Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

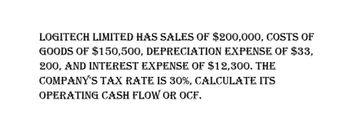

Transcribed Image Text:LOGITECH LIMITED HAS SALES OF $200,000, COSTS OF

GOODS OF $150,500, DEPRECIATION EXPENSE OF $33,

200, AND INTEREST EXPENSE OF $12,300. THE

COMPANY'S TAX RATE IS 30%, CALCULATE ITS

OPERATING CASH FLOW OR OCF.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Foraker Inc. has sales of $46,200, costs of $23,100, depreciation expense of $2200, and interest expense of $1700. If tax rate is 22%, the operating cash flow (OCF) is:arrow_forwardNeed answer pleasearrow_forwardBenson, Inc., has sales of $44830, costs of $14,370, depreciatior and interest expense of $2,390. The tax rate if 23 percent. What is the operating cash flow, or OCF?arrow_forward

- Sheaves, Inc.., has sales of $55,500, costs of $25.200, depreciation expense of $2,800, and interest expense of $2,550. If the tax rate is 24 percent, what is the operating cash flow, or OCF? (Do not round intermediate calculetions.) Operating cash fowarrow_forwardHailey, Inc., has sales of $24200, costs of $8800, depreciation expense of $2600, and interest expense of $1800. Assume the tax rate is 36 percent. What is the operating cash flow, or OCF? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)arrow_forwardDaniel's Market has sales of $36,000, costs of $28,000, depreciation expense of $3,000, and interest expense of $1,500. If the tax rate is 30 percent, what is the operating cash flow, OCF?arrow_forward

- Bronze, Inc has sales of $58,200, costs of $25,300, depreciation expense of $3,100, and interest expense of $4,400. If the tax rate is 21 percent, what is the operating cash flow?arrow_forwardGraff, Incorporated, has sales of $49,800, costs of $23,700, depreciation expense of $2,300, and interest expense of $1,800. The tax rate is 22 percent. What is the operating cash flow, or OCF? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flowarrow_forwardVijayarrow_forward

- Need help general accountingarrow_forwardBenson, Inc., has sales of $38,530, costs of $12,750, depreciation expense of $2,550, and interest expense of $1,850. The tax rate is 21 percent. What is the operating cash flow, or OCF? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.)arrow_forwardHammett, Inc., has sales of $34,630, costs of $10,340, depreciation expense of $2,520 and interest expense of $1,750. If the tax rate is 35 percent. (Enter your answer as directed, but do not round intermediate calculations.) Required: What is the operating cash flow? (Round your answer to the nearest whole number, e.g. 32.) Operating cash flowarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning