Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

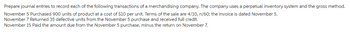

Transcribed Image Text:Prepare journal entries to record each of the following transactions of a merchandising company. The company uses a perpetual inventory system and the gross method.

November 5 Purchased 900 units of product at a cost of $10 per unit. Terms of the sale are 4/10, n/60; the invoice is dated November 5.

November 7 Returned 35 defective units from the November 5 purchase and received full credit.

November 15 Paid the amount due from the November 5 purchase, minus the return on November 7.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Palisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 20Y6 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Record the following transactions on Page 21 of the journal: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for May, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of stockholders equity, and a balance sheet. Assume that additional common stock of 10,000 was issued in January 20Y6. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the retained earnings account. 10. Prepare a post-closing trial balance.arrow_forwardDymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forwardGolden Eagle Company began operations on April 1 by selling a single product. Data on purchases and sales for the year are as follows: Purchases: Sales: The president of the company, Connie Kilmer, has asked for your advice on which inventory cost flow method should be used for the 32,000-unit physical inventory that was taken on December 31. The company plans to expand its product line in the future and uses the periodic inventory system. Write a brief memo to Ms. Kilmer comparing and contrasting the LIFO and FIFO inventory cost flow methods and their potential impacts on the companys financial statements.arrow_forward

- Review the following transactions, and prepare any necessary journal entries for Sewing Masters Inc. A. On October 3, Sewing Masters Inc. purchases 800 yards of fabric (Fabric Inventory) at $9.00 per yard from a supplier, on credit. Terms of the purchase are 1/5, n/40 from the invoice date of October 3. B. On October 8, Sewing Masters Inc. purchases 300 more yards of fabric from the same supplier at an increased price of $9.25 per yard, on credit. Terms of the purchase are 5/10, n/20 from the invoice date of October 8. C. On October 18, Sewing Masters pays cash for the amount due to the fabric supplier from the October 8 transaction. D. On October 23, Sewing Masters pays cash for the amount due to the fabric supplier from the October 3 transaction.arrow_forwardPappas Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the year, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forwardReese Manufacturing Company manufactures and sells a limited line of products made to customer order. The company uses a perpetual inventory system and keeps its accounts on a calendar year basis. A 6-column spreadsheet is presented on page 1100. Additional information needed to prepare the income statement and schedule of cost of goods manufactured is as follows: REQUIRED 1. Prepare an income statement and schedule of cost of goods manufactured for the year ended December 31,20--. 2. Prepare a statement of retained earnings for the year ended December 31,20--. 3. Prepare a balance sheet as of December 31, 20--. 4. Prepare the adjusting, closing, and reversing entries.arrow_forward

- The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. Instructions 1. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the first-in, first-out method and the periodic inventory system. 2. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the last-in, first-out method and the periodic inventory system. 3. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the dollar. 4. Compare the gross profit and June 30 inventories using the following column headings:arrow_forwardJessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December.arrow_forwardCarla Company uses the perpetual inventory system. The following information is available for January of the current year when Carla sold 1,600 units of inventory on January 14. Using the FIFO method, calculate Carlas cost of goods sold for January and its January 31 inventory.arrow_forward

- Jessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.arrow_forwardReview the following transactions, and prepare any necessary journal entries for Renovation Goods. A. On May 12, Renovation Goods purchases 750 square feet of flooring (Flooring Inventory) at $3.00 per square foot from a supplier, on credit. Terms of the purchase are 2/10, n/30 from the invoice date of May 12. B. On May 15, Renovation Goods purchases 200 measuring tapes (Tape Inventory) at $5.75 per tape from a supplier, on credit. Terms of the purchase are 4/15, n/60 from the invoice date of May 15. C. On May 22, Renovation Goods pays cash for the amount due to the flooring supplier from the May 12 transaction. D. On June 3, Renovation Goods pays cash for the amount due to the tape supplier from the May 15 transaction.arrow_forwardPalisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2016 (unless otherwise indicated), are as follows: During May, the last month of the fiscal year, the following transactions were completed: Instructions 1. Enter the balances of each of the accounts in the appropriate balance column of a four-column account. Write Balance in the item section, and place a check mark () in the Posting Reference column. Journalize the transactions for July, starting on Page 20 of the journal. 2. Post the journal to the general ledger, extending the month-end balances to the appropriate balance columns after all posting is completed. In this problem, you are not required to update or post to the accounts receivable and accounts payable subsidiary ledgers. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete (5) and (6). 5. (Optional) Enter the unadjusted trial balance on a 10-column end-of-period spreadsheet (work sheet), and complete the spreadsheet. 6. Journalize and post the adjusting entries. Record the adjusting entries on Page 22 of the journal. 7. Prepare an adjusted trial balance. 8. Prepare an income statement, a statement of owners equity, and a balance sheet. 9. Prepare and post the closing entries. Record the closing entries on Page 23 of the journal. Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. Insert the new balance in the owners capital account. 10. Prepare a post-closing trial balance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning