Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

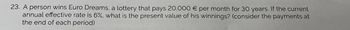

Transcribed Image Text:23. A person wins Euro Dreams, a lottery that pays 20.000 € per month for 30 years. If the current

annual effective rate is 6%, what is the present value of his winnings? (consider the payments at

the end of each period)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The present value of an annuity is payable for 4 years, with the first payment at the end of 10 years is P 21,264. If money is worth 4.69%, what is the value of annuity? Solve correctly without using Excel .arrow_forwardIf you put up $51,000 today in exchange for a 6.25 percent, 15-year annuity, what will the annual cash flow be? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardYou are paid £1,000 annually for 10 years, with the first payment due in one year and the last payment due in 10 years. What is the present value of all these payments using an interest rate of 4%?arrow_forward

- You just won the lottery! As your prize, you will receive $2,200 a month for 90 months. If you can earn 7 percent on your money, what is this prize worth to you today? $arrow_forward3. You won the lottery! You are considering whether or not to accept a lump sum amount or an annual annuity of $ 79,944 to be received at the end of every year for twelve years. Use 6% as the annual discount rate. How much is the stream of payments worth now? Round your answer to the nearest whole number.arrow_forwardYou buy an ordinary annuity today for $120,583, which promises to pay you $11,256 per year. If the interest rate is 4.29 percent, for how many years will you receive payments? Answer to 4 decimals.arrow_forward

- You will deposit $112 from each of your bi-weekly paychecks. You think that you can earn an interest rate of 8.35%. How much will you have in 42 years? show work step by step and fomular. Answer:arrow_forward4. You wish to accumulate RM100,000 at the end of 20 years. To do this, you need to deposit an equal amount into the bank at the end of each year. If you can earn 5% compounded annually, how much do you need to deposit each year?arrow_forwardYou invest in a project that is expected to pay you $960 every year forever. If the first payment to you occurs 3 years from today and the discount rate is 3.8%, then what is its value today (Round to the nearest dollar).arrow_forward

- You have just won 50 million in the lottery, payable in equal yearly installments over the next 20 years (first payment to be made immediately). Instead of taking the annual payments, you also have the option of receiving a lump sum amount immediately. If the interest rate is 6% per year, what is the minimum lump sum amount you would except in place for the payments? What if the interest rate is 10% per year? Please show the formula and answer.arrow_forwardA $1,000,000 lottery prize pays $50,000 per year for the next 20 years. If the current rate of return is 2.75%, what is the present value of this prize? (Assume the lottery pays out as an ordinary annuity. Round your answer to the nearest cent.)arrow_forwardD3) You borrow $22947 to buy a car. You will have to repay this loan by making equal monthly payments for 15 years. The bank quoted an APR of 9%. How much is your monthly payment (in $ dollars)? $________.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education