FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

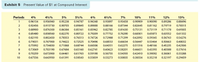

Transcribed Image Text:Exhibit 5 Present Value of $1 at Compound Interest

Periods

4%

4%%

5%

5%%

6%

62%

7%

10%

11%

12%

13%

1

0.96154

0.956940

0.95238

0.94787

0.94340

0.93897

0.93458

0.90909

0.90090

0.89286

0.88496

2

0.92456

0.915730

0.90703

0.89845

0.89000

0.88166

0.87344

0.82645

0.81162

0.79719

0.78315

3

0.88900

0.876300

0.86384

0.85161

0.83962

0.82785

0.81630

0.75131

0.73119

0.71178

0.69305

4

0.85480

0.838560

0.82270

0.80722

0.79209

0.77732

0.76290

0.68301

0.65873

0.63552

0.61332

0.82193

0.802450

0.78353

0.76513

0.74726

0.72988

0.71299

0.62092

0.59345

0.56743

0.54276

0.79031

0.767900

0.74622

0.72525

0.70496

0.68533

0.66634

0.56447

0.53464

0.50663

0.48032

7

0.75992

0.734830

0.71068

0.68744

0.66506

0.64351

0.62275

0.51316

0.48166

0.45235

0.42506

8.

0.73069

0.703190

0.67684

0.65160

0.62741

0.60423

0.58201

0.46651

0.43393

0.40388

0.37616

9.

0.70259

0.672900

0.64461

0.61763

0.59190

0.56735

0.54393

0.42410

0.39092

0.36061

0.33288

10

0.67556

0.643930

0.61391

0.58543

0.55839

0.53273

0.50835

0.38554

0.35218

0.32197

0.29459

Transcribed Image Text:Present Value of Amounts Due

Assume that you are going to receive $730,000 in 10 years. The current market rate of interest is 4.5%.

a. Using the present value of $1 table in Exhibit 5, determine the present value of this amount compounded annually. Round to the nearest whole dollar.

b. Why is the present value less than the $730,000 to be received in the future?

The present value is less due to the compounding of interest

V over the 10 years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardSuppose you wish to have $17,250 in 5 years. Use the present value formula to find how much you should invest now at 5% interest, compounded semiannually in order to have $17,250, 5 years from now. Then calculate the amount of interest. O $3,774.33 $4,312.50 $12,937.50 $13,475.67arrow_forwardPresent Value of Amounts Due Assume that you are going to receive $380,000 in 10 years. The current market rate of interest is 11%. a. Using the present value of $1 table in Exhibit 5, determine the present value of this amount compounded annually. Round to the nearest whole dollar. $ b. Why is the present value less than the $380,000 to be received in the future? The present value is less due to over the 10 years.arrow_forward

- What is the Discounted Present Value (DPV) if you expect to receive $8,000 in year 1, $9,000 in year 2 and $7,000 in year 3, when the interest rate is 8% in each year? Round your answer to one (1) decimal, do not write the dollar sign. Use the minus sign where appropriate.arrow_forward4. If you deposit $1000 in one year, $2000 in two years, and $3000 in three years, how much will you have in three years? Assume a 7 percent annum interest rate. NPV FVarrow_forwardPresent Value of Amounts Due Tommy John is going to receive $520,000 in three years. The current market rate of interest is 13%. a. Using the present value of $1 table in Exhibit 8, determine the present value of this amount compounded annually. Round to the nearest whole dollar.$fill in the blank 1 b. Why is the present value less than the $520,000 to be received in the future?The present value is less due to over the 3 years.arrow_forward

- nt Use the compound interest formulas A = P and A = Pert to solve the problem given. Round answers to the nearest cent. Find the accumulated value of an investment of $20,000 for 7 years at an interest rate of 4.5% if the money is a. compounded semiannually; b. compounded quarterly; c. compounded monthly; d. compounded continuously. a. What is the accumulated value if the money is compounded semiannually? (Round your answer to the nearest cent. Do not include the $ symbol in your answer.) b.What is the accumulated value if the money is compounded quarterly? (Round your answer to the nearest cent. Do not include the $ symbol in your answer.) c. What is the accumulated value if the money is compounded monthly? (Round your answer to the nearest cent. Do not include the $ symbol in your answer.) d. What is the accumulated value if the money is compounded continuously? (Round your answer to the nearest cent. Do not include the $ symbol in your answer.)arrow_forwardD. At a certain interest rate the present values of the following two payment patterns are equal: (i) P 200,000 at the end of 5 years plus P 500,000 at the end of 10 years; (ii) P 400,940 at the end of 5 years. At the same interest rate P100,000 invested now plus P 120,000 invested at the end of 5 years will accumulate to X at the end of 10 years. Calculate X.arrow_forward3. Use the formula for computing future value using compound interest to determine the value of an account at the end of 10 years if a principal amount of $17,000 is deposited in an account at an annual interest rate of 4% and the interest is compounded quarterly. The amount after 10 years will be $_____ (Round to the nearest cent as needed.)arrow_forward

- Present Value of Amounts Due Assume that you are going to receive $210,000 in 10 years. The current market rate of interest is 11%. a. Using the present value of $1 table in Exhibit 5, determine the present value of this amount compounded annually. Round to the nearest whole dollar. $fill in the blank 1 1,378, 329 b. Why is the present value less than the $210,000 to be received in the future? The present value is less due to the compounding of interest over the 10 years.arrow_forward(Present-value comparison) You are offered $1,300 today, $6,000 in 10 years, or $26.000 in 23 years. Assuming that you can earn 9 percent on your money, which offer should you choose? a. What is the present value of $26,000 in 23 years discounted at 9 percent interest rate? (Round to the nearest cent) b. What is the present value of $6,000 in 10 years discounted at 9 percent interest rate? $(Round to the nearest cent) c. Which offer should you choose? (Select the best choice below) OA. Choose $6,000 in 10 years because its present value is the highest OB. Choose $1,300 today because its present value is the highest OC. Choose $26.000 in 23 years because its present value is the highest Comarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education