Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

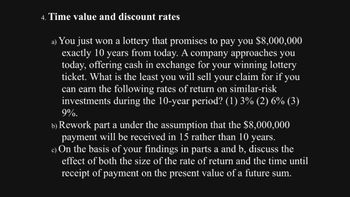

Transcribed Image Text:4. Time value and discount rates

a) You just won a lottery that promises to pay you $8,000,000

exactly 10 years from today. A company approaches you

today, offering cash in exchange for your winning lottery

ticket. What is the least you will sell your claim for if you

can earn the following rates of return on similar-risk

investments during the 10-year period? (1) 3% (2) 6% (3)

9%.

b) Rework part a under the assumption that the $8,000,000

payment will be received in 15 rather than 10 years.

c) On the basis of your findings in parts a and b, discuss the

effect of both the size of the rate of return and the time until

receipt of payment on the present value of a future sum.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (3) Today you have paid $275 for an investment that pays $100 in one year, $500 in two years,and $X in 4 years. Assuming the market interest rate is 100% and the net present value of theinvestment is zero, what must be true about X?(a) X is greater than $2,500(b) X is greater than or equal to $2,000 but less than $2,500(c) X is greater than or equal to $1,500 but less than $2,000(d) X is greater than $1,200 but less than $1,500(e) X is less than or equal to $1,200arrow_forward.You are negotiating to make a 7-year loan of $25,000 to Breck Inc. To repay you, Breck will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. Breck is essentially riskless, so you are confident the payments will be made. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X?arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- You have been depositing money into an account yearly based on the following investment amounts, rates and times, what is the value of that investment account at the end of that period? (Click here to see present value and future value tables) Amounts ofInvestment Rate Times Value at the Endof the Period $9,000 20% 16 years $fill in the blank 1 $13,000 15% 11 years $fill in the blank 2 $16,000 12% 6 years $fill in the blank 3 $35,000 10% 4 years $fill in the blank 4arrow_forwardou have discovered an investment opportunity that earns a 3% rate of interest compounded semiannually. What amount should you deposit today to have $7000 in three years? (Use spreadsheet software or a financial calculator to calculate your answer. Do not round any intermediary calculations, and round your final answer to the nearest dollar.) $6400 $6370 $6406 $6402arrow_forward(Related to Checkpoint 5.6) (Solving for) You are considering investing in a security that will pay you $4,000 in 31 years. a. If the appropriate discount rate is 10 percent, what is the present value of this investment? b. Assume these investments sell for $2,062 in return for which you receive $4,000 in 31 years. What is the rate of return investors earn on this investment if they buy it for $2,062? C a. If the appropriate discount rate is 10 percent, the present value of this investment is $. (Round to the nearest cent.)arrow_forward

- Help me pleasearrow_forwardYou just won a lottery that promises to pay you $1 million exactly 10 years from today. Because the $1 million payment is guaranteed by the state in which you live, opportunities exist to sell the claim today for an immediate lump-sum cash payment. What is the least you will sell your claim for if you could earn 5.05 % on similar-risk investments during the 10-year period?arrow_forwardHow You deposit $1,900 into an account that. pays 7⁰% per year. Your plan is to withdraw this amount at the end of 5 years to use for a down payment on a new car. much will you be able to withdraw at the end of 5 years? Do not round intermediate calculations. Rand your answer to the nearest cent. 12 Today you invest a lump sum amount in an equity find that provides on 12% annual return. You would like to have $11,500 in 6 years to help with a down payment for a home How much do you need to deposit today to reach your $11, 500 goal? Do not round intermediate calculations. Round to the nearest cent your answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education