Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

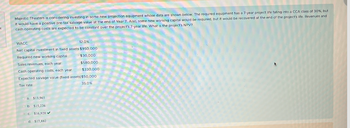

Transcribed Image Text:Majestic Theaters is considering investing in some new projection equipment whose data are shown below. The required equipment has a 7-year project life falling into a CCA class of 30%, but

it would have a positive pre-tax salvage value at the end of Year 7. Also, some new working capital would be required, but it would be recovered at the end of the project's life. Revenues and

cash operating costs are expected to be constant over the project's 7-year life. What is the project's NPV?

WACC

12.0%

Net capital investment in fixed assets $950,000

Required new working capital

Sales revenues, each year

Cash operating costs, each year

$30,000

$580,000

$330,000

Expected salvage value (fixed assets) $50,000

Tax rate

a. $13,965

b. $15,226

c. $16,920✓

d. $17,882

35.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- You must evaluate the purchase of a proposed Spectrometer for R&D department. The purchase. Price of the spectrometer including modifications is $200,000, and the equipment will be depreciated at the time of purchase. The equipment would be sold after 3 years for $51,000. The equipment would require a $15,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save firm $49,000 per year in before-tax laber casts. The firm's marginal fecteral-plus-state tarrate is 25% a) What is the initial investment outlay for the Spectrumeter after bonus depreciation is considered, that is the Year 0 project cash flow? the Enter your answer as a a positive value. Rand answer to the nearest dollar. $ b.) What are the project's annual cash flows in Years Round 1, 2, and 3? Do not round intermediate calculations. your answers to the nearest dollar. Year 1: 9 Year 2: $ Year 3: $ 10 4 yourarrow_forwardXYZ Corporation is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project (Ignore income taxes.): Sales $ 500,000 Less cash variable expenses 200,000 Less cash fixed expenses 150,000 Less depreciation expenses 45,000 Net operating income $ 105,000 The company's required rate of return is 12%. Compute the payback period for this project Enter your answerarrow_forwardConcose Park Department is considering a new capital investment. The cost of the machine is $230,000. The annual cost savings if the new machine is acquired will be $105,000. The machine will have a 5-year life and the terminal disposal value is expected to be $38,000. There are no tax consequences related to this decision. If Concose Park Department has a required rate of return of 16%, which of the following is closest to the present value of the project? A. $131,858 B. $145,662 C. $31,892 D. $113,770arrow_forward

- Delia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $162, 000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $102,000, variable costs of $27, 500, and fixed costs of $12,100. The project will also require net working capital of $2,700 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 12 percent. What is the net present value of this project?arrow_forwardYou are considering a new product launch. The project will cost $900,000, have a 4-year life, and have no salvage value; depreciation is straight-line to zero. Sales are projected at 560 units per year; price per unit will be $19,200, variable cost per unit will be $15,900, and fixed costs will be $950,000 per year. The required return on the project is 12 percent, and the relevant tax rate is 23 percent. a. The unit sales, variable cost, and fixed cost projections given above are probably accurate to within ±10 percent. What are the upper and lower bounds for these projections? What is the base-case NPV? What are the best-case and worst-case scenarios? (A negative amount should be indicated by a minus sign. Do not round intermediate calculations and round your NPV answers to 2 decimal places, e.g., 32.16.) Scenario Unit sales Variable cost per unit Fixed costs Scenario Base-case Best-case Worst-case Upper bound NPV Lower bound unitsarrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $157,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44 45 percent, 14 81 percent, and 7.41 percent, respectively. The project will have annual sales of $98,000, variable costs of $27,400, and fixed costs of $12,000. The project will also require net working capital of $2,600 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 10 percent. What is the net present value of this project? Multiple Choice $3112 $3.395 $16.360 56718 $4.645arrow_forward

- Mountain Frost is considering a new project with an initial cost of $230,000. The equipment will be depreciated on a straight-line basis to a zero book value over the four-year life of the project. The projected net income for each year is $20,500, $21,400, $24,600, and $17,400, respectively. What is the average accounting return?arrow_forwardDelia Landscaping is considering a new 4-year project. The necessary fixed assets will cost $189,000 and be depreciated on a 3-year MACRS and have no salvage value. The MACRS percentages each year are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. The project will have annual sales of $126,000, variable costs of $33,700, and fixed costs of $12,700. The project will also require net working capital of $3,300 that will be returned at the end of the project. The company has a tax rate of 21 percent and the project's required return is 9 percent. What is the net present value of this project? ASAP, PLEASEarrow_forwardYou must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $120,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $24,000. The equipment would require a $12,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $64,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. a. What is the initial investment outlay for the spectrometer after bonus depreciation is considered, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar. $ b. What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1: $ Year 2: $ Year 3: $ c. If the WACC is 11%, should…arrow_forward

- You must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $290,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $48,000. The equipment would require an $8,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $33,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. What is the initial investment outlay for the spectrometer, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar. $ What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1: $ Year 2: $ Year 3: $arrow_forwardYou must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is $190,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $57,000. The equipment would require a $14,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save the firm $24,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%. What is the initial investment outlay for the spectrometer after bonus depreciation is considered, that is, what is the Year 0 project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar.$ What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar.Year 1: $ Year 2: $ Year 3: $ If the WACC is…arrow_forwardThe X Company is considering the acquisition of a new processor that has an estimated installed cost of $57,000. The processor has an expected life of 5 years and will be depreciated over a 5 year ACRS life to a zero salvage value. However, it is expected that the processor can be sold at that time for $6,000. If purchased, the entire $57,000 would be borrowed at an interest rate of 9%. A capital budgeting analysis results in a positive NPV for the project. An alternative to purchase is to lease the asset for an annual lease payment of $13,500. The lease includes maintenance services estimated to cost Company C $3,000 per year if they were not included in the lease payment. Company C's cost of capital is 11% and its marginal tax rate is 34%. Evaluate the purchase and lease options and make a recommendation of which is preferred.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education