Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

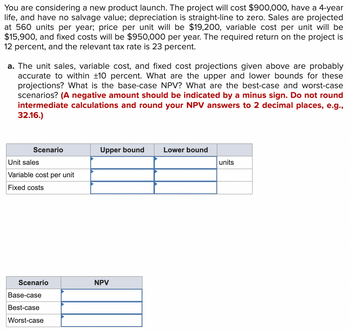

Transcribed Image Text:You are considering a new product launch. The project will cost $900,000, have a 4-year

life, and have no salvage value; depreciation is straight-line to zero. Sales are projected

at 560 units per year; price per unit will be $19,200, variable cost per unit will be

$15,900, and fixed costs will be $950,000 per year. The required return on the project is

12 percent, and the relevant tax rate is 23 percent.

a. The unit sales, variable cost, and fixed cost projections given above are probably

accurate to within ±10 percent. What are the upper and lower bounds for these

projections? What is the base-case NPV? What are the best-case and worst-case

scenarios? (A negative amount should be indicated by a minus sign. Do not round

intermediate calculations and round your NPV answers to 2 decimal places, e.g.,

32.16.)

Scenario

Unit sales

Variable cost per unit

Fixed costs

Scenario

Base-case

Best-case

Worst-case

Upper bound

NPV

Lower bound

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Given that the total cost, C, is related to sales volume, x, by the equation y=1000+0.2x, say true or false for the following and proof it. (a) The cost-sales line rises $2 for each increase of $10 in sales volume. (b) The slope of the line is interpreted as variable costarrow_forwardGiven the mixed cost function y = $6.50x + $3,000. What does the $6.50 represent? a.Total cost per unit of the cost driver b.The fixed cost per unit c.The slope of the cost function d.Total fixed costsarrow_forwardWithin the relevant range: Select one: O A. variable cost per unit decreases as production decreases. O B. fixed cost per unit increases as production decreases. O C. fixed cost per unit decreases as production decreases. O D. variable cost per unit increases as production decreases.arrow_forward

- As volume increases, which of the following statements is NOT correct? Variable cost per unit will remain the same. Total variable costs will increase. Total fixed cost will remain the same. Average cost per unit will increase. Oarrow_forwardWhich of the following statements is true? I. Incremental analysis is an analytical approach that focuses only on those revenues and costs that will not change as a result of a decision. II. When expressed on a per unit basis, fixed costs can mislead decision makers into thinking of them as variable costs. II. To estimate what the profit will be at various levels of sales volume, multiply the number of units to be sold above or below the break-even point by the unit contribution margin. Statements I and III are true. Statements II and III are true. All of the statements are true. None of the statements are true.arrow_forwardWhich of the following statements is FALSE? O a. The mark up is a percentage applied to base cost. O b. A major advantage of mark up pricing is that standard mark ups are easy to apply. Oc. The mark up can be calculated using a variety of bases. O d. The mark up is an absolute rule.arrow_forward

- 1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? b. What is the total variable expense? c. How many units were sold? d. What is the per-unit variable expense? e. What is the per-unit contribution margin? 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? b. What is the breakeven point in sales dollars? 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $48,000? b. What is the current margin of safety in units? c. What is the margin of safety in sales dollars? d. What is the margin of safety in percentage?arrow_forwardYour answer is incorrect. Divide the estimated average annual income by the average investment. Investment cost plus residual value, divided by two, equals average investment. Can you please redo it? Thanksarrow_forwardNow suppose that annual unit sales, variable cost, and unit price are equal to their respective expected values—that is, there is no uncertainty. Determine the company's annual profit for this scenario. Round answer to a whole number, if needed.$arrow_forward

- using the price p=20 - .05x, use the Revenue function to find the marginal Revenue function R'(x), Find a. R'(100)= b. R'(175)= c. R'(250)= The marginal Revenue R'(x) approximates how the revenue will change on the sale of the next item. a. Given R(100) = 642 and R'(100)= 18 then R(101) ≈ b. Given R(400) = 16,250 and R'(400)= -10 then R(401) ≈ c. Given R(1000) = 3500 and R'(1000) = 3 then R(1001) ≈arrow_forwardAssume X = $100 and So = $95. With T on the X-axis and $ on the Y-axis, plot the time value (price minus intrinsic value) implied for each of the following long call prices. Pa(So,T1,X) = $6.00; Pa(So,T2,X) = $7.00; Pa(So,T3,X) = $8.20; Pa(So,T4,X) = $12.50arrow_forward#3 ARR is incorrect. Please answer again - Calculate the payback period for above - Calculate the NPV for abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education