FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Can you please give answer?

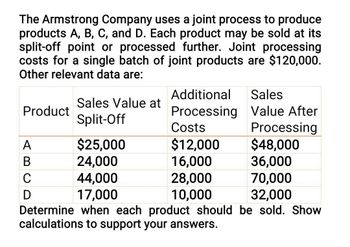

Transcribed Image Text:The Armstrong Company uses a joint process to produce

products A, B, C, and D. Each product may be sold at its

split-off point or processed further. Joint processing

costs for a single batch of joint products are $120,000.

Other relevant data are:

Additional

Sales

Sales Value at

Product

Processing

Value After

Split-Off

Costs

Processing

A

$25,000

$12,000

$48,000

B

24,000

16,000

36,000

C

44,000

28,000

70,000

D

17,000

10,000

32,000

Determine when each product should be sold. Show

calculations to support your answers.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Armstrong Company uses a joint process to produce products A, B, C, and D. Each product may be sold at its split-off point or processed further. Joint processing costs for a single batch of joint products are $120,000. Other relevant data are: Additional Sales Value Sales Value at Product Processing After Split-Off Costs Processing A $25,000 $12,000 $48,000 B 24,000 16,000 36,000 C 44,000 28,000 70,000 D 17,000 10,000 32,000 Determine when each product should be sold. Show calculations to support your answers.arrow_forwardBenjamin Signal Company produces products R, J, C from a joint process. Each product may be sold at the split off point or be processed further. Joint production costs of $92,000 are allocated to the products based on the relative number of units produced. Data for the current year operations follow: Product Units Allocated Joint Sales Value at Produced Production Spit off Cost $ 32,000 $ 40,000 $ 20,000 $ 76,000 $ 71,000 $ 48,000 R 8,000 10,000 5,000 Product R can be processed beyond the split off point for an additional cost of $26,000 and can then be sold for $105,000. Product J can be processed beyond the split off point for an additional $38,000 and then sold for $117,000. Product C can be processed beyond the split off point for an additional $12,000 and then sold for $57,000. Required: Which products should be processed beyond the split off point? Show your calculations.arrow_forwardHASF Corporation manufactures products A, B, and C from a joint process. Joint costs are allocated on the basis of relative sales value at the end of the joint process. Additional information for HASF are as follows: A B C Total Units produced 12000 8000 4,000 24,000 Joint costs 144000 60,000 36,000 240,000 Sales value before additional processing 240000 100,000 60,000 400,000 Additional costs for further processing 28000 20,000 12,000 60,000 Sales value if processed further 280000 120,000 70,000 470,000 Required: Which, if any, of products A, B, and C should be processed further and then sold? Keeping in view the answer of "part a", write down your critical feedback to support your answerarrow_forward

- Presley produces three products from a joint process. The joint process has total costs of $500,000 per month. All three products, A, B, C, are immediately saleable as they come out of the joint process. Alternatively, any of the products could continue on with additional processing and be sold as a more complete product. The following information is available: Units Immediate Sales Price Later Sales Prices Unit cost of Further Processing 1 5,000 $15 $20 $6 2 17,500 $20 $25 $4 3 10,000 $25 $32 $3 What is the total benefit the company would experience by following your recommendations vs. not processing any further? Hint: Give the sum of the benefits from each product you have chosen to process further.arrow_forwardCorporation manufactures three products from a joint process. The three products are in industrial grade form at the split off point. They can either be sold at that point or processed further into premium grade. Costs related to each batch of this process is as follows: Product 1 Product 2 Product 3 Sales Price at split-off point $16 $12 $5 Allocated joint costs $6,000 $6,000 $6,000 Sales Price after further processing $20 $18 $14 Cost of further processing $6,360 $1,420 $2,650 Product Quantity 1,000 lb. 1,000 lb. 1,000 Ib. Q. What would be the additional amount of profit that Corp. would gain from further processing the product(s) that is/are more profitable to process further rather than be sold at the split-off point?arrow_forwardJoint products A and B emerge from common processing that costs $114,000 and yields 3,800 units of Product A and 2,600 units of Product B. Product A can be sold for S 260 per unit. Product B can be sold for $190 per unit. How much of the joint cost will be assigned to Product A if joint costs are allocated on the basis of relative sales values? a. $71000 b. $76000 c. $73500 d. $66000arrow_forward

- Icy Company makes two products from a common input. Joint processing costs up to the split-off point total $42,000 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below: Product X Product Y Total Allocated joint processing costs 22400 19600 42000 Sales value at split-off point 32,000 28,000 60,000 Costs of further processing 11600 25,300 36,900 Sales value after further processing 40,800 54,200 95,000 Required:a) What is the net monetary advantage (disadvantage) of processing Product X beyond the split-off point? b) What is the net monetary advantage (disadvantage) of processing Product Y beyond the split-off point? c) What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?d) What is the minimum amount the company…arrow_forwardAgao Chemical Company manufactures three chemicals (NY29, TX38, and CA55) from a joint process. The three chemicals are in industrial grade form at the split-off point. They can either be sold at that point or processed further into premium grade. Costs related to each batch of this chemical process is as follows: NY29 TX38 CA55 Sales value at split-off point P5,000 P16,000 P12,000 Allocated joint costs P6,000 P6,000 P6,000 Sales value after further processing P9,000 P20,000 P18,000 Cost of further processing P2,000 P5,000 P3,000 For which product(s) above would it be more profitable for Agao to sell at the split-off point rather than process further?arrow_forwardA company currently produces three products from a joint process. The joint process has total costs of $515,000 per month. All three products, A, B, and C, are immediately saleable as they come out of the joint process. Alternatively, any of the products could continue on with additional processing and be sold as a more complete product. The following information is available: Product A B Units 4,500 18,000 10,500 Immediate Sales Price $18 20 27 Later Sales Unit Cost of Further Processing $ 2.00 4.00 4.00 Price $ 19 25 33 Required: a-1. Should Product A be sold immediately or sold after processing further? a-2. How much will the decision affect profit? b-1. Should Product B be sold immediately or sold after processing further? b-2. How much will the decision affect profit? c-1. Should Product C be sold immediately or sold after processing further? c-2. How much will the decision affect profit?arrow_forward

- Johns Company manufactures products R, S, and I from a joint process. The following information is available: Product R. Total Units produced 12,000 ? 24,000 ? $50,000 $200,000 ? $120,000 Sales value at split-off Joint costs $ 48,000 Sales value if processed further Additional costs if processed further $ 18,000 $14,000 $10,000 $ 42,000 $110,000 $90,000 $60,000 $260,000 Assuming that joint product costs are allocated using the relative-sales-value at split-off approach, what was the sales value at split-off for products R and S? Product R Product S $ 55,000 $ 63,000 $ 80,000 $ 91,000 A) $ 75,000 B) $81,000 C) $70,000 D) $83,000 E) $101,000 $ 92,000arrow_forwardSAMCIS Company produces three products (X, Y, and Z) in a joint process costing P100,000. The products can be sold as they leave the process, or they can be processed further and sold. The cost accountant has provided you with the following information: IIT Separable Further Processing Costs Sales Price Sales Price After Product Unit Volume at Split-Off Further Processing 3,000 4,000 8,000 P10 15 P60,000 50,000 90,000 P25 Y 30 20 35 Assume that all processing costs are variable costs. Required:/ Which products should SAMCIS sell at split-off, and which products should be processed further?arrow_forwardats Assume a company has three products-A, B, and C-that emerge from a joint process. The joint processing costs that are incurred up to the split-off point equal $1,200,000. The selling prices and outputs for each product at the split-off point are as follows: Product A B С Selling Price $33 per pound $29 per pound $24 per pound Product A B C Each product can be processed further beyond the split-off point. The additional processing costs for each product and their respective selling prices after further processing are as follows: Output 14,000 pounds 18,000 pounds 19,000 pounds Additional Processing Costs $65,000 $72,000 $88,000 Selling Price $37 per pound $34 per pound $30 per pound The company is trying to decide whether to retain or discontinue the entire joint manufacturing process. What is the financial advantage (disadvantage) of continuing to operate the entire joint manufacturing process?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education