Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

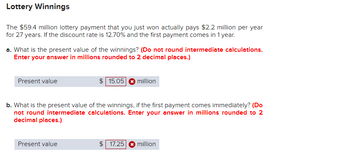

Lottery Winnings The $59.4 million lottery payment that you just won actually pays $2.2 million per year for 27 years. If the discount rate is 12.70% and the first payment comes in 1 year. a. What is the present value of the winnings? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.) Present value $15.05 million b. What is the present value of the winnings, if the first payment comes immediately? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)The $59.4 million lottery payment that you just won actually pays $2.2 million per year for 27 years. If the discount rate is 12.70% and the first payment comes in 1 year. a. What is the present value of the winnings? (Do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)

Transcribed Image Text:Lottery Winnings

The $59.4 million lottery payment that you just won actually pays $2.2 million per year

for 27 years. If the discount rate is 12.70% and the first payment comes in 1 year.

a. What is the present value of the winnings? (Do not round intermediate calculations.

Enter your answer in millions rounded to 2 decimal places.)

Present value

$15.05

million

b. What is the present value of the winnings, if the first payment comes immediately? (Do

not round intermediate calculations. Enter your answer in millions rounded to 2

decimal places.)

Present value

$ 17.25

million

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- mani.2arrow_forwardWhat is the present value of a cash flow stream of $1,000 per year annually for 18 years that then grows at 5.0 percent per year forever when the discount rate is 11 percent? Note: Round intermediate calculations and final answer to 2 decimal places. X Answer is complete but not entirely correct. Present value $ 16,666.67arrow_forwardPresent Value of Amounts Due Assume that you are going to receive $380,000 in 10 years. The current market rate of interest is 11%. a. Using the present value of $1 table in Exhibit 5, determine the present value of this amount compounded annually. Round to the nearest whole dollar. $ b. Why is the present value less than the $380,000 to be received in the future? The present value is less due to over the 10 years.arrow_forward

- Required: Solve for the unknown number of years in each of the following: (Round your answers to 2 decimal places.) Present Years Discount Rate Future Value Value $ 5,600 9 % $ 12,840 8,100 10 % 43,410 184,000 17 % 3,645,180 215,000 15 % 1,734,390arrow_forwardShow work please. Thank youarrow_forwardPresent Value of Amounts Due Assume that you are going to receive $730,000 in 10 years. The current market rate of interest is 4.5%. a. Using the present value of $1 table in Exhibit 5, determine the present value of this amount compounded annually. Round to the nearest whole dollar. b. Why is the present value less than the $730,000 to be received in the future? The present value is less due to the compounding of interest V over the 10 years.arrow_forward

- 1. You just won the PA lottery! The lottery offers you a choice: you may choose a lump sum today, or $89 million in 26 equal annual installments at the end of each year. Assume the funds can be invested (yield) at an annual rate of 7.65%. What is the lump sum that would equal the present value of the annual installments? : $89,000,000 $38,163,612 $41,083,128 $13,092,576arrow_forward4. If you receive $116 each month for 28 years and the discount rate is 0.08, what is the present value? (show the process and can use financial calculator)arrow_forwardPresent Value of Amounts Due Assume that you are going to receive $210,000 in 10 years. The current market rate of interest is 11%. a. Using the present value of $1 table in Exhibit 5, determine the present value of this amount compounded annually. Round to the nearest whole dollar. $fill in the blank 1 1,378, 329 b. Why is the present value less than the $210,000 to be received in the future? The present value is less due to the compounding of interest over the 10 years.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education