Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

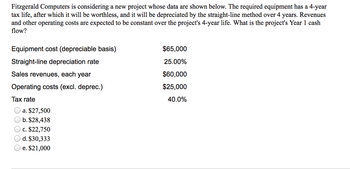

Transcribed Image Text:Fitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 4-year

tax life, after which it will be worthless, and it will be depreciated by the straight-line method over 4 years. Revenues

and other operating costs are expected to be constant over the project's 4-year life. What is the project's Year 1 cash

flow?

Equipment cost (depreciable basis)

Straight-line depreciation rate

Sales revenues, each year

Operating costs (excl. deprec.)

Tax rate

a. $27,500

b. $28,438

c. $22,750

d. $30,333

e. $21,000

$65,000

25.00%

$60,000

$25,000

40.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- METL is evaluating a project projected to have a 7-year life. The initial investment of $4.2 million will be depreciated to zero using straight-line over the project life. The project is expected to create incremental sales of $2.4 million per year and incremental expenses of $1.4 million per year. What is the incremental after-tax operating cash flow (OCF) associated with this project if METL's tax rate is 32%? Enter answer in dollars, rounded to the nearest dollar.arrow_forwardPat Inc, is considering a project that would have a ten-year life and would require a $1,000,000 investment in equipment. At the end of ten years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.): Sales $2,000,000 variable expenses $1,400,000 contribution margin $600,000 fixed expenses: fixed out-of-pocket cash expenses $300,000 depreciation $100,000 $400,000 net operating income $200,000 All of the above items, except for depreciation, represent cash flows. The company's required rate of return is…arrow_forwardA project with a life of 6 years is expected to provide annual sales of $380,000 and costs of $269,000. The project will require an investment in equipment of $670,000, which will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/−15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the best-case scenarioarrow_forward

- In your first job with TBL Inc. your task is to consider a new project whose data are shown below. What is the project's Year 1 cash flow? The annual operating cash flows of the project can be calculated as follows: OCF = {[Sales - Operating Costs]*(1-Tax Rate)} + (Depreciation * Tax Rate) Sales revenues $225,250 Depreciation $72,602 Other operating costs $92,000 Tax rate 28%arrow_forwardFitzgerald Computers is considering a new project whose data are shown below. The required equipment has a 3-year tax life, after which it will have zero book value, and it will be depreciated by the straight-line method over 3 years. Revenues and other operating costs are expected to be constant over the project's 4-year life. What is the project's Year 4 cash flow? $65,000 Equipment cost (depreciable basis) Straight-line depreciation rate Sales revenues, each year Operating costs (excl. deprec.) Tax rate a. $27,500 b. $28,438 c. $22,750 d. $21,000 e. $30,333 33.33% $60,000 $25,000 35.0%arrow_forwardThomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, additional net operating working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Net investment in fixed assets (depreciable basis) $70,000 Required net operating working capital $10,000 Straight-line depreciation rate 33.333% Annual sales revenues $70,000 Annual operating costs (excl. depreciation) $30,000 Expected pre-tax salvage value $5,000 Tax rate 35.0% a. 0$14,773…arrow_forward

- A company is considering purchasing a new piece of equipment that costs $100,000 and has an estimated useful life of 5 years. The equipment should increase annual cash receipts by $80,000 per year. Cash expenses to operate the equipment should be $25,000. The company uses straight-line depreciation. If the after-tax cost of capital is 10% and the tax rate is (Round your 30%, the net present value of this project based on the tables in the appendix is $ answer to the nearest whole number.) Need help? Review these concept resources. Read About the Conceptarrow_forwardBunnings Ltd is considering to invest in one of the two following projects to buy a new equipment. Each equipment will last 5 years and have no salvage value at the end. The company’s required rate of return for all investment projects is 8%. The cash flows of the projects are provided below. Equipment 1 Equipment 2 Cost $186000 $195000 Future Cash Flow Year 1 86000 97000 Year 2 93000 84000 Year 3 83000 86000 Year 4 75000 75000 Year 5 55000 63000 Required:a) Identify which option of equipment should the company accept based on Profitability Index? b) Identify which option of equipment should the company accept based on discounted pay back method if the payback criterion is maximum 2 years?arrow_forwardThomson Media is considering some new equipment whose data are shown below. The equipment has a 3-year tax life and would be fully depreciated by the straight-line method over 3 years, but it would have a positive pre-tax salvage value at the end of Year 3, when the project would be closed down. Also, additional net operating working capital would be required, but it would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number. WACC 10.0% Net investment in fixed assets (depreciable basis) $70,000 Required net operating working capital $10,000 Straight-line depreciation rate 33.333% Annual sales revenues $85,000 Annual operating costs (excl. depreciation) $30,000 Expected pre-tax salvage value $5,000 Tax rate 35.0% Group of answer choices…arrow_forward

- XYZ Corporation is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project (Ignore income taxes.): Sales $ 500,000 Less cash variable expenses 200,000 Less cash fixed expenses 150,000 Less depreciation expenses 45,000 Net operating income $ 105,000 The company's required rate of return is 12%. Compute the payback period for this project Enter your answerarrow_forwardA project requires an initial investment in equipment and machinery of $10 million. The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis. The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation) amounting to 1/3 of revenues. The tax rate is 40%. What is the net cash flow in year 1? Group of answer choices 3.40M 2.84M 0.84M 2.04Marrow_forwardA 3-year project requires the purchase of a machine (fixed asset) for $6,000 in Year 0. In Year 2, the project is expected to have net income of $2,000 and the depreciation rate is 45%. The tax rate is 35%. There is no interest expense. What is the Operating Cash Flow in Year 2? Enter your answer without the dollar sign and round your final answer to the nearest whole number (nearest dollar).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education