Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

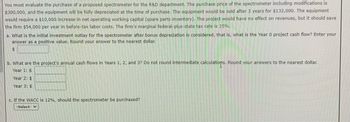

Transcribed Image Text:You must evaluate the purchase of a proposed spectrometer for the R&D department. The purchase price of the spectrometer including modifications is

$300,000, and the equipment will be fully depreciated at the time of purchase. The equipment would be sold after 3 years for $132,000. The equipment

would require a $10,000 increase in net operating working capital (spare parts inventory). The project would have no effect on revenues, but it should save

the firm $54,000 per year in before-tax labor costs. The firm's marginal federal-plus-state tax rate is 25%.

a. What is the initial investment outlay for the spectrometer after bonus depreciation is considered, that is, what is the Year 0 project cash flow? Enter your

answer as a positive value. Round your answer to the nearest dollar.

$

b. What are the project's annual cash flows in Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar.

Year 1: $

Year 2: $

Year 3: $

c. If the WACC is 12%, should the spectrometer be purchased?

-Select- v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- what is the present value of the tax shield for the following project? the initial investment is $300,000. the project will last for 6 years, at which time the asset will be sold for $90,000. the asset will be depreciated on a declining balance basis at a rate of 20 percent. the firm's marginal tax rate is 40 percent. the firm's required rate of return is 8 percent a) 16,204.36 b) 82,539.68 c) 98,744.04 d) 66,335.32arrow_forward| Frontier Corp. is considering a new product that would require an after-tax investment of $1,400,000 at t = 0. If the new product is well received, then the project would produce after-tax cash flows of $650,000 at the end of each of the next 3 years (t = 1, 2, 3), but if the market did not like the product, then the cash flows would be only $100,000 per year. There is a 70% probability that the market will be good. Tsai Corp. could delay the project for a year while it conducted a test to determine if demand would be strong or weak. The project's cost and expected annual cash flows are the same whether the project is delayed or not; however, the timing of the cash flows would change. (There would be the same number of cash flows-only the cash flows would be extended out one extra year.) The project's WACC is 10%. What is the value of the project after considering the investment timing option? a. $108,226.89 b. $137,743.32 c. $167,259.75 d. $196,776.18 e. $216,453.79arrow_forwardNeed help with entire problem.arrow_forward

- Net present value. Quark Industries has a project with the following projected cash flows: Initial cost: $280,000 Cash flow year one: $30,000 Cash flow year two: $80,000 Cash flow year three: $153,000 Cash flow year four: $153,000 a. Using a discount rate of 8% for this project and the NPV model, determine whether the company should accept or reject this project. b. Should the company accept or reject it using a discount rate of 15%? c. Should the company accept or reject it using a discount rate of 18%?arrow_forward3. Schultz Company is considering purchasing a machine that would cost $478,800 and have a useful life of 5 years. The machine would reduce cash operating costs by $114,000 per year. The machine would have a salvage value of $6,200. Schultz Company prefers a payback period of 3.5 years or less.Required: a. Compute the payback period for the machine. What does this mean? b. Compute the return on average investment (ROI)arrow_forwardA firm is considering taking a project that will produce $12 million of revenue per year. Cash expenses will be $5 million, and depreciation expenses will be $1 million per year. If the firm takes that project, then it will reduce the cash revenues of an existing project by $3 million. What is the free cash flow on the project, per year, if the firm uses a 40 percent marginal tax rate? O$2.8 million O $2.4 million 0 $4.6 million $3.4 millionarrow_forward

- Dry-Sand Company is considering investing in a new project. The project will need an initial investment of $3,000,000 and will generate $1,800,000 (after-tax) cash flows for three years. Calculate the MIRR (modified internal rate of return) for the project if the cost of capital is 13%. 18.62% 23.43% 26.91% 28.72%arrow_forwardA project’s initial cost is 13 million. The company expects a net cashflow of 10 million in year one, but the net cashflow is expected to decrease 1 million each year for the next years. If the company’s MARR is 12%, using NPW/NFW analysis is the project profitable in the first 5 years?arrow_forwardA project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27,300 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim 100% bonus depreciation on the investment. Suppose the opportunity cost of capital is 10%. Ignore inflation.a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.)arrow_forward

- Godoarrow_forwardA project with a life of 6 years is expected to provide annual sales of $260,000 and costs of $173,000. The project will require an investment in equipment of $490,000, which will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the best-case scenario?arrow_forwardA long term efficiency project will cost $837 today but will not yield any return for for 3 years (Cashflows at time (1) and (2) = 0). At time (3), the project will yield a positive cashflow of $1,079. What is the efficiency project's internal rate of return?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education