Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

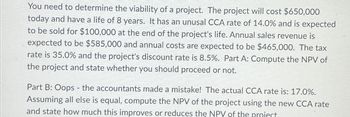

Transcribed Image Text:You need to determine the viability of a project. The project will cost $650,000

today and have a life of 8 years. It has an unusal CCA rate of 14.0% and is expected

to be sold for $100,000 at the end of the project's life. Annual sales revenue is

expected to be $585,000 and annual costs are expected to be $465,000. The tax

rate is 35.0% and the project's discount rate is 8.5%. Part A: Compute the NPV of

the project and state whether you should proceed or not.

Part B: Oops - the accountants made a mistake! The actual CCA rate is: 17.0%.

Assuming all else is equal, compute the NPV of the project using the new CCA rate

and state how much this improves or reduces the NPV of the project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- We are evaluating a project that costs $853,000, has a life of 11 years, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 106,000 units per year. Price per unit is $39, variable cost per unit is $24, and fixed costs are $856,412 per year. The tax rate is 22 percent, and we require a return of 15 percent on this project. Calculate the accounting break-even point. What is the degree of operating leverage at the accounting break-even point? Calculate the base-case cash flow. Calculate the NPV.arrow_forwardWe are evaluating a project that costs $735, 200, has an eight year life, and has no salvage value. Assume that depreciation is straight - line to zero over the life of the project. Sales are projected at 80, 000 units per year. Price per unit is $48, variable cost per unit is $33, and fixed costs are $730, 000 per year. The tax rate is 22 percent, and we require a return of 12 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within \pm 15 percent. Calculate the best - case and worst case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.)arrow_forwardWe are evaluating a project that costs $788,400, has a nine-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 75,000 units per year. Price per unit is $52, variable cost per unit is $36, and fixed costs are $750,000 per year. The tax rate is 21 percent, and we require a return of 12 percent on this project. a-1.Calculate the accounting break-even point. (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a- What is the degree of operating leverage at the accounting break-even point? (Do 2. not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) b- Calculate the base-case cash flow and NPV. (Do not round intermediate 1. calculations. Round your cash flow answer to the nearest whole number, e.g., 32. Round your NPV answer to 2 decimal places, e.g., 32.16.) b- What is the sensitivity of NPV to changes in the…arrow_forward

- We are evaluating a project that costs $1,800,000, has a 6-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 87,300 units per year. Price per unit is $38.19, variable cost per unit is $23.40, and fixed costs are $827,000 per year. The tax rate is 24 percent and we require a return of 9 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16. Best-case NPV Worst-case NPVarrow_forwardBuiltrite is considering purchasing a new machine that would cost $60,000 and the machine would be depreciated (straight line) down to $0 over its five year life. At the end of five years it is believed that the machine could be sold for $15,000. The machine would increase EBDT by $42,000 annually. Builtrite’s marginal tax rate is 34%. What is the TCF associated with the purchase of this machine? $5,100 $7,500 $0 $9,900arrow_forwardA 7-year project is expected to provide annual sales of $201,000 with costs of $95,000. The equipment necessary for the project will cost $335,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-10 percent. The tax rate is 40 percent. What is the annual operating cash flow for the worst-case scenario? Multiple Choice $45,840 $100,503 $49,703 $64,983 $73,383arrow_forward

- We are evaluating a project that costs $604,000, has an 8-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 55,000 units per year. Price per unit is $36, variable cost per unit is $17, and fixed costs are $685,000 per year. The tax rate is 21 percent and we require a return of 15 percent on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardA 5-year project is expected to provide annual sales of $237,000 with costs of $99,500. The equipment necessary for the project will cost $380,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the worst-case scenario? Multiple Choice $143,185 $52,215 $105,590 $65,210 $84,710arrow_forwardWe are evaluating a project that costs $800,000, has an eight-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 60,000 units per year. Price per unit is $40, variable cost per unit is $21, and fixed costs are $800,000 per year. The tax rate is 21 percent, and we require a return of 10 percent on this project. c. What is the sensitivity of OCF to changes in the variable cost figure?.arrow_forward

- We are evaluating a project that costs $1,100,000, has a ten-year life, and has no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 42,000 units per year. Price per unit is $50, variable cost per unit is $25, and fixed costs are $820,000 per year. The tax rate is 35 percent, and we require a 10 percent return on this project. Suppose the projections given for price, quantity, variable costs, and fixed costs are all accurate to within ±10 percent. Calculate the best-case and worst-case NPV figures. (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and round your final answers to 2 decimal places. (e.g., 32.16)) Best-case Worst-case NPV $ LA LAarrow_forwardA 7-year project is expected to provide annual sales of $221,000 with costs of $97,500. The equipment necessary for the project will cost $360,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 35 percent. What is the annual operating cash flow for the worst-case scenario?arrow_forwardYour boss asked you to evaluate a project with an infinite life. Sales and costs project to $1,000 and $500 per year, respectively. (Assume sales and costs occur at the end of the year [i.e., profit of $500 at the end of year one]). There is no depreciation and the tax rate is 21 percent. The real required rate of return is 10 percent. The inflation rate is 4 percent and is expected to be 4 percent forever. Sales and costs will increase at the rate of inflation. If the project costs $3,000, what is the NPV? Multiple Choice $950.00 $1,629.62 $365.38 $472.22arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education