FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

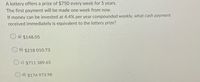

Transcribed Image Text:A lottery offers a prize of $750 every week for 5 years.

The first payment will be made one week from now.

If money can be invested at 4.4% per year compounded weekly, what cash payment

received immediately is equivalent to the lottery prize?

a) $148.05

b) $218 010.73

c) $711 389.65

d) $174 973.98

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume you win a lottery, and you are offered the following stream of payments by the lottery commission: $25,000 today, $32,000 one year from now, another $32,000 two years from now, and a final payment of $55,000 three years from now. You accept the offer. If you invest all of these proceeds at 6% compounded annually and extract nothing from the investment, how much will you have at the end of the fourth year? Excel Formula Pleasearrow_forwardYou have just won a two-part lottery! The first part will pay you $50,000 at the end of each of the next 20 years. The second part will pay you $1,000 at the end of each month over the same 20 year period. Assuming a discount rate of 9%, what is the present value of your winnings? use a HP 10bII+ to solve itarrow_forwardSuppose you borrow $14,000. The interest rate is 11%, and it requires 4 equal end-of-year payments. Set up an amortization schedule that shows the annual payments, interest payments, principal repayments, and beginning and ending loan balances. Round your answers to the nearest cent. If your answer is zero, enter "0". Beginning Repayment Ending Year Balance Payment Interest of Principal Balance 1 $ fill in the blank 60 $ fill in the blank 61 $ fill in the blank 62 $ fill in the blank 63 $ fill in the blank 64 2 $ fill in the blank 65 $ fill in the blank 66 $ fill in the blank 67 $ fill in the blank 68 $ fill in the blank 69 3 $ fill in the blank 70 $ fill in the blank 71 $ fill in the blank 72 $ fill in the blank 73 $ fill in the blank 74 4 $ fill in the blank 75 $ fill in the blank 76 $ fill in the blank 77 $ fill in the blank 78 $ fill in the blank 79arrow_forward

- You want to buy a new sports car for $85,403. The contract is in the form of a 63-month annuity due at a 5.61 percent APR. What will your monthly payment (in $) be? Answer to two decimals..arrow_forwardSuppose a state lottery prize of $3 million is to be paid in 5 payments of $600,000 each at the end of each of the next 5 years. If money is worth 12%, compounded annually, what is the present value of the prize? (Round your answer to the nearest cent.)arrow_forwardShow work please. Thank youarrow_forward

- 1. You just won the PA lottery! The lottery offers you a choice: you may choose a lump sum today, or $89 million in 26 equal annual installments at the end of each year. Assume the funds can be invested (yield) at an annual rate of 7.65%. What is the lump sum that would equal the present value of the annual installments? : $89,000,000 $38,163,612 $41,083,128 $13,092,576arrow_forwardAn insurance policy provides a benefit of $12,000 nine years from now. Alternatively, the policy pays $820.94 at the beginning of each year for nine years. What is the effective annual rate of interest paid? The effective annual rate of interest is %. (Round to two decimal places as needed.)arrow_forward1. The current value of a lottery ticket paying $4,000 per year for 10 years, with the first payment being currently due, and assuming a 5% annual interest rate. 2. The amount that a $2550 deposit into an investment account will grow to in 5 years, at 8% interest, compounded quarterly. 3. The current measurement of a $125,000 obligation that is due 3 years, assuming a 10% annual interest rate.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education