000, and the fim reduced its net working capital investment by $122.000. What was the fem's 2019 operating cash fow, or OCF7 (A nogative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in dollars, not millions of dollars, rounded to the nearest whole number, eg. 1,234,567.) Operating cash flowarrow_forward

- BI's income for the year ended December 31, 2021 was $ 4,000,000. This was earned evenly over the year. In addition BI paid dividends of $ 300,000 each on March 31, June 30, September 30 and December 31, 2021 to their shareholders of records on that date. The inventory on July 1, 2021 was 75% sold as of December 31, 2021. Required. For the investment in AI 1. Using IFRS 9 prepare the journal entries for DC for all of 2021. 2. Using ASPE prepare the journal entries for DC for all of 2021. For the investment in BI 3. Using IFRS prepare the journal entries for DC for 2021. 4. Using ASPE prepare the joumal entries for DC for 2021 for all options available under ASPE.arrow_forwardOn June 30, 2015, Gell-O Corp paid USD48 per share for 50,000 shares, representing a 25% ownership interest in Migs Company, plus broker's fees of USD3. On December 20, 2015, Miggs Company declared and paid USD5 dividends per share to shareholders, and reported a net income of USD2,240,000 for 2015 (earned equally all throughout 2015). On December 31, 2015, what was the balance of the investment in Miggs Company?arrow_forwardSquare Hammer Corporation shows the following information on its 2018 income statement: Sales = $196,000; Costs = $84,000; Other expenses = $5,100; Depreciation expense = $9,000; Interest expense = $13,300; Taxes = $29,610; Dividends = $10,300. In addition, you're told that the firm issued $7,100 in new equity during 2018 and redeemed $8,700 in outstanding long-term debt. a. What is the 2018 operating cash flow? Operating cash flow b. What is the 2018 cash flow to creditors? Cash flow to creditorsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education