Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

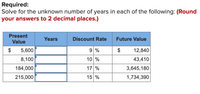

Transcribed Image Text:Required:

Solve for the unknown number of years in each of the following: (Round

your answers to 2 decimal places.)

Present

Years

Discount Rate

Future Value

Value

$

5,600

9 %

$

12,840

8,100

10 %

43,410

184,000

17 %

3,645,180

215,000

15 %

1,734,390

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Complete the following using compound future value. (Use the Table provided.) Note: Do not round intermediate calculations. Round your final answers to the nearest cent. Time: 3 years Principal: $17,100 Rate: 6% Compounded: Quarterly Amount: Interest: Period 0.5% 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 6.0% 6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5% 10.0% 1 1.0050 1.0100 1.0150 1.0200 1.0250 1.0300 1.0350 1.0400 1.0450 1.0500 1.0550 1.0600 1.0650 1.0700 1.0750 1.0800 1.0850 1.0900 1.0950 1.1000 2 1.0100 1.0201 1.0302 1.0404 1.0506 1.0609 1.0712 1.0816 1.0920 1.1025 1.1130 1.1236 1.1342 1.1449 1.1556 1.1664 1.1772 1.1881 1.1990 1.2100 3 1.0151 1.0303 1.0457 1.0612 1.0769 1.0927 1.1087 1.1249 1.1412 1.1576 1.1742 1.1910 1.2079 1.2250 1.2423 1.25.97 1.2773 1.2950 1.3129 1.3310 4 1.0202 1.0406 1.0614 1.0824 1.1038 1.1255 1.1475 1.1699 1.1925 1.2155 1.2388 1.2625 1.2865 1.3108 1.3355 1.3605 1.3859 1.4116 1.4377 1.4641 5 1.0253 1.0510 1.0773 1.1041 1.1314 1.1593 1.1877…arrow_forwardWhat is the present value of a perpetual stream of cash flows that pays $ 7,500 at the end of year one and the annual cash flows grow at a rate of 2% per year indefinitely, if the appropriate discount rate is 9%? What if the appropriate discount rate is 7%? Question content area bottom Part 1 a. If the appropriate discount rate is 9%, the present value of the growing perpetuity is $ enter your response here . (Round to the nearest cent.)arrow_forwardQuestion What is the value, 6 years in the future, of $3,707 invested to earn an annual return of 4.4% ? Enter your answer rounded to the nearest second decimal place. For example, enter $123.456 as $123.46. Flag question: Question 7 Question Imagine that you would like to withdraw $2,511 at the beginning of each year starting today and lasting for the next 8 years. Assuming the funds in the account are invested to generated an annual return of 6.4%, how much would you need to have in the account to fund this stream of payments? Enter your answer rounded to the nearest second decimal place. For example, enter $1,234.567 as 1234.57.arrow_forward

- You are going to receive $220,000 in 50 years. What is the difference in present value between using a discount rate of 16 percent versus 4 percent? Use Appendix B as an approximate answer, but calculate your final answer using the formula and financial calculator methods. (Input your answer as a positive value. Do not round intermediate calculations. Round your final answer to 2 decimal places.) Difference in present valuearrow_forwardDevarrow_forwardSuppose you inherit $100,000 at age 25 and immediately invested in a growth fund who’s annual rate of return average is 13%. Five years later, you transfer all proceeds from the scrubs fun into a long-term IRA that pays an average annual rate of 8%. Immediately you start making additional contributions of $7000 per year to the same IRA. Assuming continuous interest, steady interest rates, and a perfect record of making annualcontributions, how much is this IRA worth when you reach the age of 65? The formula that will need to be used is A = P e^r*t + D/r (e^r*t - 1). Hint: use the continuous interest formula to find the accumulated amount for the first five years, which is then the annual investment, P, into the IRA. arrow_forward

- What's the future value of $20,000 after 8 years if the appropriate interest rate is 5.75%, compounded annually?Round your answer to two decimal places. For example, if your answer is $345.667 enter as 345.67 and if your answer is .05718 or 5.718% enter as 5.72 in the answer box provided. Group of answer choicesarrow_forwardFind the missing values assuming continuously compounded interest. (Round your answers to two decimal places.) InitialInvestment Annual% Rate Time toDouble Amount After10 Years $ % 15 yr $1600arrow_forwardWhat is the present value of $3,000 to be received 2 years from now, if the discount rate is: (a) 6%, (b) 10%, and (c) 13% ? 1. Use the appropriate table (Appendix C: Table 1) to answer the above questions. 2. Use the formula shown at the bottom of Appendix C. Table 1, to answer the above questions. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Use the formula shown at the bottom of Appendix C, Table 1, to answer the above questions, (Round "PV Factor" to 5 decimal places and "PV values" to 2 decimal places.) Future after-tax cash Bow Cash flow received at the end of year (a) (b) [(0) Answer is complete but not entirely correct. Rate 6% 10% 13% PV Factor 0.89000 $ 0.82645 $ 0.78315 S PV < Required 1 7,553 18,406 2,669.99 2,479.34 2,349 44 **arrow_forward

- using computation solution (not excel)arrow_forwardFind the following values using the equations and then a financial calculator. Compounding/discounting occurs annually. Do not round intermediate calculations. Round your answers to the nearest cent. a. An initial $800 compounded for 1 year at 9%. $ b. An initial $800 compounded for 2 years at 9%. $ c. The present value of $800 due in 1 year at a discount rate of 9%. $ d. The present value of $800 due in 2 years at a discount rate of 9%. $arrow_forwardInvestment X offers to pay you $5,800 per year for eight years, whereas Investment Y offers to pay you $7,900 per year for five years. Use Appendix D. (Round "PV Factor" to 3 decimal places. Round the final answers to 2 decimal places.) Calculate the present value for Investment X and Y If the discount rate is 5%. Investment X Investment Y Present value Investment X Investment Y 14 Calculate the present value for Investment X and Y If the discount rate is 15%. Present value M PAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education