Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Give true answer

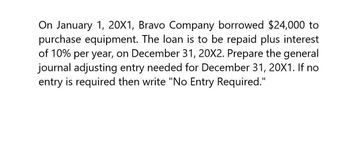

Transcribed Image Text:On January 1, 20X1, Bravo Company borrowed $24,000 to

purchase equipment. The loan is to be repaid plus interest

of 10% per year, on December 31, 20X2. Prepare the general

journal adjusting entry needed for December 31, 20X1. If no

entry is required then write "No Entry Required."

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2018, King Inc. borrowed $150,000 and signed a 5-year, note payable with a 10% interest rate. Each annual payment is in the amount of $39,569 and payment is due each Dec. 31. What is the journal entry on Jan. 1 to record the cash received and on Dec. 31 to record the annual payment? (You will need to prepare the first row in the amortization table to determine the amounts.)arrow_forwardWhole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from the bank in the amount of $310,000. The terms of the loan are 6.5% annual interest rate, payable in three months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on February 24, and the entry for payment of the short-term note and final interest payment on April 24. Round to the nearest cent if required.arrow_forwardEverglades Consultants takes out a loan in the amount of $375,000 on April 1. The terms of the loan include a repayment of principal in eight, equal installments, paid annually from the April 1 date. The annual interest rate on the loan is 5%, recognized on December 31. (Round answers to the nearest cent, if needed.) A. Compute the interest recognized as of December 31 in year 1. B. Compute the principal due in year 1.arrow_forward

- On September 1, Kennedy Company loaned $126,000, at 11% annual interest, to a customer. Interest and principal will be collected when the loan matures one year from the issue date. Assuming adjustments are only made at year-end, what is the adjusting entry for accruing interest that Kennedy would need to make on December 31, the calendar year-end? Multiple Choice Debit Cash, $4,620; credit Interest Revenue, $4,620. Debit Interest Expense, $4,620; credit Interest Payable, $4,620 Debit Interest Receivable, 4,620; credit Interest Revenue, $4620. Debit Interest Expense, $13,860; credit Interest Payable, $13,860 Debit Interest Receivable, $13,860; credit Cash, $13,860 Graw 7:26 PM W 100% 3 Type here to search 2/21/2022arrow_forwardXYZ Company lent $9,000 at 10% interest on December 1, 2019. The amount plus all interests accrued will be collected after 1 year. At the end of December, which of the following journal entry is required to take up the interest income? Select one: a. Debit Cash $900; Credit Interest Revenue $900 b. Debit Interest Revenue $75; Credit Interest Receivable $75 c. Debit Interest Receivable $900; Credit Unearned Revenue $900 d. Debit Interest Receivable $75; Credit Interest Revenue $75arrow_forwardOn December 1, Milton Company borrowed $390,000, at 7% annual Interest, from the Tennessee National Bank. Interest is paid when the loan matures one year from the issue date. What is the adjusting entry for accruing interest that Milton would need to make on December 31, the calendar year-end? Multiple Choice debit Interest Payeble, $2.275; credit Interest Expense, $2,275. debit Interest Expense, $4,550; credit interest Payable, $4,550. debit Interest Expense, $27,300; credit Interest Paynble, $27,300. debit Interest Expense, $2,275; crecit Cash, $2,275. debit Interest Expense, $2,275; credit Interest Payable, $2,275. < Prev 12 of 30 SEN MacBook Air O O O 00arrow_forward

- Midshipmen Company borrows $19,000 from Falcon Company on July 1, 2024. Midshipmen repays the amount borrowed and pays interest of 12% (1%/month) on June 30, 2025. Required: 1.&2. Record the necessary entries in the Journal Entry Worksheet below for Falcon Company. 3. Calculate the 2024 year-end adjusted balances of Interest Receivable and Interest Revenue (assuming the balance of Interest Receivable at the beginning of the year is $0).arrow_forwardA gift shop signs a three-month note payable on May 1/2020 of OMR 36,000 with an annual interest of 10%. What is the adjusting entry to be made on December 31 for the interest expense accrued to that date? Select one: O a. Debit Interest Expense, 2,400; Credit Interest Payable, 2,400. b. Debit Prepaid Interest, 2,000; Credit Interest Expense, 2,000. c. Debit Interest Expense, 2,100; Credit Interest Payable, 2,100. d. None of the answers are correct e. Debit Interest Expense, 2,400; Credit Prepaid Interest, 2,400.arrow_forwardOn August 1, Wilshire Company borrowed $150,000 from People's National Bank on a 1-year, 8% note. Required: Hide What adjusting entry should Wilshire make at December 31? Dec. 31 1 result is available, use up and down arrow keys to navigate. (Record accrual of interest expense)arrow_forward

- On July 1, 2023, Wildhorse Ltd. received a loan from its bank for $20,000 bearing interest at 636. The loan la payable in two annual Instalments of $10,909 principal and Interest on June 30 each year. The company records adjusting journal entries annually at year and on December 31 Your answer la correct. Prepare an instalment payment schedule for the term of the loan. (Round answers to 0 decimal places, eg. 5,255) (b) Cash Payment 20909 20909 Textbook and Media List of Accounts Your answer la correct. Account Titles Cash Loan P Interest Exerc Interat Payable Internet Experas Rank Loan Payable Interat Pay Cash Interest Expens Interest Expens Record (1) the receipt of $20,000 cash from the loan on July 1, 2023; (2) the accrual of Interest on December 31, 2023; (3) the first Instalment payment on June 30, 2024; and (4) the accrual of Interest on December 31, 2024. (Round answers to decimal places, g 5,275. Credit account titles are automatically indented when the amount is entered. Do…arrow_forwardOn December 1, Daw Company accepts a $46,000, 45-day, 9% note from a customer. (1) Prepare the year-end adjusting entry to record accrued interest revenue on December 31. (2) Prepare the entry required on the note's maturity date assuming it is honored. (Use 360 days a year.) View transaction list Journal entry worksheet Record the year-end adjustment related to this note, if any. Note: Enter debits before credits. Date General Journal Debit December 31 Clear entry Record entry Credit View general journalarrow_forwardOn November 1, 2024, Dual Systems borrows $140,000 to expand operations. Dual Systems signs a six-month, 7% promissory note. Interest is payable at maturity. Dual System's year-end is December 31. Required: 1., 2. & 3. Record the following transactions for the note payable by Dual Systems. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations. Round your answers to the nearest dollar amount.) View transaction list Journal entry worksheet < 1 2 3 Record the issuance of the note on November 1, 2024, Note: Enter debits before credits. Date November 01, 2024 General Journal Debit Credit Record entry Clear entry View general journal G 110 Earrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College